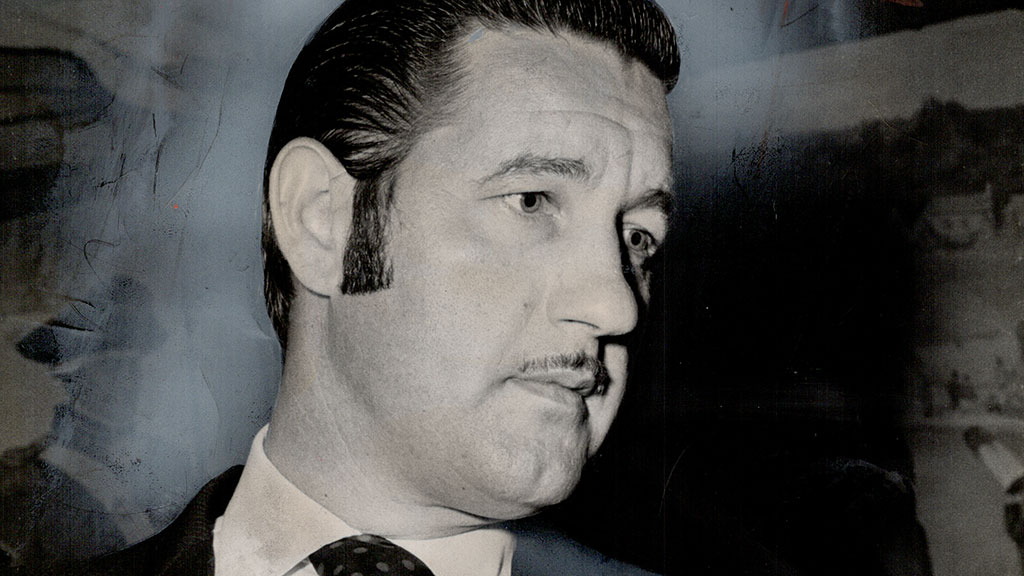

Great frauds in history: Robert Vesco’s dubious schemes

Robert Vesco looted IOS, a Swiss fund of funds, and the funds it ran by having them invest in a web of banks and shell companies that he himself owned.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Robert Vesco was born in Detroit in 1935 and by the age of 30 had acquired control of a small machine parts company, which he renamed International Controls Corporation (ICC). Over the next five years he took advantage of ICC’s rising stock price, fuelled by the bull market and dubious accounting, to borrow additional sums of money, which he used to take ICC on a buying spree, further boosting its share price. In January 1971 he took control of troubled Swiss-based Investors Overseas Services (IOS), which sold and ran various “funds of funds” (funds which invest in other funds).

What was the scam?

Vesco pledged to sort out the mess left by IOS’s founder Bernie Cornfeld, who had allowed administration and sales costs to spiral out of control. Cornfeld had also invested the money in IOS’s funds in a number of dubious schemes, including a property scam involving overvalued Arctic land. Vesco took over stating good intentions, but he was little more than a thief, looting IOS and the funds it ran by having them invest in a web of banks and shell companies that he himself owned.

What happened next?

Vesco’s time at IOS would last little more than a year, during which time he faced attempts by regulators to get him to answer questions about what was going on at his company. By April 1972 Vecso had cut all ties with the fund. By November 1972 the Securities and Exchange Commission (SEC), the US regulator, had launched a lawsuit against Vesco for stealing money from IOS. The SEC estimates that Vesco embezzled at least $224m (around $1.3bn in today’s money) from four funds run by IOS. Vesco simply absconded to Costa Rica and would later be linked with a variety of dubious (and illegal) schemes. These included trying to set up his own country, attempting to broker an arms deal between Libya’s Muammar Gaddafi and the US, and acting as an intermediary between Cuba’s Fidel Castro and the drug cartels. He died in Cuba in 2007.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lessons for investors

In general, it’s a good idea to avoid funds of funds altogether as they tend to be expensive (because investors are in effect paying two sets of fees) and it’s hard to see what you’re actually putting your money into. The fact that Cornfeld had been banned from selling shares in IOS funds in America as early as 1967 should have been another big warning sign to investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.