Is now a good time to invest in gold?

Gold prices enjoyed their best year since the 1970s in 2025, but does that make now a good time to invest in gold?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The appeal of gold is soaring, as investors worldwide turn to precious metals as a defence against increasingly turbulent geopolitical conditions.

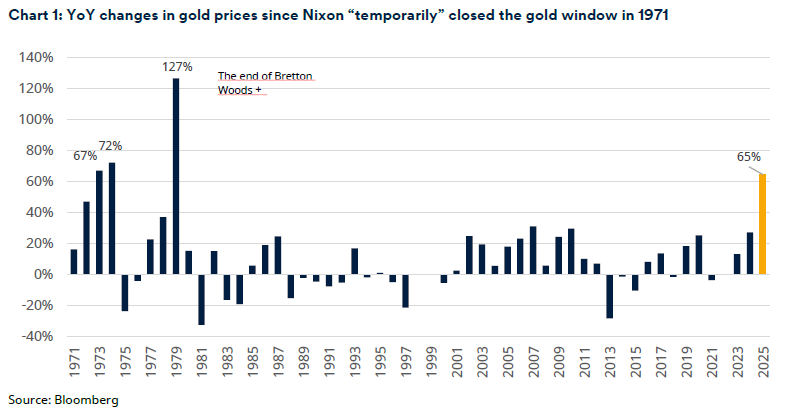

Gold investors enjoyed their best year since 1979 in 2025, with the yellow metal gaining 64.5% over the course of the year.

“Consumers and investors alike bought and held gold in an environment where economic and geopolitical risks have become the new normal,” said Louise Street, senior markets analyst at the World Gold Council, an industry body representing the gold industry.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The 1970s was a standout decade for gold in several respects. It marked the end of the Bretton Woods era whereby fiat currencies were effectively pegged to gold.

The same period also saw an inflationary oil crisis, which saw the price of gold more than double in 1979.

“The extreme inflation and volatility of the 1970s coincided with gold’s emergence as a fully investable asset class,” said Nitesh Shah, head of commodities and macroeconomic research at asset manager WisdomTree. “Although gold has been valued for millennia, a meaningful influx of private investors only began in the 1970s and 1980s.”

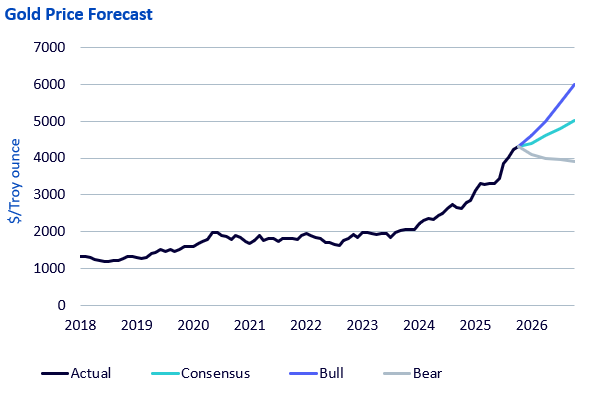

Following strong gains in 2024 and a record year in 2025, momentum has continued into 2026, with the price of gold gaining 16% to smash through the $5,000 threshold by 26 January.

During big, eye-catching bull runs like these it’s always possible for investors deciding where to invest to feel as though they’ve missed the boat.

So, given its glittering gains, is now a good time to invest in gold?

Gold demand is rising

According to the latest Gold Demand Trends report from the World Gold Council, gold demand reached an all-time high of 5,002 tonnes in 2025.

Investment accounted for a significant chunk of this demand, with total gold investment demand rising to a record 2,175 tonnes. Gold ETFs alone contributed 801 tonnes of gold demand.

Supply is also increasing; gold mining production reached a record 3,672 tonnes during 2025, but this is below the level of total gold demand (the balance is mostly made up through recycling of gold).

This gap between gold supply and demand is another factor that could increase gold prices in the future.

US policy is still supportive of gold prices

Besides broader geopolitical instability, domestic US policy appears to provide tailwinds for gold prices.

Financial markets have been spooked by perceived threats to the ability of the Federal Reserve (Fed) to take independent decisions, especially in the face of persistent US inflation.

“The threat to Fed independence – and US institutional credibility that a criminal investigation of chair [Jerome] Powell represents – is clear,” said James Luke, senior portfolio manager, gold and commodities at Schroders.

“From a pure ‘debasement’ perspective, the return to Fed money printing via ‘reserve management purchases’ of treasury bills ($40 billion per month), plus buying of mortgage backed securities from Fannie Mae and Freddie Mac ($200 billion to help cap mortgage rates) also feed the fiscal dominance theme,” Luke added.

Fiscal dominance refers to an environment in which the government’s fiscal policy takes precedence over, or constrains, the central bank’s monetary policy.

“Fiscal dominance is unequivocally positive for gold. As a pseudo-currency with limited supply growth, gold acts as an antidote to the potential debasement of fiat currencies issued by central banks engaged in monetary expansion,” said Shah.

Central banks began purchasing gold in greater quantities to divert risk away from dollar assets following the freezing of Russian assets in the aftermath of the 2022 invasion of Ukraine.

This, along with a more protectionist trade policy, has caused the dollar to weaken in recent years. Because gold prices are quoted in dollars, that has contributed to a rise in the price of gold.

Interestingly, while the spot price of gold has increased 83% in the year to 27 January in dollar terms, it is up only 67% in sterling over the same period.

Is now a good time to invest in gold?

The case for investing in gold now depends on whether the momentum will continue, or if the price has reached a peak.

Ultimately that can only be said in hindsight. But Luke believes that the current cycle has further to run yet.

“The secular top will be reached when either the geopolitical and fiscal drivers are resolved (ushering in a new status quo) or demand itself is undeniably saturated,” he said. “We don’t think either of those requirements are near to being met.”

The Fed is likely to cut interest rates in 2026, regardless of how independently it acts. Lower interest rates, particularly in the US, increase the appeal of gold compared to other safe haven assets like bonds – gold pays no interest, and as such higher interest rate environments make bonds a more appealing investment.

WisdomTree’s mid-range forecast for gold prices puts them a little over $5,000 by the end of 2026 – though the forecast was produced in December 2025, so may be slightly dated already.

Its bull case predicts that gold prices could push towards $6,000 by the end of the year, while its bear case envisages gold slipping back below $4,000.

Gold for diversification

One of the most compelling arguments for investing in gold is the diversification that it can offer to a portfolio.

“When bond yields stand at higher levels, shares and fixed income investments tend to track each other higher and lower,” says Tom Stevenson, investment director at Fidelity International. “That reduces the incentive to own a mixture of both bonds and shares. And it means that investors need to look further afield, into commodities and property, to gain that portfolio balance.”

Gold, by contrast, has “low-to-negative correlation to equities”, according to Raymond Backreedy, chief investment officer at Sparrows Capital. It also typically sees lower drawdown rates, which Backreedy says is “particularly desirable especially in times of market stresses”.

An allocation to gold within a portfolio can therefore act as a hedge against broader turbulence.

When building multi-asset portfolios, “we typically allocate 3-10% [to gold] using the gold ETCs available on the market, depending on user case and overall percentage allocated to the defensive asset class”, said Backreedy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets