Filtronic: A British stock reaching for the stars

British stock Filtronic’s explosive growth is only just getting started, says Rupert Hargreaves.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The continual drip, drip of companies being taken over or delisted from the London Stock Exchange, and the lack of a pipeline to replace them, is making it increasingly challenging to find exciting, undervalued opportunities there. That means it’s even more critical for investors to act quickly and with conviction when opportunities arise.

Filtronic (Aim: FTC) is one such opportunity. It is a UK-based designer and manufacturer of high-performance radio-frequency microwave and millimetre-wave components and subsystems for the aerospace industry. Over the past decade, it has carved out a world-leading niche in this corner of the market, and today it’s reaping the benefits.

Filtronic's change in fortune

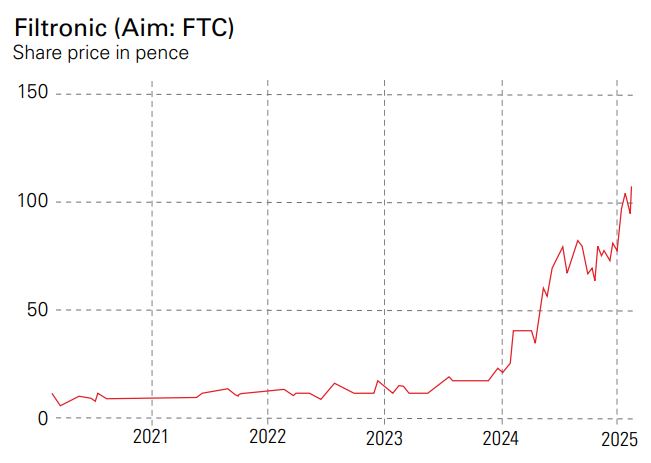

Historically, Filtronic’s three main areas of activity have been mobile telecommunications infrastructure, defence and aerospace, and public safety. Orders from these sectors provided a steady stream of revenue, but the firm struggled to grow and to differentiate itself in a highly competitive industry. Revenue stagnated, as did the shares. After Filtronic moved from the main market to Aim in 2015, the stock rarely traded above 10p per share.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The outlook started to change in 2021 when European countries began raising defence spending in response to Russian aggression. The firm also started to attract interest from the space sector, as companies such as Elon Musk’s SpaceX began to deploy satellite constellations in increasing numbers. SpaceX and other sector trailblazers have turned to low-Earth orbit (LEO) satellite constellations to achieve global coverage at a fraction of the cost of traditional geostationary orbital satellites (GEO). LEO constellations comprise thousands of smaller satellites, which can be launched in large groups, mass-produced, and use each other to improve range. SpaceX began launching its Starlink LEO constellation in 2019, and so far it’s put more than 7,000 into orbit. As many as 55,000 LEO satellites could be launched in the coming years.

Filtronic announced its first series of contracts to supply LEO satellite communications equipment in 2023. One agreement was with the European Space Agency, worth a total of £3.2 million, to develop multi-frequency transceiver technology for satellite payload feeder links. The series of smaller contracts helped the company gain an edge in the market while reinvesting cash in research and development. These investments culminated in a transformational long-term partnership agreement with SpaceX in April 2024.

Filtronic linking arms with Elon Musk

SpaceX has tied Filtronic into a deal to get its hands on the company’s E-band solid state power amplifiers. These devices help ground stations communicate with SpaceX’s Starlink constellations and, as a result, are crucial to the operation.

Under the terms of the agreement, Filtronic issued warrants to SpaceX, allowing the latter to subscribe for up to 10% of the business with a five-year vesting period. The warrants vested in two equal tranches based on the volume of orders – the first after $37 million in orders and the second on the balance up to a total of $60 million. SpaceX also laid out plans for the next generation of these devices. The second tranche of warrants is tied to the further development of the technology.

In Filtronic’s 2024 financial year, revenue rose 56.3%, and earnings before interest, tax, depreciation and amortisation (Ebitda) jumped 280%. In the first half of the company’s 2025 financial year, revenue rose by 202%, primarily driven by the SpaceX contract. Following two years of expansion, analysts at Cavendish had expected revenue to fall in fiscal 2026 as the first phase of the contract with SpaceX ended. Cavendish pencilled in revenue of £48.4 million in fiscal 2025, falling to £41 million in fiscal 2026. It expected growth to re-accelerate in fiscal 2027 as the second phase of the SpaceX contract started to pay off. But on 10 February, Filtronic surprised the market by announcing it had won a new contract with SpaceX valued at $20.9 million (£16.8 million) to be fulfilled in 2025 and 2026.

Filtronic reaches for the stars

This deal was yet another sign of how transformational the SpaceX agreements have been and how management has deployed the cash to drive further growth. Filtronic has invested heavily to meet the demands of its substantial contracts with SpaceX, and it continues to do so. The company’s capital spending totalled £2.1 million in the first half of the year and is expected to come in at around £2.4 million in the second half of the year. Even after this growth, Cavendish had Filtronic ending the year with £10.4 million in net cash, up 100% year on year. Thanks to the bespoke proprietary nature of its technology, its Ebitda margin was 19.2% in 2024 and expected to hit 28.3% in 2025.

Filtronic’s exposure to one primary customer is risky, but it is winning clients, leveraging its experience working with SpaceX to access other parts of the LEO market. Profit generated from the deal is also funding significant research and development to drive growth in other markets. Based on the company’s latest deal, the stock is trading at a forward price/ earnings (p/e) ratio of around 20 on a fully diluted basis after stripping out cash. Even though the stock has risen in value ten times since 2021, its current value isn’t too demanding, considering its market proposition and product base.

The company is also a prime acquisition target. Compared to other SpaceX suppliers in the network communications arena, such as Taiwan-based Wistron NeWeb Corp, Filtronic is a minnow and could become an incredibly attractive bolt-on acquisition.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?