Uranium prices are on the rise and could go higher still

Although clean-energy funds have been taking a hammering, uranium is the bright spot with scope for further growth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Clean-energy funds and related equities have taken a hammering this year. The Global Clean Energy ETF (exchange-traded fund) with $3.5bn in assets is the biggest, most liquid green-energy ETF. It has fallen by 26% since 1 January 2023.

UK-focused investors will have noticed an echo of this pain in the investment trust sector. The battery storage industry has been especially badly hit. The three listed funds in this area have suffered huge falls in their share prices:

- Harmony Energy Income Trust (LSE: HEIT) is down by 40% to 75p

- The Gore Street Energy Storage Fund (LSE: GSF) has fallen by 40% to 68p

- The Gresham House Energy Storage Fund (LSE: GRID) has declined by nearly 50% to 88p. (I am a nonexecutive director at GRID.)

This sector had been a market darling as the market for short-duration battery energy storage system (BESS) projects boomed in the UK. According to industry news site Energy Storage News, in recent years the UK market had “ become the largest in Europe with over 3.5GW now online, with projects benefiting from high ancillary service market prices, particularly in 2022”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That growth resulted in market saturation, which also coincided with falling revenues, partly because the operator of the electricity grid, National Grid, hasn’t opened up as many opportunities as expected in a segment of the market called the balancing mechanism (designed to maintain the stability of power supply). While efforts are being made to give battery storage a more prominent role in the balancing mechanism, investors haven’t stuck around.

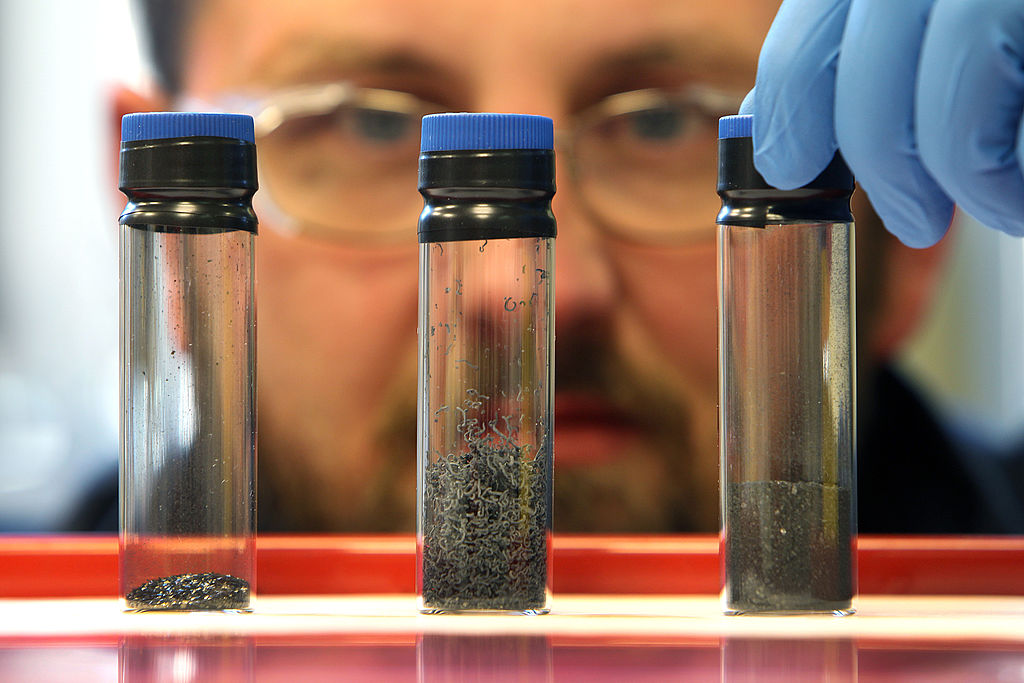

Other emerging parts of the clean-energy spectrum are having a better 2023, notably nuclear energy, and especially uranium prices. Over the last few weeks uranium prices have breached the important $60 and $70 a pound barriers. So far this year spot prices have risen by 46% (they are up by 400% since 2019). Unsurprisingly, share prices for uranium miners (and to a lesser degree the small handful of uranium processors) have shot up.

Alternative assets advisory house Ocean Wall runs an index for the small number of stocks in this sector and it has gained 52% in 2023. The market value of global uranium equities is $50bn, made up of just 84 stocks.

Options for UK retail investors

UK investors have two main options to play the uranium rally.

The biggest listed play is Aim-listed Yellowcake (Aim: YCA), which owns a physical reserve – in Canada – of uranium oxide. Its market capitalisation is $1.2bn and with uranium prices above $70/lb, the investment company is trading at a 12% discount to its net asset value (NAV).

Another popular choice is uranium equities fund Geiger Counter (LSE: GCL), which has a NAV of 60p against its current share price of 49.6p, representing an 18% discount. The fund is overweight in US-sourced uranium and owns no Kazatomprom shares. The Kazakh producer is the biggest player globally but is largely state-owned and an integral part of the Russia/ China economic axis. Geiger Counter’s single biggest holding is NexGen Energy, which boasts one of the largest reserves of cheap uranium in a Western jurisdiction. The fund also owns big stakes in America’s Uranium Energy Corporation (7.6%) and Canada’s Fission Uranium Corp. (6.4%).

Over in the ETF sector, one of the most popular ways of buying into the nuclear story is through the HANetf Sprott Uranium Miners UCITS ETF (LSE: URNM). According to HANetf’s Tom Bailey, there’s a decent chance that uranium prices could go even higher from current levels. The uranium spot price “is now only at a comparable level to the spot price right before Fukushima in 2011. In fact, if you were to increase the pre-Fukushima price by inflation, it would be in the high 90s today”. Furthermore, he says, “We are nowhere near the all-time high, which was near $140/lb”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Related articles

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The state of Iran’s collapsing economy – and why people are protesting

The state of Iran’s collapsing economy – and why people are protestingIran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

-

Why does Donald Trump want Venezuela's oil?

Why does Donald Trump want Venezuela's oil?The US has seized control of Venezuelan oil. Why and to what end?

-

The graphene revolution is progressing slowly but surely – how to invest

The graphene revolution is progressing slowly but surely – how to investEnthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

-

Stock markets have a mountain to climb: opt for resilience, growth and value

Stock markets have a mountain to climb: opt for resilience, growth and valueOpinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

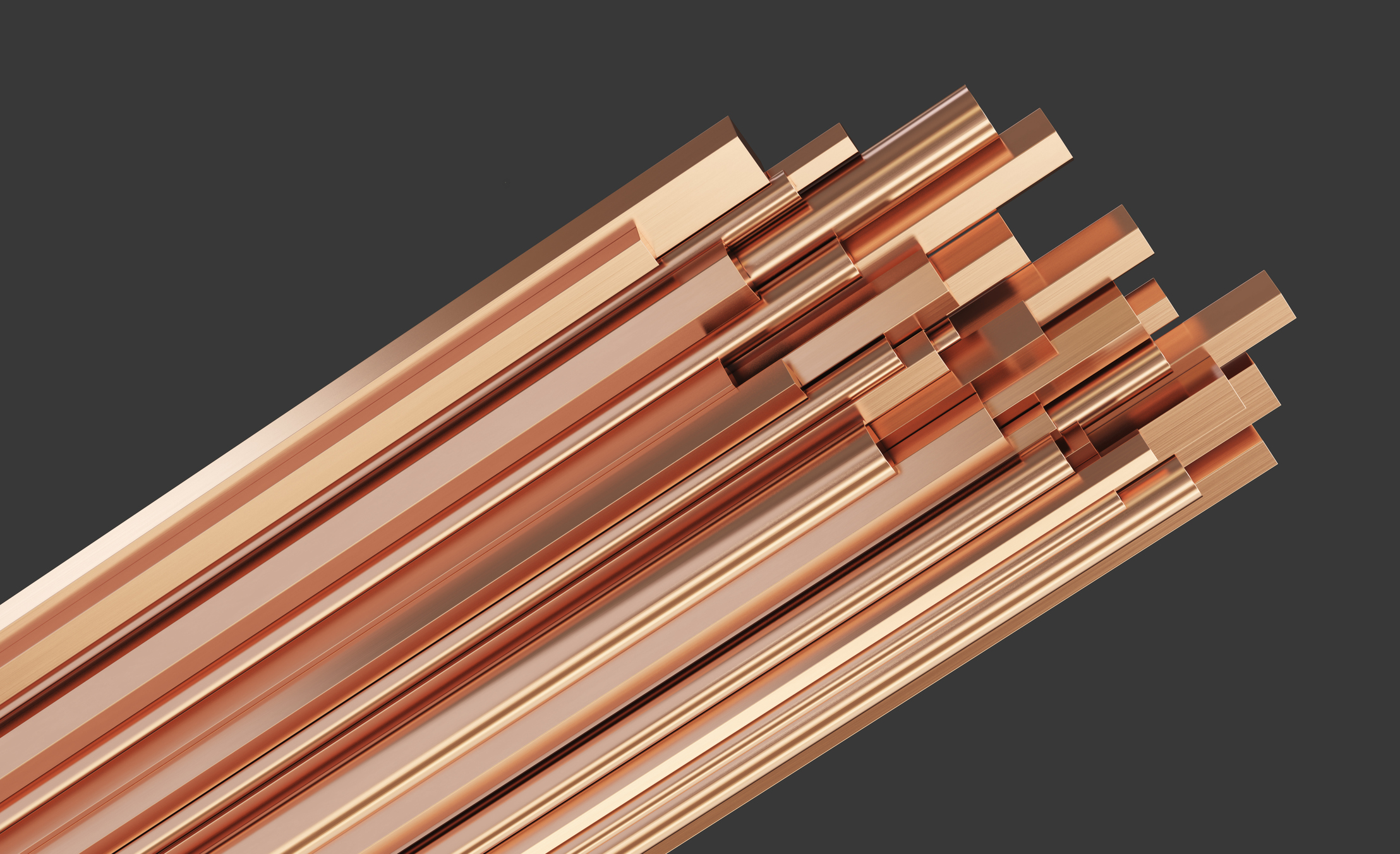

King Copper’s reign will continue – here's why

King Copper’s reign will continue – here's whyFor all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too