If you bought gold with pounds, it’s been a disappointing year – but be patient

Measured in US dollars, gold is flat on the year. In pounds, it's fallen. But sterling investors should be patient, says Dominic Frisby. It won’t be too long before gold goes on another of its runs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I received a rather concerned email from an investor last week.

He bought gold in the summer of 2020, when it was around $1,800 an ounce, and was horrified to learn that, a year later, he was underwater with his investment, even though gold was still trading around $1,800/oz – the same price he had bought.

Was it storage fees? Commission? How could it possibly be so?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The reason, of course, is that he’s English and he bought his gold with pounds.

Frisby for prime minister: my first manifesto pledge

We tend to think of the gold price only in US dollars. The dollar price is the price that gets reported. The dollar price is the professional price, the price used on futures exchanges, and international exchanges.

But, to UK investors buying physical metal, the dollar price is mostly irrelevant. You buy your gold with pounds and when you sell, assuming you do, pounds are what you get.

The same goes for oil. We obsess over the dollar price of oil. We report the dollar price of oil in the news. Yet when we buy it at the pump we pay in sterling.

Even with bitcoin we tend to use the US dollar price, when to sterling buyers and sellers it is, to a certain extent, irrelevant.

This method of reporting, used because the dollar is the international standard, is something, were I to become prime minister (as we all know I should), I’d have stamped out on Day One.

No matter that I am guilty of it with virtually every missive I write (I wouldn’t be the first prime minister to legislate for doing what I say rather than what I do), to those who do not buy and sell in dollars, which is basically the entire retail investment world outside of the US, it can be misleading.

We pretty much all think of the US dollar price of these assets, when in fact only the sterling price is relevant.

So today we consider the sterling price of gold.

Sterling has had a pretty good year

Sterling is bouncing back from its period in the wilderness. In the corona-panic of spring 2020 it re-tested its Theresa-May lows below $1.20, and has since been in something of a bull market. So the gains seen in US dollar gold are not so pronounced.

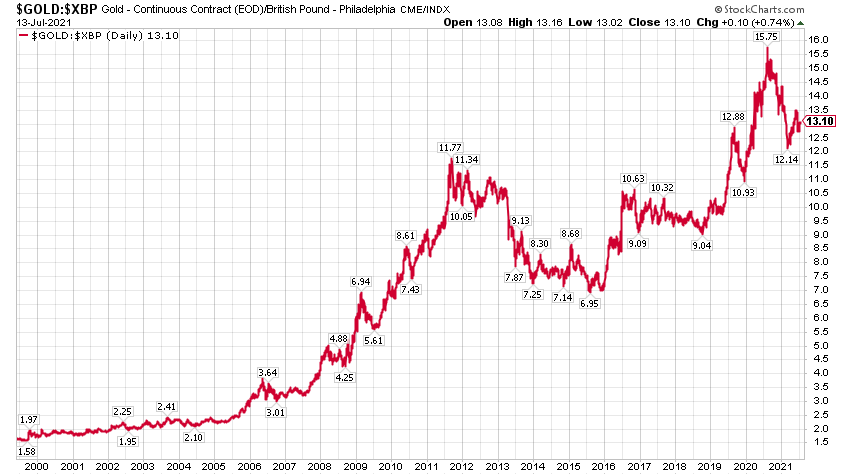

I thought it would be informative to look at a chart of gold in pounds since the turn of the century. In 1999 you could buy gold for little more than £150 an ounce. How about that!

Sterling was strong in the 2000s until 2008, and so the bull market in gold was not so visible. By 2005 gold was still trading in the £200 to £250/oz range. Sterling meanwhile went over $2. It seems absurd now.

It was after 2008, when sterling collapsed, that British gold owners really became thankful for the yellow metal, and gold launched on a run to £1,200/oz. Over the course of that decade gold increased about eight times over.

Then came the bear market and gold lost around 40%, falling back to around £700, an area that proved strong support in the 2014 to late 2016 time zone.

Since then we have had two marked rallies. In 2016 gold went from £700 almost to £1,100, after which followed two years of side action with a bearish bias. Then from late 2018 to summer 2020 – last year – gold had another huge run from £900 to £1,600.

It’s time to be patient

We are now in another of those periods of sideways action with a bearish bias. They tend to last around a couple of years, I’m afraid, maybe a bit less, but they do come after gold run-ups.

We got one such period from 2006 to 2008, another in 2017-2018. It’s tempting to sell – but the problem then is buying back in. Patient holders tend to be rewarded when gold goes off on another of its runs.

Gold is a better store of value than sterling. It’s a better store of value than most things. Sterling may be the oldest currency in the world still in use today, but gold has been around a lot longer and it will be around for a lot longer. So whatever the vagaries of sterling over the next year, or whatever, gold is the better bet. There is no need to sell, unless you really need the money for something else.

I can look at the above chart, project my own biases and find fractal patterns that suggest the sterling price of gold is doing what it did in 2009, when it fell from £700 to £550/oz before launching on its run to £1,200.

If I had to bet, I would wager a more likely scenario is for it to consolidate for another year, but the bottom line is I don’t know. I do know, however, that sterling is being debased, and gold isn’t, so whether it’s now or three years from now, gold is going to go off on another of its runs that will take it over £2,000. Then when it gets there it will consolidate for another year or two and then it will go up some more.

Who knows, all this money printing may actually come home to roost, inflation will get very serious, and then you might not actually be able to buy gold.

So to my email correspondent who is despondent at his gold price performance, be patient. Its day will come. That day is not today. But the gold train is one train on which you should always have your seat reserved.

Look at that chart of sterling gold above, and tell me where the long-term trend is going.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.