Is it time to top up on gold? Or should you wait for a better opportunity?

Fears of inflation, money-printing and a global pandemic are all conditions that should drive the gold price higher. But it has been struggling. Dominic Frisby asks if the turning point is finally here – and if so, should you buy in?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gold investors were feeling the pinch back in March. It “should” have been going up. Inflation was (and is) everywhere you look, except in government statistics.

There was Covid-19, money printing, a clear rotation from growth into real assets – yet gold kept trending lower.

Is that likely to continue? Or have we already seen the bottom for the year?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold has been struggling this year – but is the turnaround finally here?

Earlier this year, amid gold’s struggle, we noted all the negatives: that bitcoin was stealing gold’s thunder; that bond yields were rising; that the US dollar was rising; that the world no longer valued physical assets as much as it does digital.

But, especially, we noted the role that rising yields were playing.

Gold pays no interest – you don’t get a yield. If bond yields are rising, money that would otherwise have gone to gold (in the event that yields were flat or falling) goes to bonds instead. Gold suddenly has an opportunity cost to it, as well as a storage cost. Thus rising bond yields are bad for gold.

For some reason, the effect of bond yields on gold is most visible with the ten-year bond. I’m not sure why, but one theory is that the average time it takes to take a mine from discovery through to production is around ten years, so gold and ten-year bond yields tend to correlate.

But we also noted that gold was oversold, that it was sitting on an important technical level, that we were headed into a positive time of year for gold (April is usually a good month). What’s more, we noted that business was getting back to normal.

Rising yields indicate that people expect economic strength. A strong economy gives rise to inflation. Gold is the de facto hedge against inflation. In the long-term then, rising yields are good for gold.

The bottom-line roadmap was that we expected a rally in April, a turn in May, a June low and then highs later in the year.

We got the April rally: gold went from $1,680 to $1,845 a couple of days ago. It now sits ten bucks lower. Are we now getting the May turn? It’s possible, but the landscape has changed.

There are two big changes in the underlying drivers. Firstly, bond yields have turned down. Inflation expectations, meanwhile, have risen again. As Charlie Morris notes in The Fleet Street Letter this week: “If the reduction in the bond yield continues, then markets will start to favour more defensive assets. This would be a major shift in the narrative that has built up over the past year, from value back to gold”.

Morris has recommended that his readers, already long gold, buy more. He thinks we are headed back into a “risk-off” environment, and you want to be in safe assets.

The fates of gold and the US dollar are once again intertwined

Perhaps the biggest driver of the lot though is the US dollar itself. The mini bull market it enjoyed in the first three months of the year that saw the US dollar index go from 89 to 93 is well and truly over. It is now back at 90, almost where it started.

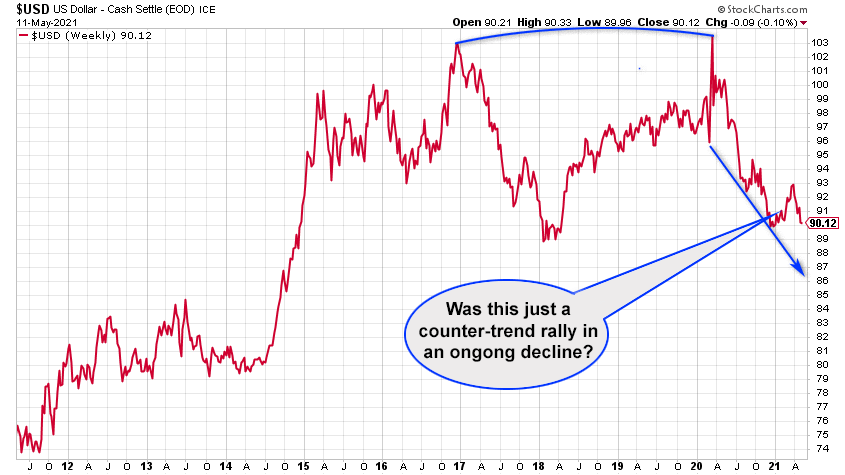

Let’s pull back and look at the bigger picture. When we do this, the first three months of 2021 just look like a counter-trend rally in a US dollar bear market, one that began with the Covid-19 panic of March 2020 at 104.

Below is a ten-year chart. I’ve marked the March 2020 top, which coincides with the 2017 highs, and the current broader trend both in blue.

If this bear market breaks below 88, it will go to the low 80s and gold will go a lot higher. By a lot higher, I mean over $2,000 an ounce, and to record highs.

As so often seems to be the case, the fate of gold will be the fate of the US dollar.

So the questions we have to ask ourselves are: “whither ten-year bond yields?” and “whither the US dollar?” Whither, by the way, is olde English for “to what place” – a very useful word that I am surprised we don’t use more often. Nevertheless, we are doing what we can to revive it here on these pages.

I’m less sure about bond yields, but I do know the powers-that-be will not let them rise too high. My hunch is that the all-important US dollar goes lower. That will be good for gold, but there is a lot of support in the 88-89 region to get through first.

Over the last ten years late May has consistently been the best time of year to buy gold. But over the last 40 years July has been the time. So gold does tend to be weak in the early summer.

We’ve had a nice run. I rather suspect a period of range trading while the US dollar plays with that 88-89 area. The next big run will come when that support is broken.

So, if you are not long gold and you are thinking of taking a position, I’d recommend looking for dips over the next couple of months.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.