Chinese stocks rally – can it continue?

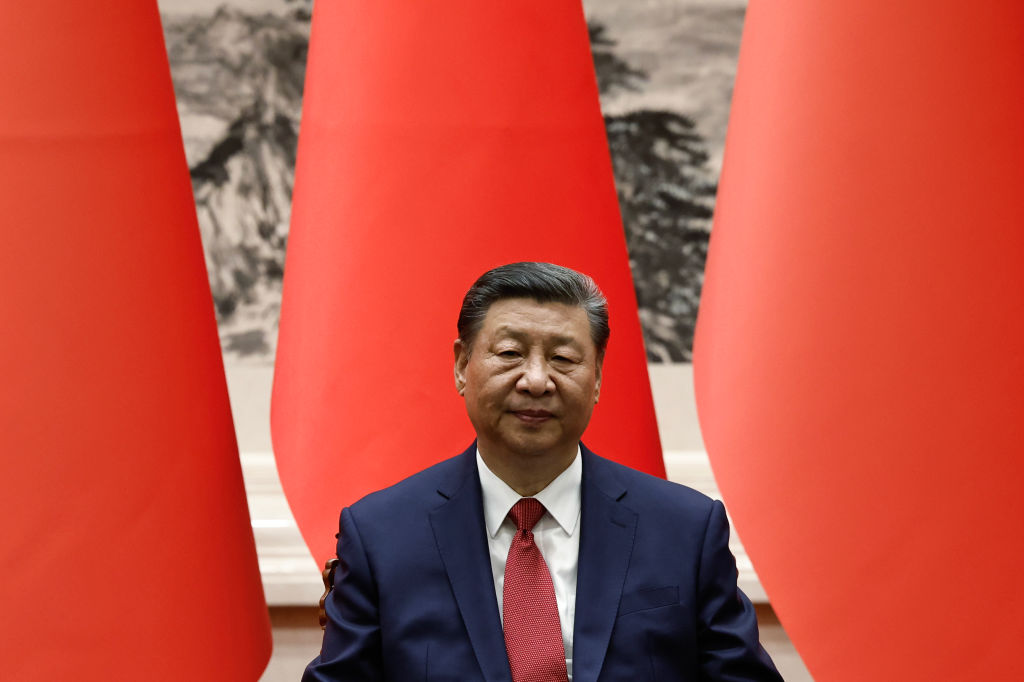

Chinese stocks surged after the politburo, led by President Xi Jinping, vowed to ramp up fiscal support for the world's second-largest economy. Should investors be cautious?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The world’s capitalists are feeling cheerful, says John Authers on Bloomberg. Why? Because the “politburo of the world’s largest communist state” is warming to the idea of more welfare spending. There are “enough ironies… to sink the Titanic”. Chinese stocks leapt 8.5% on 30 September for their best day since 2008. Over five sessions the CSI 300 index has risen an astounding 24%. In Europe, luxury shares, which are highly exposed to Chinese consumption, also rallied strongly.

Why are Chinese stocks rising?

The excitement came after a statement by the politburo suggesting Beijing is open to using fiscal stimulus to “prod consumers to start buying stuff again”, something economists have been advising for years to little effect. Stronger social support policies are also on the table. There are as yet “no numbers”, but the declaration of intent from political leaders has been enough to trigger a surge of confidence in stock markets.

“Gone is the equivocation on deleveraging, moral hazard and provincial indebtedness, a staple of previous politburo meetings,” says Marko Papic of BCA Research. “This is Beijing’s ‘Whatever It Takes’ moment,” he says, a reference to Mario Draghi’s famous declaration in 2012 during the euro crisis. Investors are dreaming of a repeat of China’s “massive” 2008 stimulus, which helped the country avoid the worst of the global downturn, says James Mackintosh in The Wall Street Journal. But that splurge also left the economy with many of its current problems, including local government debt, overcapacity and excess housing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

China’s central bank had earlier unveiled a series of measures designed to tackle the housing slump, including easier monetary policy and cuts to mortgage rates for existing housing, says Anthony Anastasi for the South China Morning Post. But making credit cheaper doesn’t address the country’s fundamental “structural imbalance” – consumption is too low, while investment and savings are too high. High investment was a good strategy when China needed to build out its infrastructure and factories, but now all those factories are pumping out products that local households don’t have the cash to buy. What’s needed is a rebalancing towards consumption.

That is why the politburo’s hint of big fiscal stimulus to come has excited markets, says Reshma Kapadia in Barron’s. With the official 5% growth target “in jeopardy”, officials seem to have become “alarmed enough to shift out of slow gear”. For markets, the big question now is whether political statements are followed up with significant cash.

Some foreign investors are cautious, says the Financial Times. “We have seen these fits and starts, where China puts in place some kind of stimulus, and it has not resulted in a long-term constructive recovery,” says Saira Malik of asset manager Nuveen. “We’d be looking for more follow-through in terms of a pick-up in economic activity.” Others caution that a more immediate threat to the rally is coming into view: a possible Trump victory in the US presidential election and the prospect of a renewed US-China tariff war.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China