2024 US elections: What impact could a Trump win have on the US Markets?

If Donald Trump wins the US election, what does it mean for your investments?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As the UK gets ready for a general election, the US is as well with both Donald Trump and Joe Biden running for presidency again.

The 2024 US election is unique in providing a rare glimpse into market behavior, as both potential nominees have previously held the presidency.

The stock market's performance during each presidential term offers valuable insights into potential future trends.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

During Trump's tenure, the S&P 500 increased by 69.59%, driven by policies such as corporate tax cuts and deregulation. However, his presidency faced significant challenges, notably the COVID-19 pandemic, which led to severe market volatility and economic disruptions.

Conversely, under Joe Biden, the S&P 500 has risen by 41.87% (data as of 20 June 2024), supported by substantial fiscal stimulus and infrastructure spending. Biden's term has been marked by the challenge of high inflation and a restrictive Federal Reserve policy, which has aimed to control inflation through interest rate hikes.

Amidst a restrictive Federal Reserve policy, the treasury market commands significant attention. Jerome Powell, appointed by Trump and retained by Biden, navigates the economy through a `challenging landscape marked by inflation concerns and interest rate hikes. It's noteworthy that the US is unique in having a debt ceiling, which merely allows the government to meet existing obligations rather than authorize new spending. The fiscal burden includes substantial interest payments on the deficit. During Trump's term, the Gross Federal Debt as a percentage of GDP increased by 19.5%, while under Biden, it decreased by 1.5%.

Unemployment rates provide another lens to evaluate economic performance. Under Trump, unemployment rose from 4.7% to 6.4%, primarily due to the pandemic. Biden's term has seen a significant recovery, with unemployment at a record low of 4%. The current economic narrative is dominated by inflation and the Federal Reserve's efforts to contain it through restrictive policies.

Analyzing sector performance reveals further implications for market impacts. Under Trump, the top-performing sectors were Financials, Technology, and Consumer Discretionary. Biden's term has seen Energy, Financials, and Technology sectors leading the charge. These variations highlight the influence of differing fiscal policies and broader economic factors on market dynamics.

| Sector | Trump | Biden |

|---|---|---|

| Financials | 179% | 78% |

| Technology | 179% | 78% |

| Discretionary | 113% | 10% |

| Comm Services | 91% | 27% |

| Healthcare | 82% | 30% |

| Materials | 61% | 26% |

| Industrials | 53% | 44% |

| Utilities | 48% | 22% |

| Staples | 39% | 29% |

| Real Estate | 37% | 16% |

| Energy | -29% | 134% |

Data sourced from stockcharts.com utilizing SPDR GICS sectors, Trump data time frame 01/20/2017 – 01/20/2021; Biden data time frame 01/20/2021 – present

The election outcome alone doesn't determine market crashes or booms; rather, policy direction plays a crucial role. Significant policy advancements occur when one party controls both the White House and Congress. Current polls suggest we are far from this scenario. Thus, monitoring party platforms as campaigns intensify will be vital for economic predictions and subsequent market impacts.

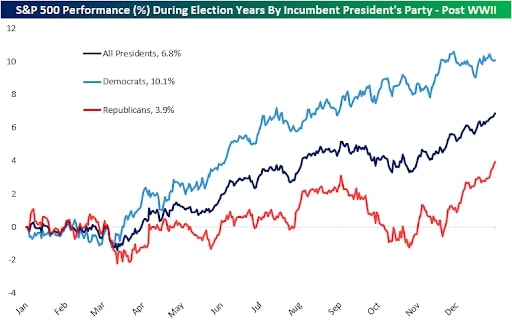

How does the stock market perform during an election year?

Historically, election years bolster stock market optimism. Typically, the S&P 500 starts slower in Q1, climbs until summer, stalls before the November election, and finishes with an average increase of 6.8%. Regardless of the election outcome, markets generally exhibit positive performance during election years.

Source: chart from Bespokepremium.com

What are possible fiscal policy implications on the stock market?

The Tax Cuts and Jobs Act of 2017, a hallmark of Trump's administration, is set to expire in 2025. If re-elected, Trump might extend these cuts, potentially exacerbating federal budget deficits. Conversely, allowing the act to expire would raise the corporate tax rate from 21% to 35%. This shift occurs amidst a high-interest environment due to restrictive Fed policies, leading to increased treasury auction yields.

Both candidates have indicated potential tariff increases, which could boost revenue. Energy policy divergence is clear: Trump favors increased domestic drilling, while Biden leans towards cleaner energy initiatives. Defense spending is expected to remain robust under either administration. Traditionally, Republicans' lenient anti-trust stance might spark more merger and acquisition activity.

Trump's first term was marked by his direct and often unpredictable targeting of corporations via social media, sometimes suggesting boycotts, which could potentially impact revenues. A critical factor to watch in a potential second term is the composition of his administration, which will likely differ significantly from his first term.

What could happen if Trump wins?

A Trump victory could lead to several notable market impacts. His administration's focus on deregulation and tax cuts could stimulate short-term market gains. However, these policies might also increase the federal budget deficit, particularly if the Tax Cuts and Jobs Act of 2017 is extended.

Trump's approach to trade, including potential tariff increases, could affect international markets and supply chains. His stance on energy policy, favoring increased domestic drilling, could boost the Energy sector but might face opposition from environmental groups and clean energy advocates.

Another potential impact is the influence of Trump's social media presence on individual companies and sectors. His direct communication style and willingness to criticize companies could lead to market volatility.

Moreover, Trump's potential second term would likely involve new cabinet members and advisors, whose policy perspectives could shape economic directions in unforeseen ways. Investors would need to stay vigilant about these appointments and their implications.

How should I position my portfolio?

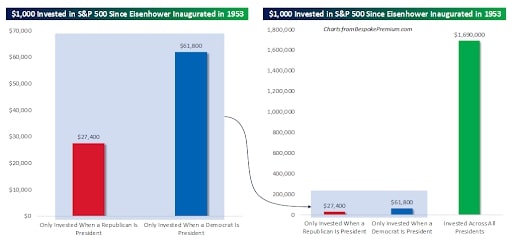

The dominant theme for the market remains the inflation outlook rather than the election itself. Markets tend to respond more to economic and inflation trends than to election results. Historical data indicates that remaining invested regardless of the party in power yields better returns than timing investments based on political leadership.

Source: chart from Bespokepremium.com

While the 2024 election will undoubtedly influence the US market, broader economic factors such as inflation, fiscal policy, and global events will play more significant roles. Investors should stay informed about policy developments and economic indicators to navigate the evolving landscape effectively.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jessica is a finance trailblazer, known for being the first female on Fidelity's Active Trader Desk and work frequently recognized by Jim Cramer. With expertise in advanced trading strategies and technical analysis, she has had a significant impact. Jessica appears frequently on CNBC, FOX Business, Yahoo! Finance and the Schwab Network as a guest and commentator.

Since joining the finance industry in 2009, she has held diverse roles in brokerage firms, specializing in strategic initiatives, high-frequency trading, options, and derivatives. Currently, she is the Director of Investor Research at Stockbrokers.com. Jessica's work is featured in esteemed firms and exchanges such as Fidelity, Merrill, TD, Nasdaq, and more. Alongside her professional endeavours, she actively promotes financial literacy through social media, gaining a dedicated following of over 100,000 advocating for the younger generation. Jessica recently launched the Market MakeHer podcast which has won various awards and is focused on breaking down the complexities of the stock market.