The bond bubble has burst – what comes next?

Investors in government debt have seen some of their biggest ever losses as the bond bubble bursts. John Stepek explains what’s going on and asks what might make prices turn back up again.

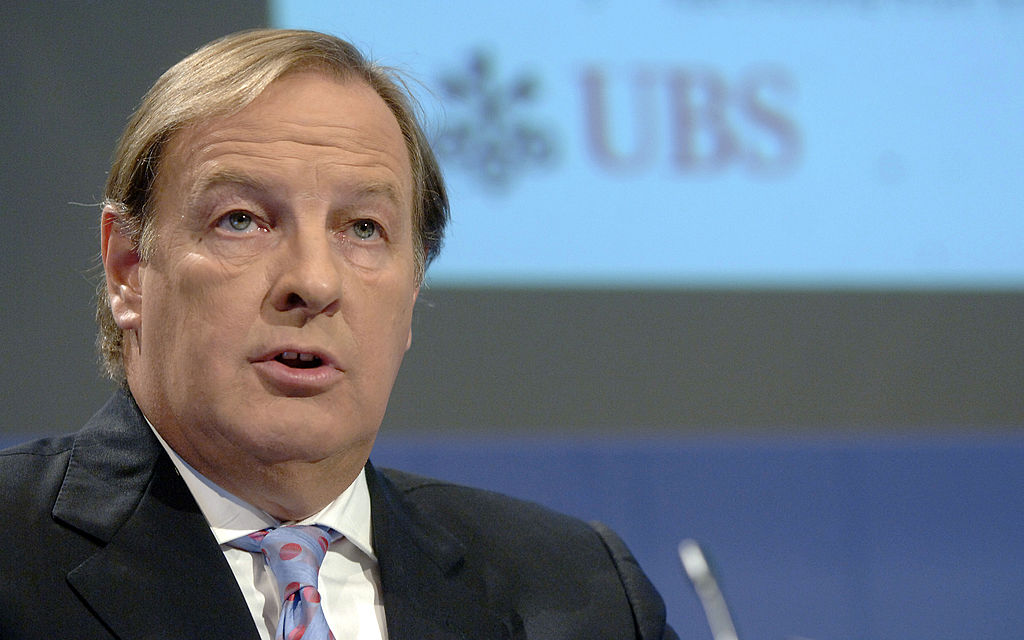

Before we get started today, a reminder – if you want a good excuse to be in Edinburgh on Saturday 30 April, Merryn and I will be interviewing one of the smartest people in finance, Russell Napier, to celebrate the opening of the new premises of his Library of Mistakes.

The event is completely free, but tickets are limited, and more than half of them have gone already, so be quick and reserve your spot now. I’m looking forward to it and it’d be nice to see you there.

It appears that the bond bubble has well and truly popped.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bond investors – accustomed to steady, perhaps even “rather good by historic standards” annual gains – have experienced some of their biggest losses on record over the last year or so.

So what happens now?

Bond prices are collapsing

US long-dated Treasury prices have fallen roughly by a third since the middle of 2020, notes Louis-Vincent Gave of Gavekal. That means that “Treasuries have now taken out more than five years’ worth of gains and accumulated income, with the asset’s long-dated index back at its July 2016 level”.

Ouch. Those are the sorts of losses that might make even an equity investor wince. For a bond investor – used to the idea that these are risk-free assets, the sensible ballast weighting the flightier, riskier parts of your portfolio – it must feel like the world is falling in.

So what’s going on? As a quick reminder for those of you who glaze over as soon as the subject of bonds comes up, most government bonds pay a fixed income. So when bond prices fall, yields rise (just like the relationship between dividends and share prices).

So another way to put all this is that US long-term interest rates hit a bottom in mid-2020 and have since risen sharply.

There are good reasons for this. Ordinary bonds (as in, ones that pay a fixed income) are allergic to inflation. Why’s that? Well, if an IOU promises to pay you £5 a year, every year, with no credit risk, until it matures, how much are you willing to pay for it?

The answer is: it depends. But if you expect inflation to be high and rising in the future, you’re going to pay less than if you expect inflation to fall or even turn negative.

In the first scenario, your £5-a-year payout is losing value every year at an accelerating rate. In the second scenario, your £5 is losing value at a slower rate and if inflation turns negative, it might even become more valuable.

Put very simply, we’ve gone from an environment where investors largely believed that the first scenario was more likely than the second, to a scenario in which investors are starting to believe that the second is more likely.

So it makes sense that long-term bonds (which are more sensitive to all this stuff than short-term ones, because their value is more dependent on payouts further into the future) have dropped in value.

Also, note that it’s not just the long bond – bond prices are falling and yields are rising across the board. High-rate US corporate debt for example, notes Lisa Abramowicz on Bloomberg, now yields more than 4%, not far off its highest level since 2011.

And of course, the mountain of negative-yielding debt that became such a glaring indicator of the downright weirdness of the post-financial crisis era, has now thawed away close to nothingness, sitting at around $2.7trn, the lowest figure since 2015.

There’s more to it than simply inflation rising, it’s also about how central banks react to inflation. We last saw moves in the bond market like this in the period between late 2017 and late 2018.

That’s when the Federal Reserve, America’s central bank, started raising interest rates in the hope of getting back to something approaching “normal” again. That was aborted after China’s growth panic stopped the Fed in its tracks and we then saw long-term yields drop over the course of 2019.

Then of course we had the corona panic during which the world’s central banks flooded the place with liquidity and thus pushed bond prices higher and yields lower.

Bond prices are now largely around about where they were at the most recent bottom in late 2018. The reason the pain has been much more dramatic this time round is because they fell from a higher peak, and the decline has been more rapid than during 2018.

What might cause a rebound in bonds?

What turned bonds around last time is the Fed changing its mind about interest rate rises. Could the same thing happen again this time?

It’s worth considering, given the pleasing symmetry in the charts, if nothing else. It’s exactly the sort of area you might expect to see a rebound if you place stock in such things.

More than that, you have to think that central banks must be starting to get nervous. We had the yield curve recently signalling a recession. We have interest rates on government debt shooting up at a time when there’s an awful lot of government debt out there.

And there are all sorts of concerns about bits of the financial plumbing. The commodities sector is having many tribulations with the rising costs of insuring against price moves; the Japanese yen is cratering. These are all distress signals.

Moreover, Bank of America’s latest global fund manager survey also showed that fund managers are exceptionally gloomy about the outlook, more so than they were even after the financial crisis of 2008, which is striking.

They are also extremely worried about market fragility – in other words, they think something is set to break. And they hate bonds.

That all signals to a contrarian investor that it might be time for the tension to break and something to change. The most obvious thing would be that we get some sort of mild relief on the US inflation front (all you really need is the April figure to come in a bit less astronomical than forecast) and the Fed can nod to being a bit less hawkish and you’ll get a relief rally.

Ironically, the other thing, which Gave points out, that might give a short-term rebound to US Treasuries would be a victory for Marine Le Pen in the upcoming French election, which could see a “safe haven” rush.

Either way, I don’t think it would represent a long-term change – I suspect that this time the bond bubble really has burst for real.

On that front, I’d just reiterate that you should make sure you own some gold, and also make sure you hold some cash for the inevitable panics that will no doubt be part of the return to “normal”.

I’d just add that this is all the sort of stuff that we may well be chatting to Russell about on 30 April, so do come along if you get the chance.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John Stepek is a senior reporter at Bloomberg News and a former editor of MoneyWeek magazine. He graduated from Strathclyde University with a degree in psychology in 1996 and has always been fascinated by the gap between the way the market works in theory and the way it works in practice, and by how our deep-rooted instincts work against our best interests as investors.

He started out in journalism by writing articles about the specific business challenges facing family firms. In 2003, he took a job on the finance desk of Teletext, where he spent two years covering the markets and breaking financial news.

His work has been published in Families in Business, Shares magazine, Spear's Magazine, The Sunday Times, and The Spectator among others. He has also appeared as an expert commentator on BBC Radio 4's Today programme, BBC Radio Scotland, Newsnight, Daily Politics and Bloomberg. His first book, on contrarian investing, The Sceptical Investor, was released in March 2019. You can follow John on Twitter at @john_stepek.

-

High earners underestimate how much they need to retire comfortably

High earners underestimate how much they need to retire comfortablyHigh net worth individuals grossly misjudge how much money they need for a comfortable retirement, new data shows, with many not saving enough.

-

Retired banker who gave wife £80m to avoid inheritance tax won’t face equal split in divorce

Retired banker who gave wife £80m to avoid inheritance tax won’t face equal split in divorceFamily lawyers say the Supreme Court ruling will have significant impact on high net worth divorce cases

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.