Are vintage Ladybird books valuable?

Keep an eye out for vintage Ladybird books at the car boot sale or on online marketplaces like eBay. You could find gold dust between its hard covers

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

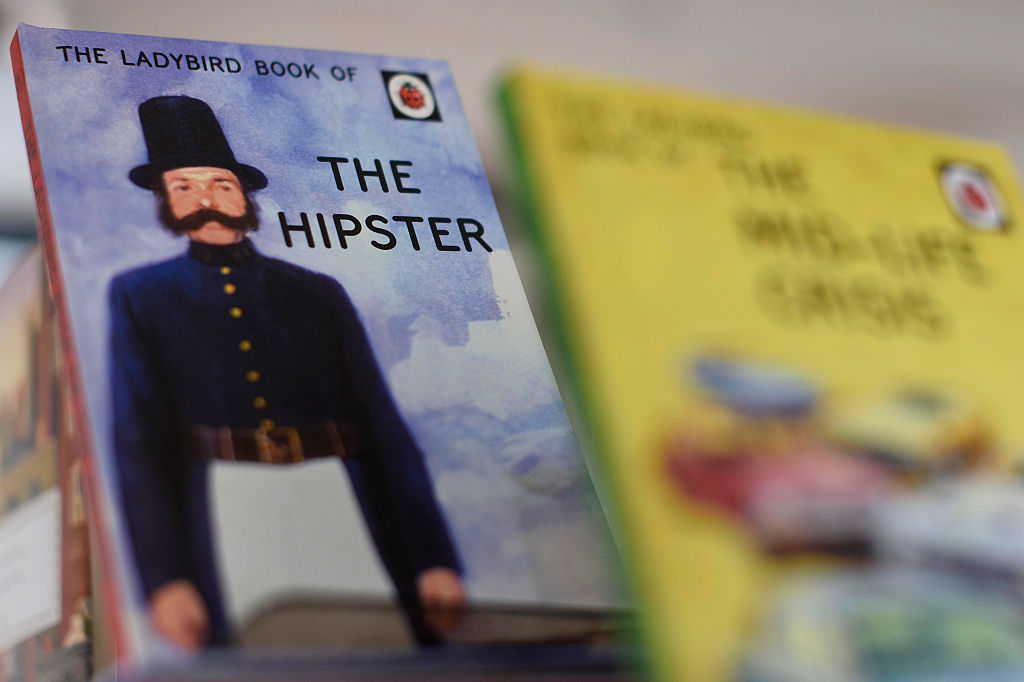

These days you can find Ladybird books exploring everything from the mid-life crisis to hangovers – examples from a spoof series released by Penguin, which bought the publisher in 1998, to capitalise on the nostalgia and resurgent interest in the series of children’s books. There doesn’t yet seem to be a Ladybird Book of Investing. It would be fun to follow the adventures of the original child protagonists, Peter and Jane, as they pore over balance sheets and the latest earnings reports.

Ladybird had its origins in Henry Wills’ bookshop in Loughborough, established in 1867, Michael Wood explains in BBC History Magazine. The first books appeared in 1914, but the golden age of Ladybird spans the years 1940-1975, when the series evolved beyond stories to cover science, history and nature (and, more recently, How it Works: The Wife). “These snapshots of ‘Our Island Story’ are nationalist, white, largely male; kings such as Alfred are noble and merciful, and the empire is still a Good Thing,” says Woods. Naturally, they are a product of their time, he notes, but many of the stories have stuck with us “like myths”.

It was in the early years of this golden age that Ladybird books assumed the pocket-sized format we recognise today. Paper was rationed during the war, but it was discovered that a single piece of paper could be folded into a diminutive 56-page book, perfect for children. Over 100 million copies had been sold by 2016, says Marion Willingham in the Financial Times. Naturally, the rarest examples are the most sought-after by collectors today. Often they are the ones that were the least popular at the time of their printing, Helen Day, a collector of 10,000 titles, tells the paper. One, The Impatient Horse, about “an errant milk float”, sells for around £250. Cinderella, the only Ladybird to come in a dust jacket, fetches about £180 for a first edition.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But be careful, warns Day. Ladybird played fast and loose with the rules, so a stated “first edition” may, in fact, be a later version. “First editions” were sometimes completely rewritten and even the illustrations changed, while leaving the original publication date unaltered. “If you’ve picked up an old Peter and Jane book and been bewildered to find Jane in a pair of jeans, this would be why.” Another giveaway is the Ladybird logo – open wings dates the books to the 1940s and 1950s. The “holy grail” of Ladybirds is How it Works: The Computer. Like the Biblical chalice, no one really knows if it ever existed.

Second-hand book shops, car-boot sales and online marketplaces such as eBay are hunting grounds for vintage Ladybirds. Day’s collection has been on tour for the past few years and it is next scheduled to pitch up at Peterborough Museum in the spring if you need inspiration. There is no market for modern Ladybirds. Sadly, that includes the spoof titles. That said, London bookseller Peter Harrington is selling a copy of “the original satirical Ladybird book” We go to the gallery, from 2014, for £1,250. Penguin threatened to sue the publisher, Elia, for infringing on the Ladybird name, so Elia created a new imprint – Dung Beetle Limited.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward