Forget stocks – handbags have outperformed them all

A surprising collectable has been trouncing other asset classes. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

No longer mere fashion accessories and Margaret Thatcher’s weapon of choice, handbags are this year’s darlings of the collecting world. So says the oft-quoted 2020 Wealth Report from Knight Frank. The value of handbags rose by 13% last year, the most of any collectable asset class (see below for the others). That was also slightly better than the 12% the FTSE 100 managed for 2019 – remember those days?

Of course, expensive handbags have been around for at least as long as there have been chihuahuas to put in them. But as a collectable, they’re relatively new to the scene. And, until very recently, there hasn’t existed any index to track prices. So Art Market Research (AMR), the company that supplies Knight Frank with data for its Knight Frank Luxury Investment Index (KFLII), made one.

“It’s only been possible to create an index on handbags now because of the frequency with which many iconic pieces are coming to auction today,” says AMR’s Sebastian Duthy. That has left some auction houses scrambling to catch up. Bonhams, a major auction house founded in 1793, only opened its handbags and fashion department in January, having pinched a couple of staff members from Chiswick Auctions, according to the Antiques Trade Gazette. The west London auctioneer is big in the way of selling handbags. Last March it launched its free The Handbag Report email newsletter, offering tips and auction news.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What to buy

Collectable handbags should be kept in tip-top condition. “The only person who has got away with mistreating theirs was Jane Birkin,” says Carol Lewis in The Times. Then again, the actress did lend her name to one of the most sought-after of all handbags – the Hermès Birkin (so much so, in fact, that its rising value has been termed “Birkinomics”). She sold one of her beaten-up bags on auction site eBay in 2011 for £100,100 for charity. And the most expensive bag ever sold at auction was a Birkin. Made from crocodile skin, with gold and diamonds, it fetched HK$2.9m (£293,000) in Hong Kong with Christie’s. And last June, a Himalaya niloticus crocodile Birkin 35 sold for £162,500 in London, also with Christie’s.

Hermès is arguably the most prestigious of marques and custom-made bags, known as Hermès Horseshoe Stamp (HSS) bags, featuring the stamp inside the bag, are the “ultimate status symbol”, says Chiswick Auctions’ Winnie McGee. Chanel bags also carry status. Bags made from ethically sourced exotic skins, such as crocodile, fetch high prices, as do limited editions.

Coming up…

If you’re quick, you can still get in a bid for a “rare” Hermès Ombre Birkin handbag, made from Varanus salvator lizard with “palladium hardware” (pictured). It takes pride of place at Sotheby’s online auction, with bidding set to end at 4pm today (Friday). It is expected to fetch up to $120,000. Bonhams, Chiswick Auctions and Christie’s are holding sales in London in April, May and June.

Good news for stamp lovers

Good news at last for philatelists – stamps were the second-highest-rising collectable asset of 2019, rising by 6%. That market has been in a slump for the past few years, so 2019 might just have heralded a turnaround for these once-popular collectables. We’ll have to wait and see.

Over ten years, the market has only grown by 64% – not much compared with other collectable assets, such as whisky and classic cars. That said, classic cars (and jewellery) were last year’s biggest losers, both down 7%. The signs were there, particularly for cars. Values had risen by 194% over ten years (again, according to Knight Frank), but the demand failed to turn up at the calendar highlight that is Monterey Car Week, in California, last August.

Surprisingly, whisky “only” grew by 5% (imagine if you could get that kind of return on your cash Isa), but that market has done superbly well over the past decade, increasing by 564%. Andy Simpson of Rare Whisky 101 blames oversupply and a “softening of values for the market leader, The Macallan”.

Still, with investors fleeing stocks and whisky being an easily storable, tax-efficient (if you store it “in-bond”) and relatively liquid asset,I doubt we’ve reached the dregs of the whisky market just yet.

Auctions

Going…

A rare stone lithography film poster for The Invisible Man from 1933 is to be sold with Texas-based Heritage Auctions as part of its Movie Poster online sale, taking place this Saturday and Sunday. “This beautiful poster is an outstanding example of the horror artwork by artist Karoly Grosz, which made the Universal monster genre such a success,” says Grey Smith, director of posters at Heritage Auctions. It is expected to sell for up to $125,000. A “front-of-house card” (a smaller film poster, known as a “lobby card” in the US) for the 1931 horror classic Frankenstein is expected to fetch between $50,000 and $100,000.

Gone…

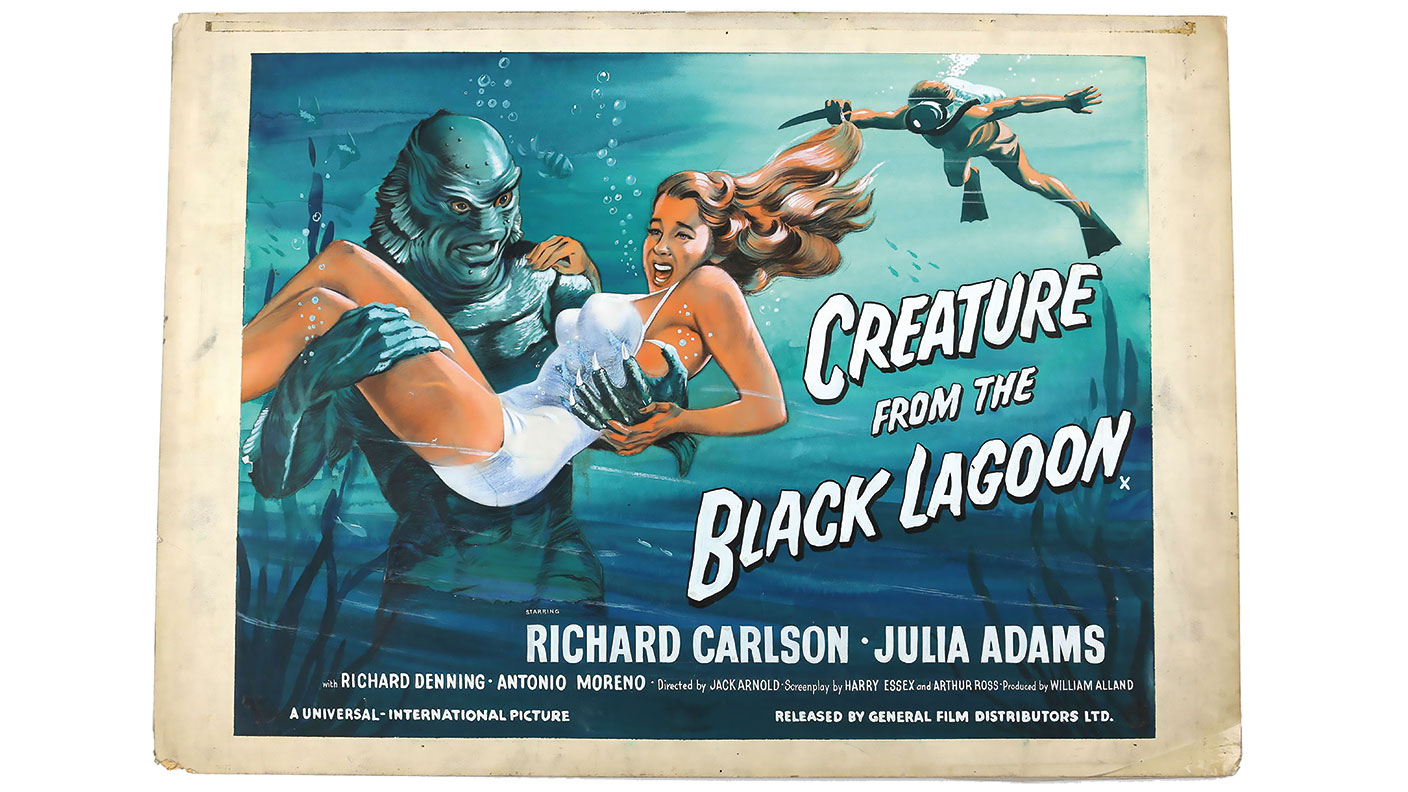

Hand-painted artwork for the 1954 monster movie Creature from the Black Lagoon sold for £22,000 before fees with Ewbank’s Auctions in Surrey late last month. It had been expected to sell for up to £4,000. It was one of a collection of film and circus posters produced by Bradford-based W E Berry for Disney, Rank, Universal, Columbia Pictures, Paramount and Ealing Studios from the 1920s, says the BBC. In total, the collection brought in £165,000 – three times the estimated asking price of £55,000. Artwork for Ealing comedy The Ladykillers fetched five times its asking price – it sold for £8,000.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.