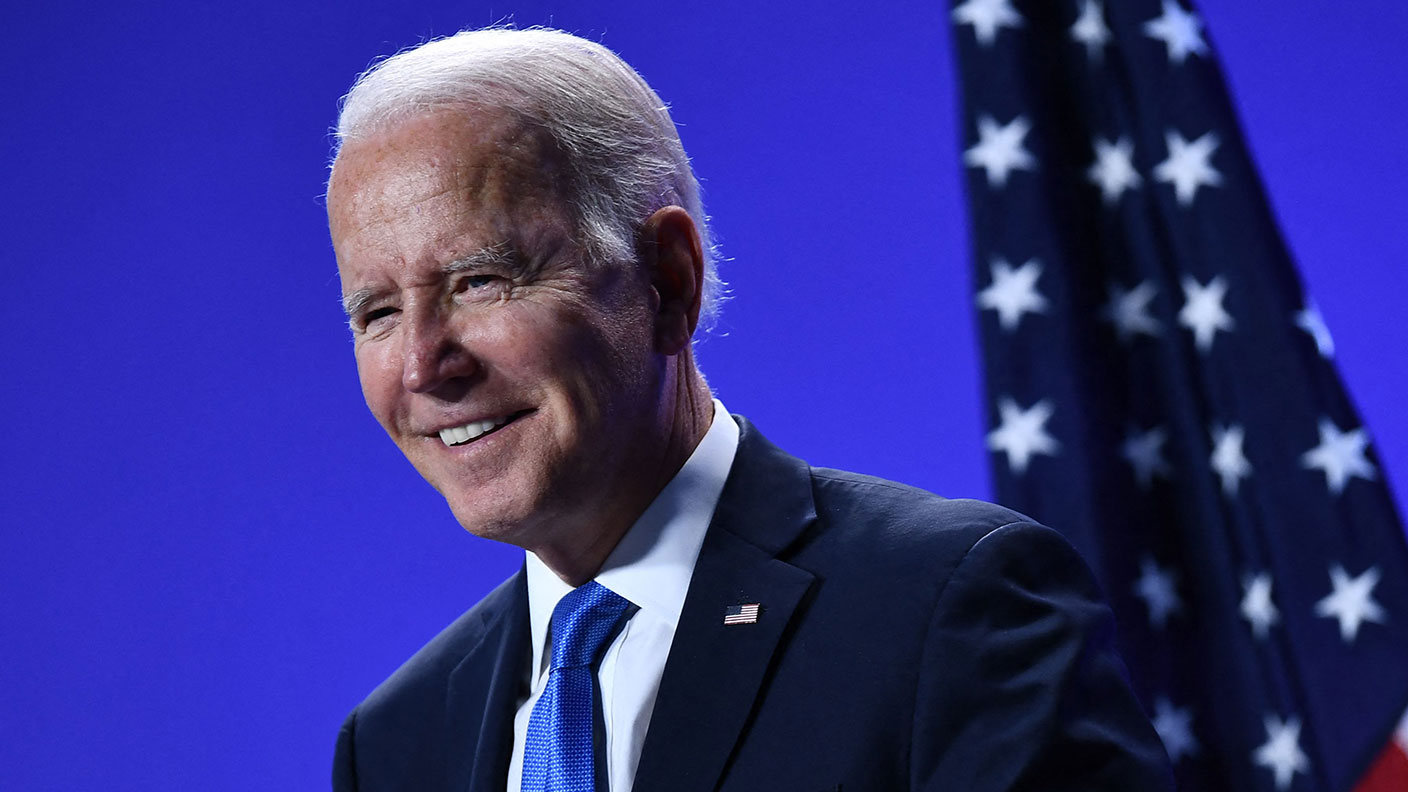

Joe Biden’s public spending revolution eats itself

The US president’s flood of free money was going to save America. Now, the country is drowning, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It’s like fighting a war, argued economist Paul Krugman – no point worrying about the cost. It’ll create a “stronger industrial base”, said economist Mariana Mazzucato. It’ll “speed the recovery”, said Janet Yellen, another economist, now Treasury secretary.

When US president Joe Biden unveiled his huge $1.9trn stimulus programme at the start of the year, it had no shortage of cheerleaders from the economics establishment. And yet, only a few months later, the plan is starting to come apart.

Throwing caution to the winds

Biden’s plan to shrug off the centrist caution of previous Democratic presidents and transform the US economy was supposed to rival Roosevelt’s New Deal in ambition. Infrastructure would be rebuilt, climate change dealt with, new industries created, poverty defeated. Money would not be any object. Higher taxes on corporations and the rich would pay for everything, and if more cash was needed then the government would borrow it. Finally, the US was throwing off the shackles of fiscal orthodoxy, and growth would accelerate.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Ten months later, and what is happening? In the last week, we have learned that growth slowed to an annualised rate of just 2% in the third quarter of this year, down from 6.7% in the second quarter. Meanwhile, inflation has jumped to an alarming 5.4%. And the rate of job creation has slowed. In the latest data, fewer than 200,000 new jobs were created, compared with expectations of more than 500,000, and unemployment is still above its pre-pandemic levels.

True, the American economy is still expanding. But it is sluggish at best, and there is absolutely no sign of the acceleration of growth that was predicted. And this at the very moment when all that massive stimulus should have turbo-charged growth to 5% or 6%.

Even worse, Biden’s tax plans are a mess. First, he proposed a “billionaire’s tax” that fell apart on its first contact with reality. It would have taxed a handful of the richest Americans on unrealised gains in their companies, forcing the likes of Amazon’s Jeff Bezos and Tesla’s Elon Musk to sell huge chunks of their holdings simply to pay their tax bills. It was badly planned, with minimal support, and had to be cancelled soon after it had been announced.

It has now been replaced with a “millionaire’s tax” that seems to be just as bad. It would impose a 5% surtax on households with a net worth of more than $10m, as well a minimum corporation tax on the largest US firms. Neither proposal seems likely to get through Congress, or to stand up to scrutiny by the Supreme Court even if it does. Biden’s team simply seems to be making it up as it goes along. A few “bash the rich” slogans is not a substitute for clear policies.

The slide towards stagflation

The US is learning some very old lessons. The first is that much of the money the government spends in any stimulus programme is simply wasted. Hundreds of billions were spent on sending out cheques to every qualifying citizen. The recipients didn’t even need to live in the US – plenty were sent to the UK, for example – which means they had precisely zero impact on demand.

Of the rest, many inevitably went to people who were already perfectly well off, and went into the bank, or into the stockmarket, inflating asset prices to even more absurd levels. Many of the new day traders dominating the market were simply playing with their free money. Much of the $1.9trn has been frittered away.

The second is that if you simply stoke up demand, without doing anything to improve supply, then all that happens is prices rise. There is lots more money around, but no more goods and services, and so everything simply becomes more and more expensive. You can’t spend your way to faster growth.

It has not taken long for America's president to be proved wrong. The US is now rapidly sliding towards stagflation. Prices are rising, growth is slowing down.That will carry on until someone gets a grip. The cheerleaders for the stimulus plan are looking ridiculous right now – and will look worse and worse as the US economy declines even further.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn