What Friday's stonking US jobs report means for markets

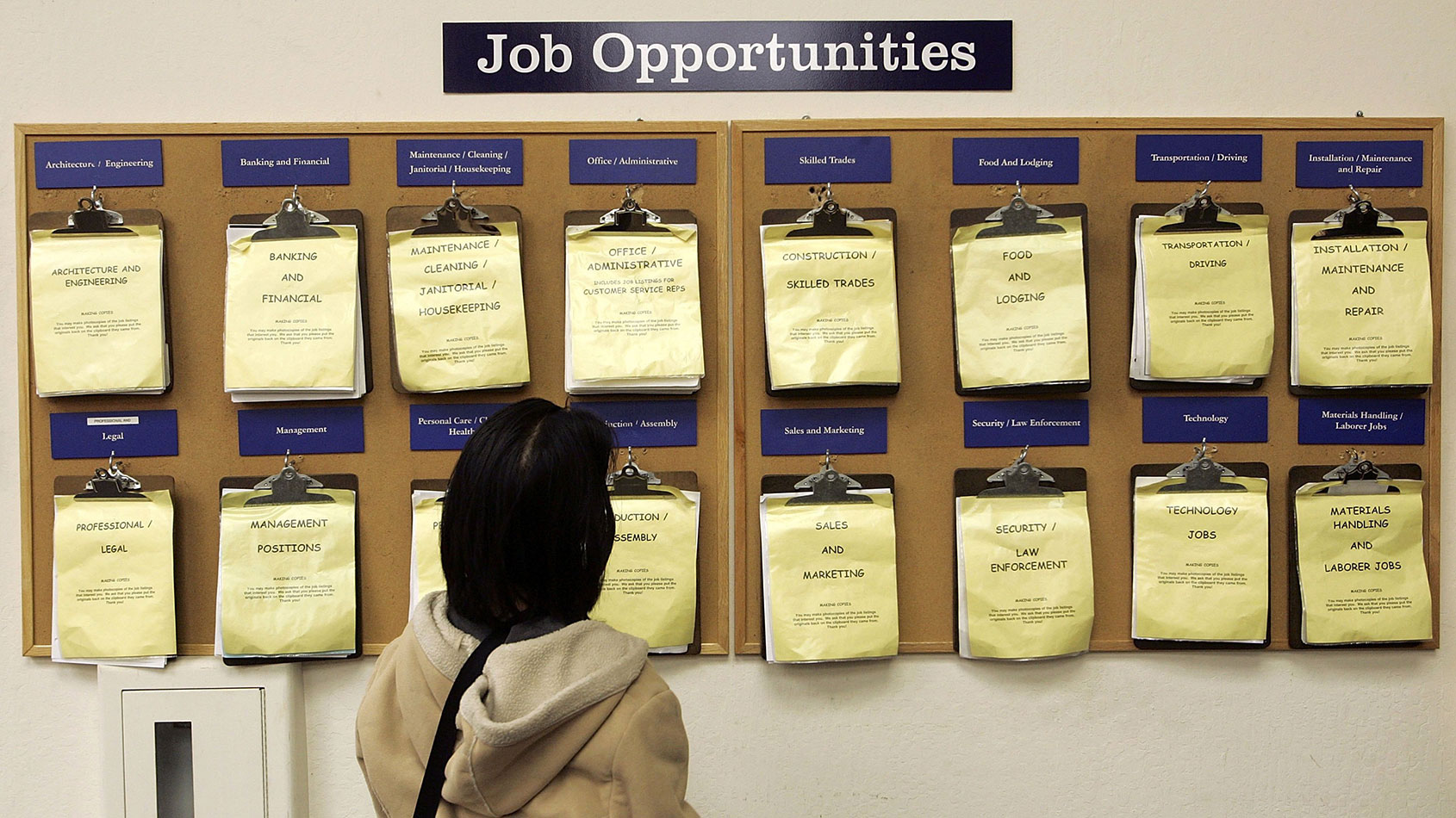

At the end of last week, US employment figures gave everyone a pleasant surprise and sparked hopes of a “V-shaped” recovery. John Stepek explains how the markets reacted, and what it means for you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before the coronavirus broke out, the monthly US non-farm payrolls figures were one of the most scrutinised pieces of data on the planet. Amid coronavirus and the economic shutdown, the figures lost a lot of their impact.

The weekly jobless claims data was more timely, and the sums were so huge as to become meaningless. How can you make sense of job loss figures when they are driven by an entirely unique situation, and also – you hope – temporary in nature to an extent?

But with the latest big surprise, the US jobs data is very much back on the traders’ menu.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Stocks up, bonds down

On Friday afternoon, UK-time, the US released the latest non-farm payrolls data. Analysts had been expecting yet more horrendous news; they expected the US to have lost as many as eight million jobs last month. Instead, it turned out that so many furloughed/idled workers have been added back to payrolls during the gradual reopening of the US, that there was actually a net gain of 2.5 million jobs.

The biggest gains were seen in those industries hit hardest by lockdown. As Capital Economics points out, the leisure and hospitality, construction, and retail industries "accounted for over half the total rise in employment”.

There are, of course, still loads of people who are unemployed, and loads of businesses that are or will be in trouble. But it's a nod in the direction of a far more “V-shaped” recovery than most people had really expected.

And with markets, it’s all about expectations. The absolute state of an economy – good or bad – isn’t important. What matters is what the market thinks will happen next, and whether those expectations are met, undershot, or surpassed.

So what does the market reaction tell us?

First, stocks shot up. It’s not as if shares have been doing badly, but this gave them a real shot in the arm. The reason is obvious – if the economy recovers faster than anyone expected, then profits will return more quickly too.

Of course, if the news gets too good too quickly, then investors may start to worry that rising interest rates might crimp the appeal of shares at these valuations. But we’re not there yet.

This takes us to the second big notable reaction. Bond yields rose (and thus bond prices fell). Why’s that? Firstly, government bonds are “safe haven” assets – you buy them when you are scared and don’t know what else to do with your money. If the world is getting better, and you feel more bullish, you pull your money out of bonds and put it to work.

Secondly, if the economy recovers more rapidly than expected, then that implies higher interest rates (and higher inflation) over time. In turn that makes bonds less attractive – their yields have to rise to maintain their appeal, and thus prices fall.

Why did gold fall hard?

A third notable side-effect was that gold cratered. Why is that?

There are two things at play here. One is that – like bonds – gold is viewed as a “safe haven” asset. To be very clear, I think that’s a misnomer (it’s a misnomer for bonds too, but in a different way). Gold is good at preserving the long-term value of your money but it is extremely volatile – buy it today and you could easily have lost 20% of your money by the end of the week, if you have to sell it. So that word “safe” very much gives the wrong impression.

But with that caveat in mind, gold does tend to benefit from the “risk-off” mentality. If it suddenly seems that the economy will recover more quickly than expected, then you don’t want to be in dull, “safe” stuff. You want to be in cyclical, “risky” stuff. Hence gold dropping.

The other issue is that gold does best when real interest rates are falling. Real interest rates are interest rates adjusted for inflation. So for example, if inflation is rising and interest rates are rising more slowly, are static, or are falling, then that’s good for gold. But if inflation is falling, and interest rates are rising or static, or are falling more slowly, then that’s bad for gold.

In this case, how does that play out? A surprisingly good jobs number means a couple of things. Firstly, it indicates that America’s central bank, the Federal Reserve, may need to be less aggressive with monetary easing than previously expected. In other words, interest rates aren’t going to be as low for as long as was previously expected (the market may be wrong here of course, but I’m just talking you through the thought processes – remember, it’s the direction and rate of change in expectations, not the actual numbers that matter).

That said, the good jobs number should also mean that inflation expectations pick up. And inflation expectations (as measured by US index-linked bonds) have in fact picked up. But not by as much as interest rate expectations. So in other words, real interest-rate expectations rose. That hurts gold, because if you think you can get an inflation-beating interest rate from your bank account, say, then why invest in an inert, non-income paying, piece of metal?

Now, I’m sticking with gold principally because I think the market is wrong – that’s what it boils down to. I think that inflation is going to bounce back more strongly than the market expects. And I think that central banks and governments are going to be loath to tackle it by raising rates. In fact, I think they’ll welcome it (at first).

But I hope that this explanation at least helps you to see why gold fell.

What’s next?

So where are we? The non-farm payrolls report often sets the tone for the month. The market is now set up to hope for more news that confirms the V-shaped scenario.

To be clear, that means there’s a lot of room for disappointment. Yes, the jobs report was a lot better than expected, but some of that could be statistical glitches (remember this is an unprecedented situation). And the initial rebound was always going to be speedy – the question is how much damage we’ll see once government stimulus wears off.

That said, I don’t expect the Fed to see this as a cue to start getting cautious about stimulus packages, and with Donald Trump hoping for re-election in November, I don’t see him being keen to avoid dishing out more money to the voters either.

In the longer run, as I just said, that’s why I think we’ll end up with an inflationary environment in which bonds struggle, gold does well, and equities are fair to middling (unless and until inflation really takes off).

What does that mean for you as an investor? If you're holding a decent mix of stocks (that reminds me, I must write about Japan again – the yen, another “risk-off” asset, weakened sharply on Friday which is always nice for Japanese stockmarkets), plus you own some gold, and some commodities, then I think that sets you up well for this environment.

For more specific ideas, make sure you subscribe to MoneyWeek magazine – this week I’ll be writing about how this inflationary environment might come about, along with tips for various funds and sectors that might do well out of it. You can get your first six issues free here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

The downfall of Peter Mandelson

The downfall of Peter MandelsonPeter Mandelson is used to penning resignation statements, but his latest might well be his last. He might even face time in prison.

-

Default pension funds: what’s in your workplace pension?

Default pension funds: what’s in your workplace pension?Default pension funds will often not be the best option for young savers or experienced investors

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.