Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s magazine, we’re looking at economic and investment cycles. As John said in yesterday’s Money Morning, you can’t use them to time your entrances and exits into a market, but they can be a valuable tool for investors. Akhil Patel revisits the theme he wrote about in MoneyWeek in 2014 – that economies and markets are driven by an 18-year cycle based on land and property values. It’s a compelling read – subscribe to MoneyWeek here (and get your first six issues free) if you haven’t already done so.

This week’s “Too Embarrassed To Ask” video explains what “options” are. You can watch that here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Merryn’s pulled another big hitter out of the bag as a guest on this week’s podcast – historian and author Professor Niall Ferguson. He talks to Merryn about the unpredictability of disaster and how we’ll never be prepared for it. Plus, he gives his views on bitcoin (he’s a fan), Covid restrictions and our possible descent into a total surveillance society. Find out what he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Here’s why investors were happy with Friday’s US employment data

- Tuesday Money Morning: What China’s war on tech firms means for investors

- Merryn’s blog: If a company is cheap enough for private equity, why isn’t it cheap enough for everyone else?

- Wednesday Money Morning: Commodity supercycle or not, here’s a metal that’ll still be in demand – tin

Web article: What’s driving the oil price volatility, and where could it go next? - Thursday Money Morning: It’s a tug of war between reflation and deflation – who will win?

- Web article: Ether price looks set to climb as network “hard fork” approaches

- Friday Money Morning: The real value to investors of cycle theories

- Web article: British fintech Wise has hit the market. Should you invest?

- Crypto roundup: $100bn wiped off crypto market value in one day

Now for the charts of the week.

The charts that matter

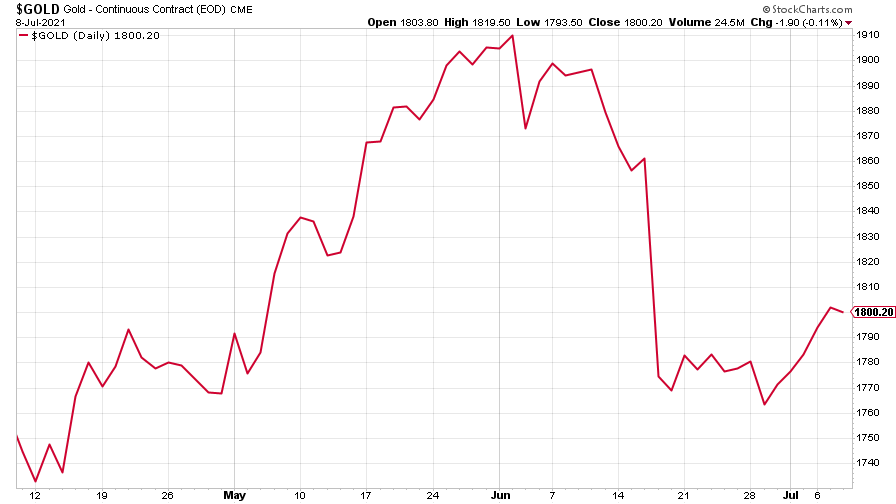

Gold started to climb back up after its big fall.

(Gold: three months)

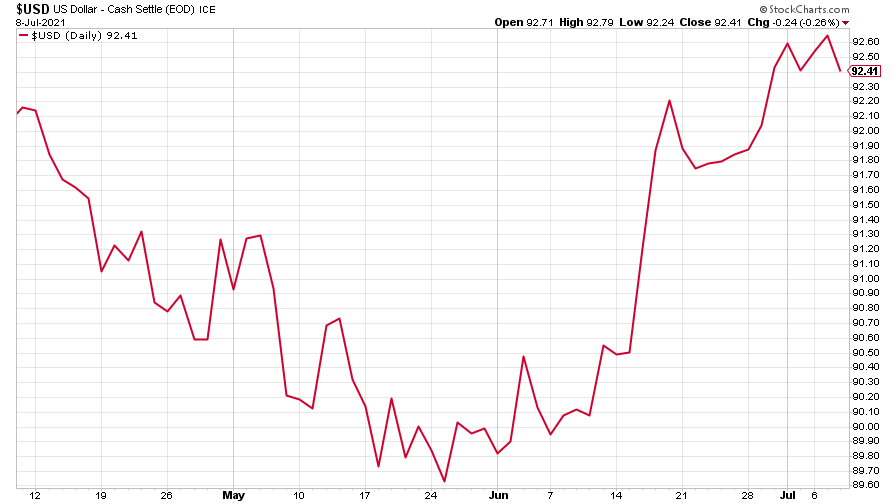

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) climbed higher.

(DXY: three months)

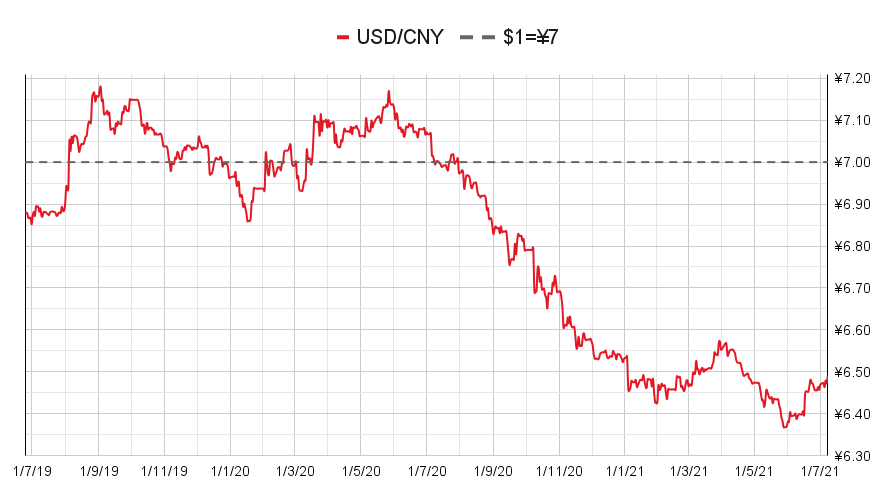

The Chinese yuan (or renminbi) reflected the dollar’s strength, weakening a little (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

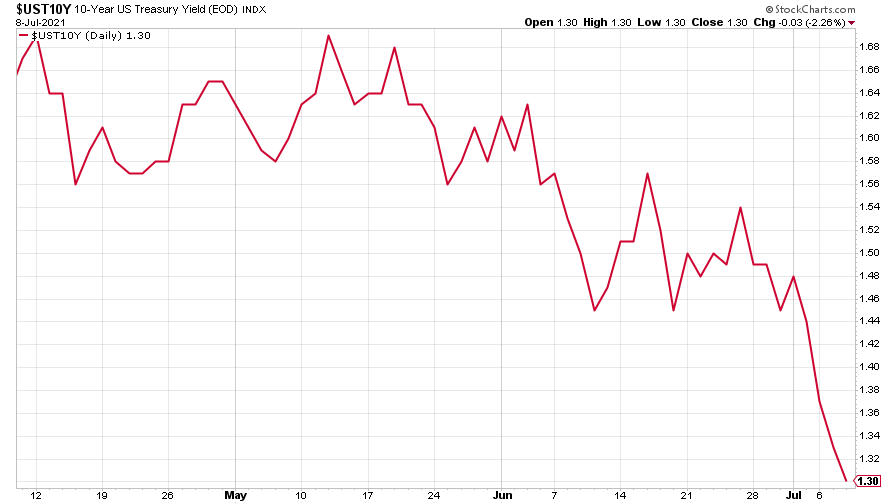

After seeming to settle last week, the yield on the ten-year US government bond dived lower again.

(Ten-year US Treasury yield: three months)

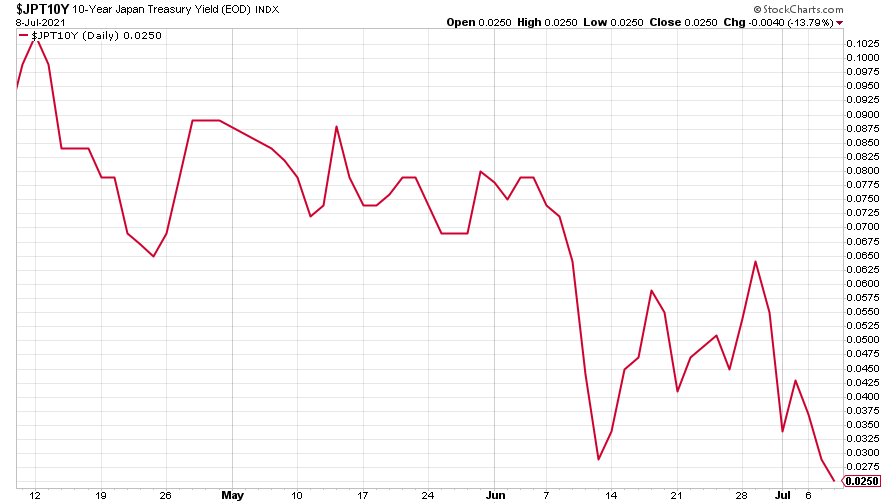

The yield on the Japanese ten-year bond reversed last week’s gains.

(Ten-year Japanese government bond yield: three months)

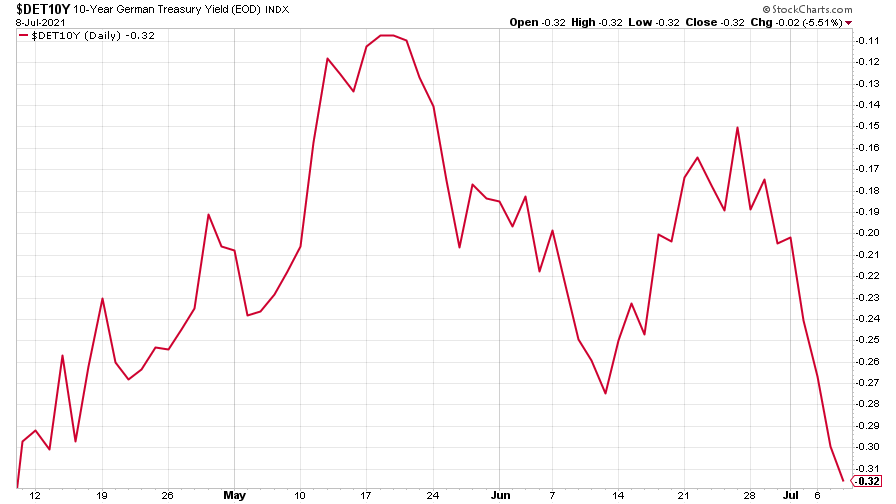

And the yield on the ten-year German Bund fell back to its level of three months ago.

(Ten-year Bund yield: three months)

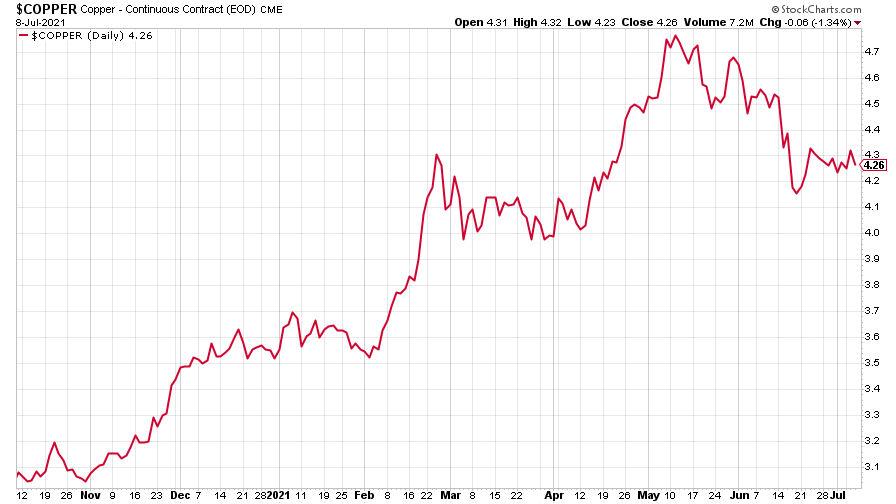

Copper drifted lower – just a breather or have investors given up on the Great Reflation?

(Copper: nine months)

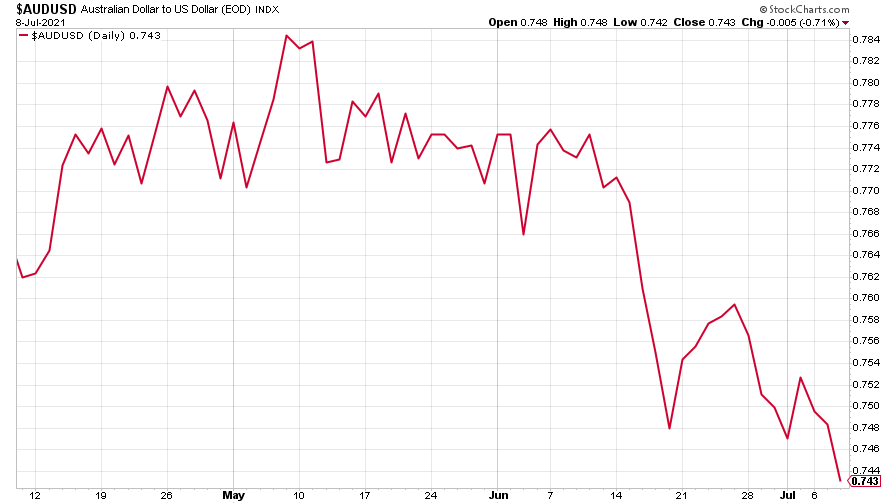

The closely-related Aussie dollar resumed its slide.

(Aussie dollar vs US dollar exchange rate: three months)

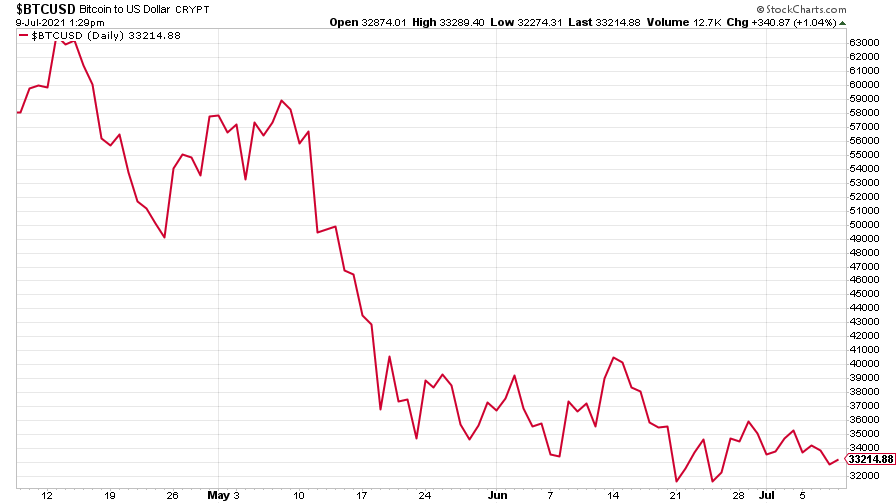

Bitcoin drifted lower.

(Bitcoin: three months)

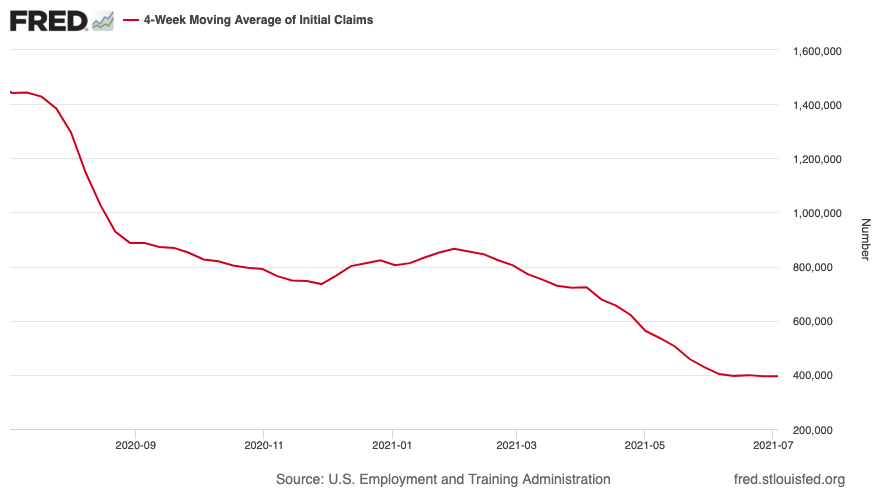

US weekly initial jobless claims rose slightly, up by 2,000 to 373,000, revised up from 364,000. The four-week moving average fell, however, down 250 to 394,500.

(US initial jobless claims, four-week moving average: since Jan 2020)

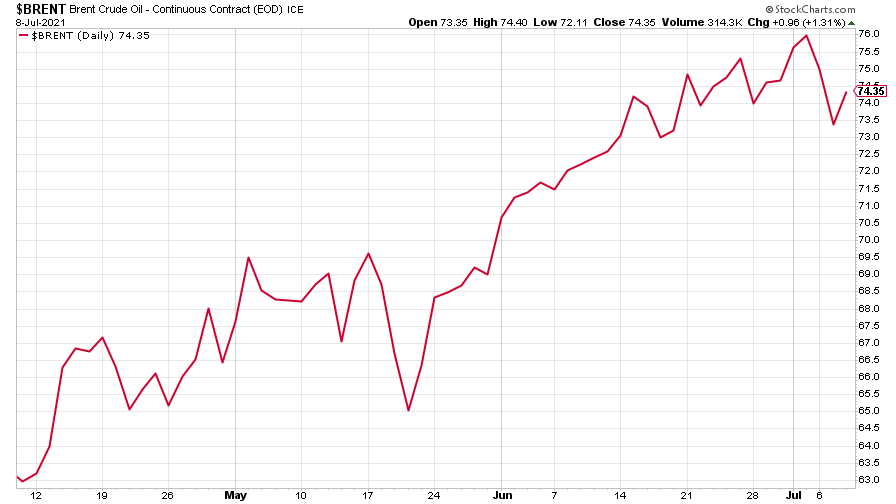

The oil price paused for breath – but that might not be the end of its bull run.

(Brent crude oil: three months)

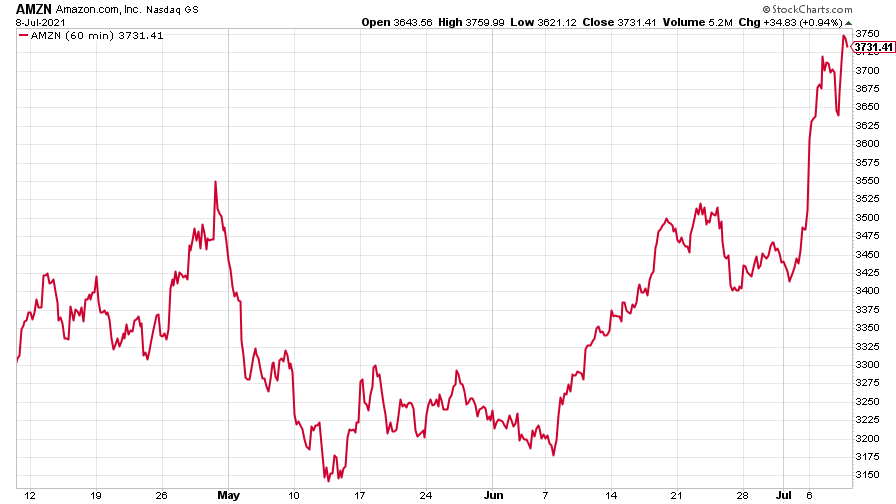

Amazon took another big jump.

(Amazon: three months)

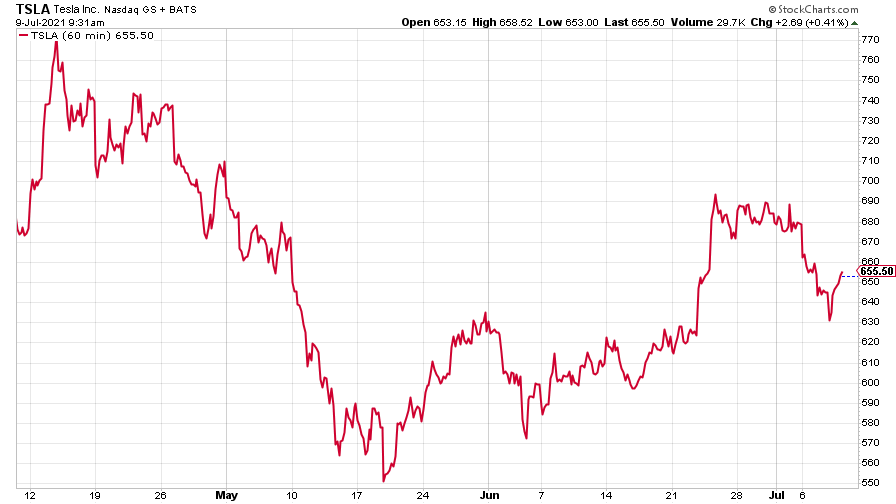

While Tesla fell back, with a little rally towards the end of the week.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.