The charts that matter: a surprisingly uneventful week in markets

John Stepek looks back over the last seven days to see what effect their events have had on the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back – first things first, don’t miss this week’s podcast, in which Merryn talks to the team at Amati Global Investors about their favourite small-cap stocks, and particularly opportunities in healthcare and biotech.

Also, don’t miss this week’s issue of MoneyWeek magazine, in which we ask, are monopolies destroying capitalism, as many people on both sides of the political divide seem to believe? Or is it more complicated than that – and is probable government intervention only going to make things worse? Get your copy now - you get six weeks free plus a free report on gold investing.

And if you’ve ever struggled to understand what bonds are or how they are priced, then please watch our latest “Too Embarrassed To Ask” video for a quick beginner’s guide.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: What are “fallen angels” – and why have they been such good investments?

- Merryn’s blog: Are we really in a stockmarket bubble?

- Tuesday: Investors are shunning UK stocks – but they might regret that in a year’s time

- Wednesday: Two commodities that could lie at the heart of the next resources bubble

- Thursday: It’s getting harder for big investors to ignore gold

- Friday: Trump’s Covid diagnosis has rattled markets – but you should sit tight

Now for the charts of the week.

The charts that matter

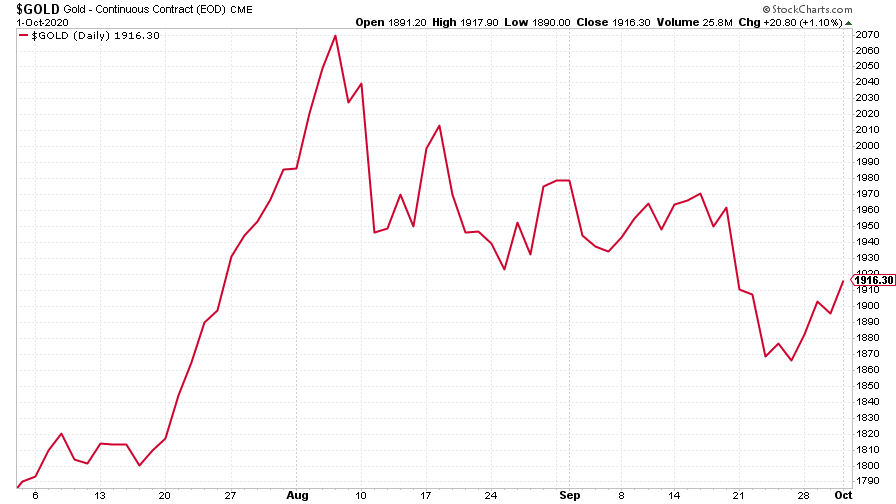

Gold clawed back some ground this week, helped partly by the market reaction to the news that Donald Trump has tested positive for Covid-19.

(Gold: three months)

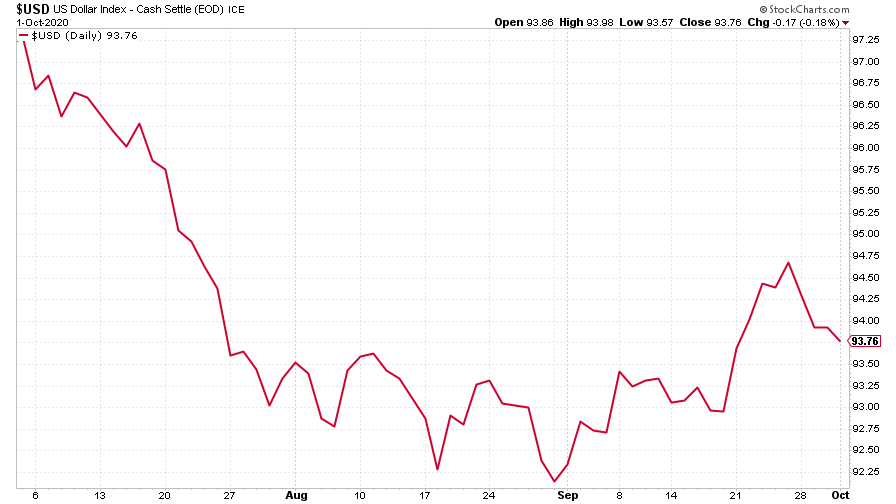

Gold was also helped by the fact that the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) gave back some of its recent gains.

(DXY: three months)

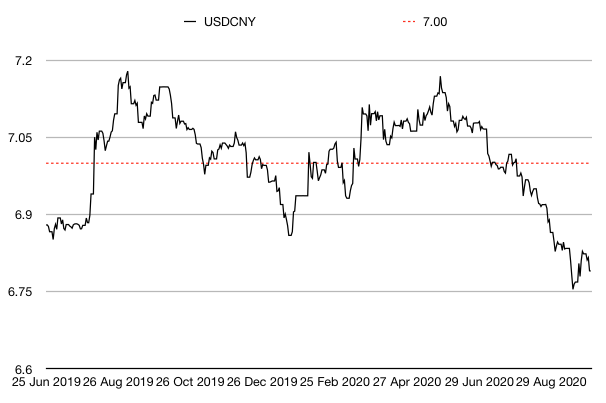

Even the Chinese yuan (or renminbi) strengthened against the dollar again this week (when the black line below rises, it means the yuan is getting weaker vs the dollar) as the US currency was generally weaker across the board.

(Chinese yuan to the US dollar: since 25 Jun 2019)

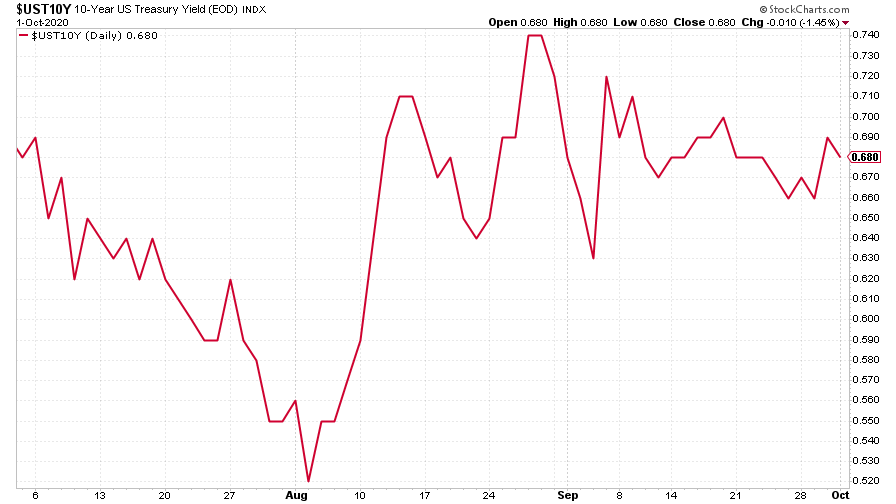

Yet again, the yield on the ten-year US government bond didn’t change much.

(Ten-year US Treasury yield: three months)

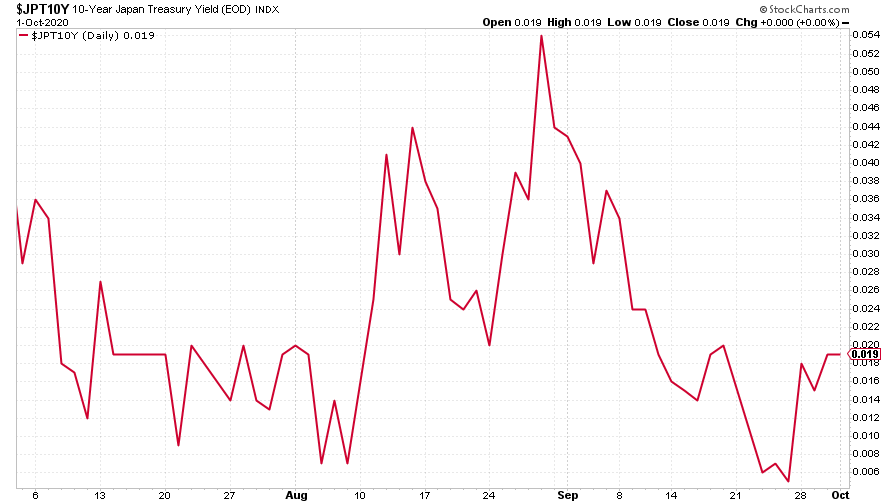

The yield on the Japanese ten-year more than doubled this week. That sounds like a huge move, but it was from 0.007% to 0.019%, so in reality it’s nothing.

(Ten-year Japanese government bond yield: three months)

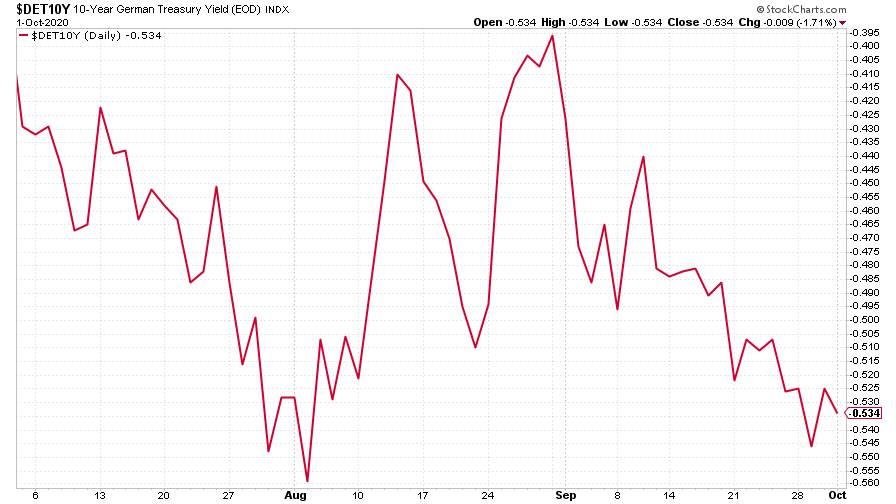

The yield on the ten-year German Bund fell back a bit.

(Ten-year Bund yield: three months)

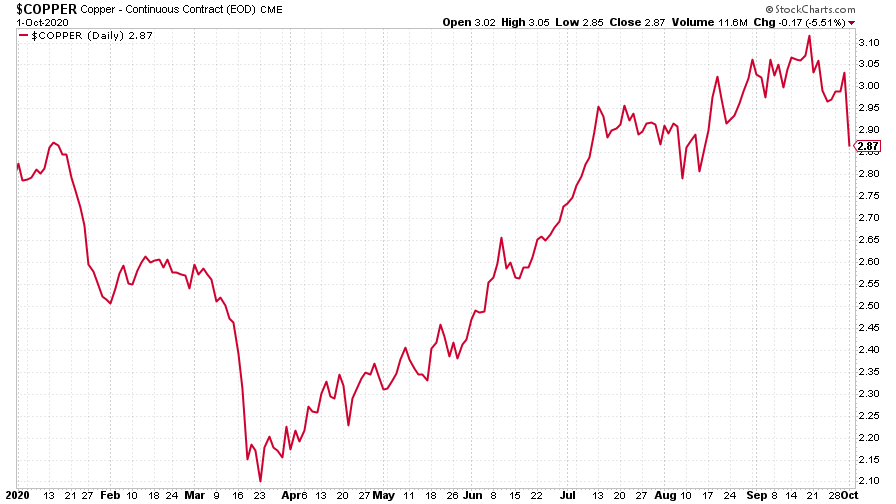

Copper fell this week as concerns grow about the impact of fresh coronavirus outbreaks on global economic activity.

(Copper: nine months)

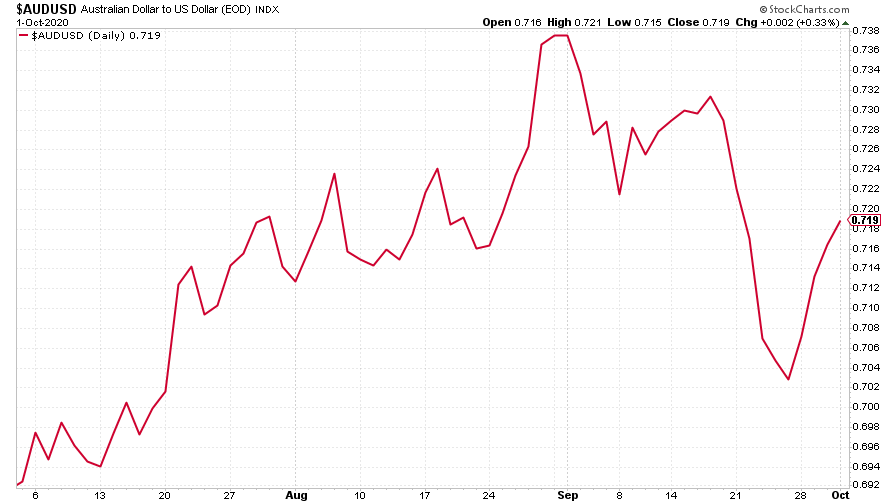

The Aussie dollar rebounded this week as the US dollar drifted lower.

(Aussie dollar vs US dollar exchange rate: three months)

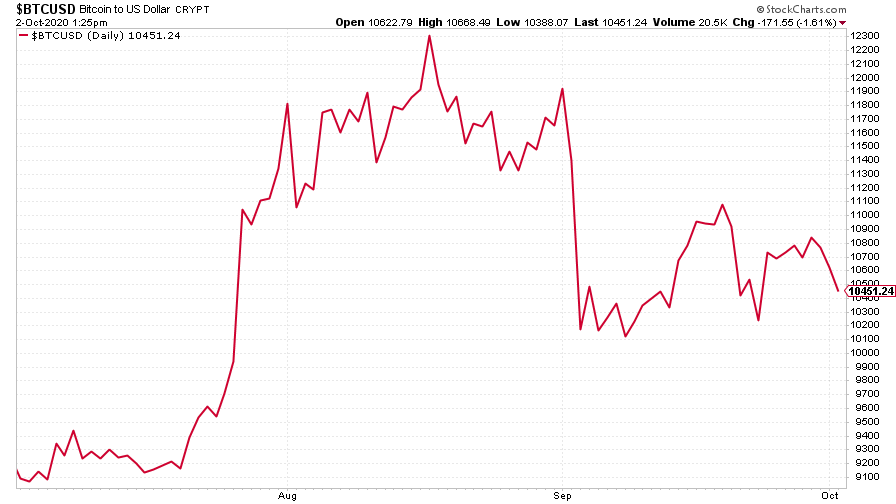

Cryptocurrency bitcoin fell somewhat towards the end of the week, but well within the sort of range you’d expect from the cryptocurrency.

(Bitcoin: three months)

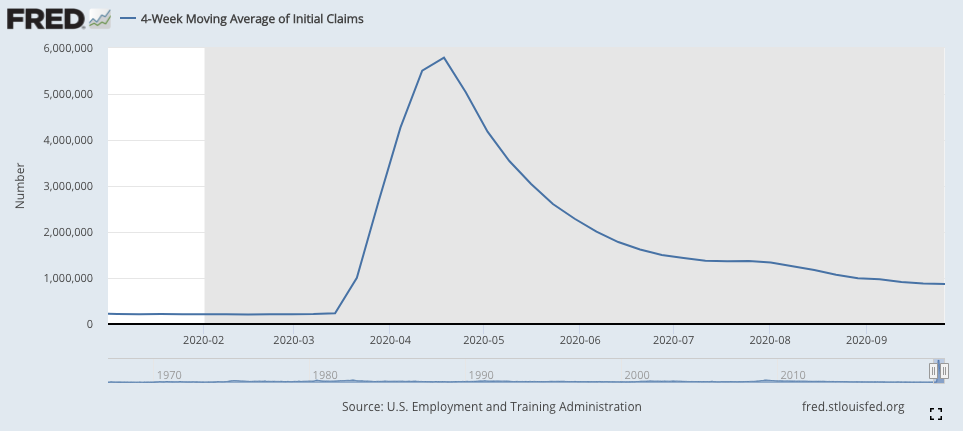

US weekly jobless claims were lower than analysts expected. There were 837,000 new claims, down from 873,000 last week (that was revised a little higher from 870,000). The four-week moving average fell to 867,250 from 878,250 previously.

More importantly, the US non-farm payrolls data for September came out on Friday. US workplaces only added 661,000 jobs, compared to expectations for 850,000. That said, the August gain was revised up to 1.49 million jobs from 1.32 million, so that was quite an improvement. Also the unemployment rate fell to 7.9% from 8.4%, which beat analysts’ expectations.

It’s going to be difficult to get a reliable picture of what’s going on for quite some time, so the relatively muted market reaction wasn’t surprising.

(US jobless claims, four-week moving average: since Jan 2020)

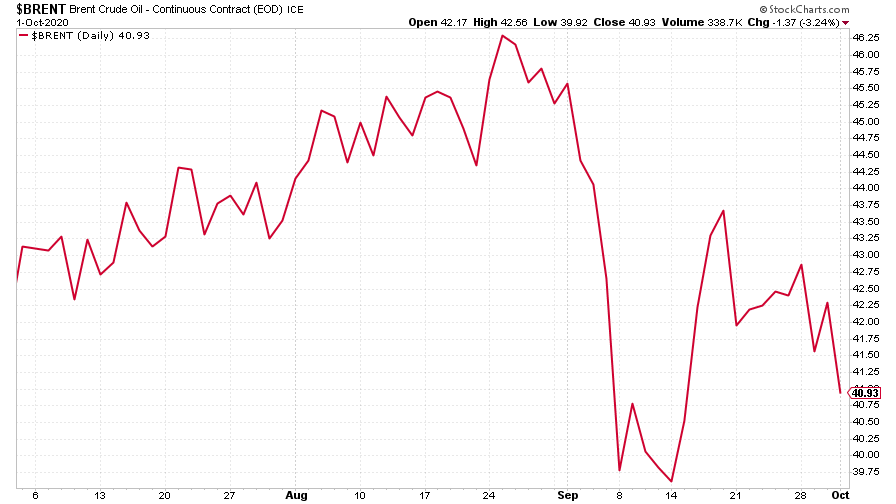

The oil price (as measured by Brent crude) continued to drop this week as the threat of more lockdowns hangs on demand.

(Brent crude oil: three months)

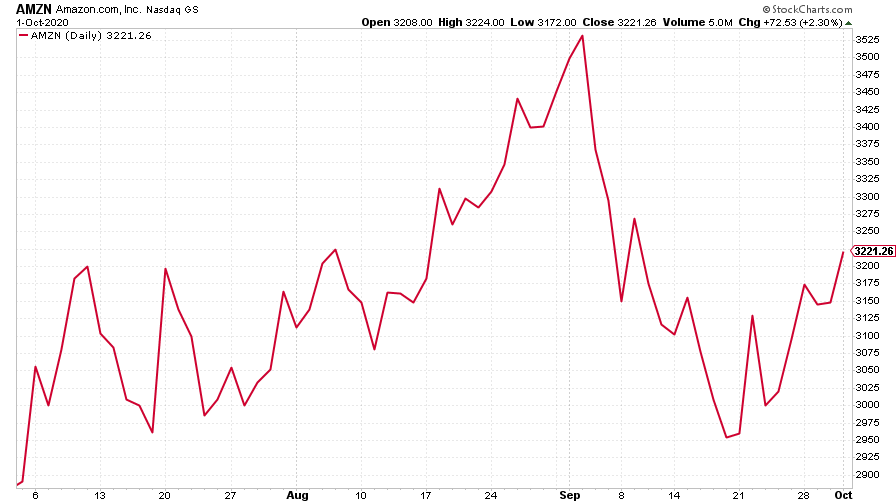

Amazon gained this week as the Nasdaq index recovered some ground from its recent falls.

(Amazon: three months)

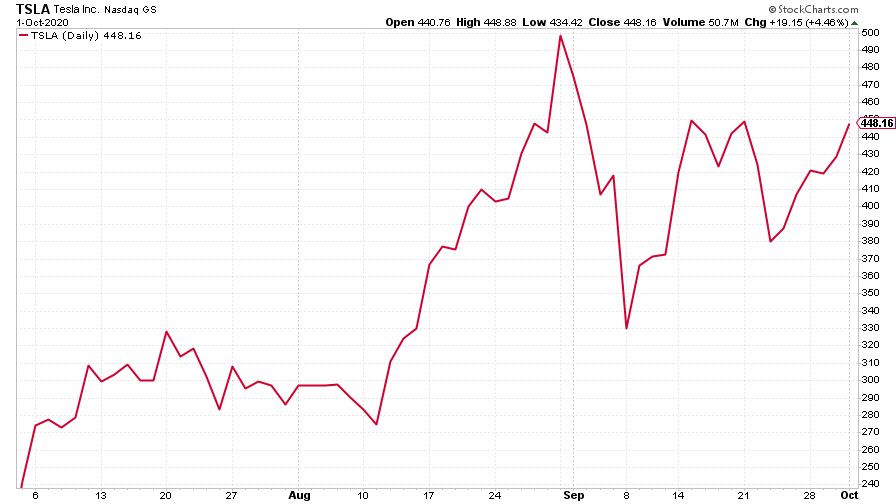

Tesla also ended the week higher.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.