Trump’s Covid diagnosis has rattled markets – but you should sit tight

Donald Trump’s positive test for Covid-19 sent the markets into a tizz. But it’s not worth changing your investment plans over, says John Stepek. Here, he explains why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

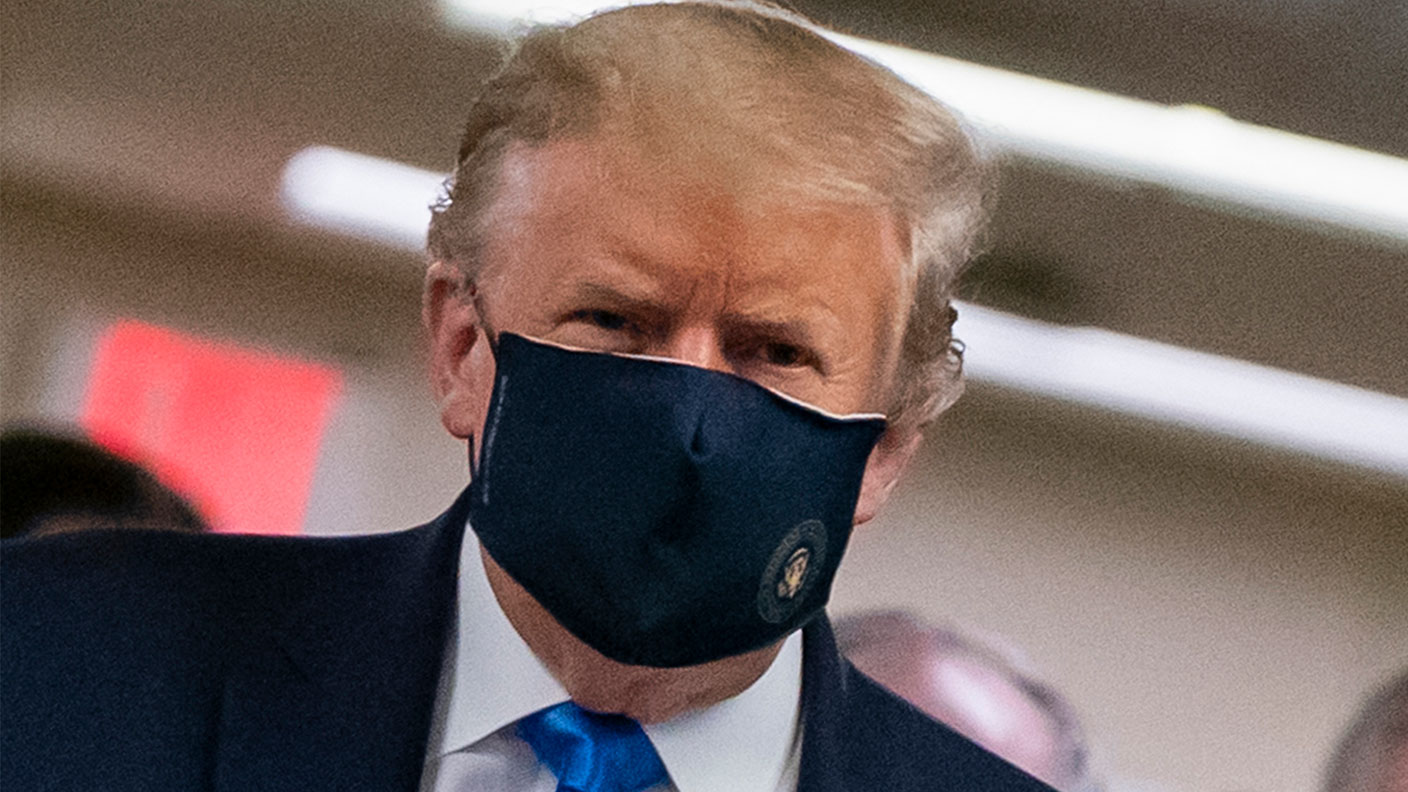

Donald Trump has been diagnosed with Covid-19.

That rattled markets somewhat first thing this morning. It sounds like a big deal. And if you’re a reporter on politics, or a White House employee getting tested for Covid-19, then it is.

But in the grand scheme of things, is it really something that should have you rushing to adjust your portfolio?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You can see why Trump’s diagnosis has rattled markets

When I got up this morning. I had a quick glance to see what was going on in the markets (it’s a bad habit, don’t copy it).

I noticed that Nasdaq futures had dropped rather rapidly in the space of about five minutes (long story short, futures prices trade even when the market is closed). Oh and gold was spiking higher too.

Clearly, something had happened.

So I flicked on Twitter – there are lots of things to dislike about Twitter, but it’s hard to beat for breaking news. The reason for the slide rapidly became apparent – Donald Trump and his wife Melania have both tested positive for Covid-19.

I have to admit, my immediate thought was – when’s this going to bounce? Which perhaps shows how the “buy the dip” mentality has got its grip on even the most cynical among us.

Then again, maybe it’s not that daft. Even as I’m writing this, futures are climbing higher. Maybe by the time the US market opens for business, it’ll be back to square one.

You can see why the market reacted. Like it or not, the US president is the most important politician in the world. If he’s ill with a potentially debilitating or even lethal virus, then that’s going to disrupt the governance process of the most important economy in the world, particularly if he’s infected a lot of other people in the White House too.

On top of that, we’re a month away from what is certain to be one of the most contentious presidential elections on record. I mean, it already is. How will it affect that? Does it mean that Joe Biden is more or less likely to win?

And what if Trump infected Biden the other night at the debate? What if Biden gets seriously ill? What if they both get seriously ill? Might we even end up looking at entirely different presidential candidates?

Those are a lot of “what ifs”. They’re the sort of “what ifs” that could inspire anyone to panic and look at reshuffling their portfolio or hitting the “go to cash!” button.

But let’s take a step back.

Will the US have a president in a year’s time? Of course

When market “events” happen, I find it helps to try to skip over the immediate panic and focus on the aftermath.

You can drive yourself mad trying to second guess what all of this means. You could go a long way down a rabbit hole trying to work out exactly who would take charge of the US if enough of the top people are debilitated by coronavirus.

You could also spend lots of time exploring conspiracy theories and trying to work out “cui bono” from all the different scenarios. There’s even a group of people who think Trump is faking it so he can make a triumphant jack-in-the-box return to campaigning in a fortnight’s time.

Here’s my suggestion: don’t waste your time. You’re not a day trader (if you are, consider whether it's worth the emotional stress – you may have a moment of clarity).

None of this is worth changing your investment plans over. To be honest, while I always tell you to keep a watchlist in case a bit of panic selling drives down the price of a company or market you’re keen to buy, I’m not even sure that it’s going to end up being a buying opportunity.

Depending on who wins the US election, certain sectors may benefit while others may suffer (and there may be some opportunities in that – we’ll be writing more on this in the lead up, so subscribe to MoneyWeek magazine now to get your first six issues free).

And yes, the next few months are likely to be hairy, which was always the case, even before Trump caught Covid. The election might be contested, which means that we might have a repeat of the 2000 US election, only much much angrier. We might not know who’s going to be president for a prolonged period.

But as to the bigger picture – a year from now, will the US have a president? I’m going to bet that the answer is “yes”. And regardless of who it is, their actions are going to be shaped by far larger forces than their own policy preferences.

The economy will still be suffering the after-effects (or the immediate effects, depending on whether it’s over by then) of the pandemic. Whatever else that means, it points to an electorate clamouring for more government spending.

Neither the Republicans nor the Democrats oppose more spending. They differ on who they think should get the money – but that’s it.

So in all, if you were happy with your asset allocation before this happened, you should be happy with it now. Nothing major has changed. We might see a bit more volatility than we were already going to see. But you don’t need to worry about that, because presumably you’ve got a financial plan that stretches beyond Christmas.

And if you don’t, you know what to do – get one.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.