The charts that matter: recession is here – how deep it will get?

After a week in which US unemployment claims topped six million, John Stepek looks at how the charts that matter most to the global economy are looking.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

We’ve been on something of a podcast roll this week.

First Merryn and I asked for your questions and you very kindly sent us them: so on Monday we had a good chat about house prices, dividends and inflation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Then Merryn got Edward Chancellor, author of the investment classic Devil Take the Hindmost, on to discuss his qualms about the economic consequences of the coronavirus shutdown.

And we ended the week on a real high with Merryn interviewing financial historian and analyst and all-round MoneyWeek favourite, Russell Napier. Russell cheered us all up with his vision of a world dominated by financial repression, capital controls, and where Japan offers the only hope for income investors. Happy days!

And here are the links for this week’s editions of Money Morning plus other stories you might have missed on the website this week.

- Monday: Oil prices have collapsed – and some argue that they could even turn negative

- Merryn’s blog: Buy stocks for the long term, but buy very carefully

- Tuesday:How to shield your portfolio from dividend disaster

- Merryn’s blog: How the coronavirus pandemic is killing cash

- Wednesday: Three things matter for the UK housing market now – and “location” isn’t one of them

- Thursday: Has the stockmarket hit rock bottom yet?

- Friday: Oil shoots higher – have we seen the bottom for the big oil companies?

- Subscribe to MoneyWeek now and get your first six issues free!

- Buy The Sceptical Investor – your guide to contrarian investing

The charts that matter

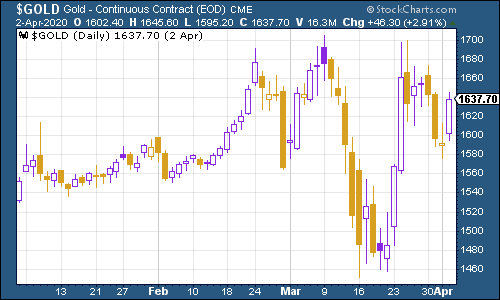

Gold (measured in dollar terms) had a less excitable week this week. That’s partly because markets rebounded somewhat (who wants to be in gold when you could be piling back into the S&P 500?), but it’s also because the dollar rallied somewhat after last week’s sharp fall.

(Gold: three months)

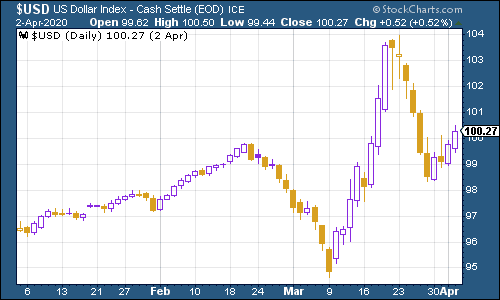

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – rallied a bit this week. Whether it’s a “dead cat bounce” or something more durable is a very important question for the world. The Federal Reserve has been doing all it can to make dollar access easier and cheaper for the entire world. It needs to keep that up if we ever hope to return to a “risk-on” boomtime world in the near-ish future again.

(DXY: three months)

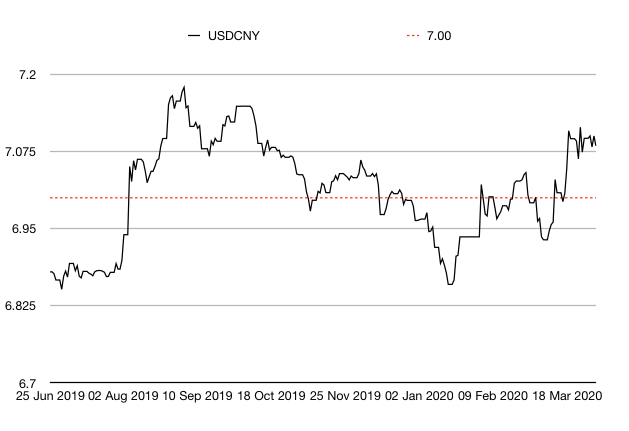

The Chinese yuan (or renminbi) is still above the $1/¥7 mark that gets markets nervous, but it’s not doing anything particularly noteworthy or concerning right now.

(Chinese yuan to the US dollar: since 25 Jun 2019)

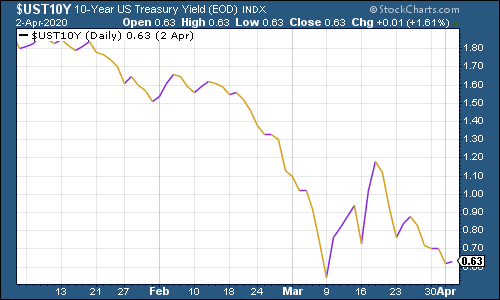

The yield on the ten-year US government bond continued to fall. People might be worried about inflation in the long run but in the short term the bottom has dropped out of the economy. That’s strongly deflationary.

(Ten-year US Treasury yield: three months)

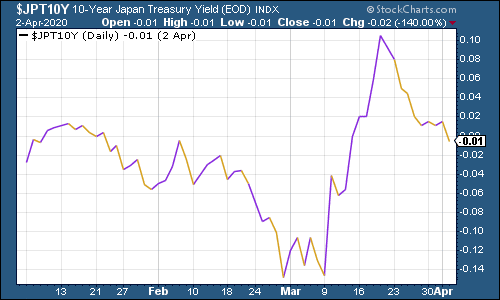

The yield on the Japanese ten-year was little changed.

(Ten-year Japanese government bond yield: three months)

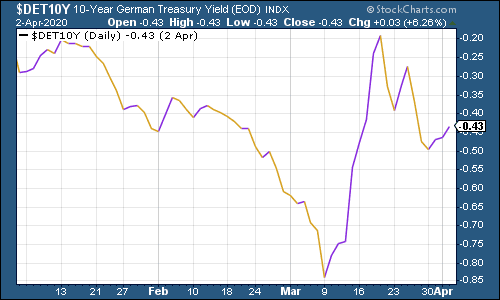

And the yield on the ten-year German Bund slipped a little further but was edging higher by the end of the week.

(Ten-year Bund yield: three months)

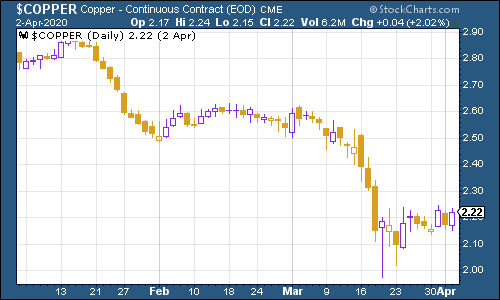

The good news on the economic front is that copper has so far managed to hold out about its 2016 lows. That doesn’t mean we’ve seen the bottom for markets but while it stays above that level (around about the $2.10 level) then it suggests that the global economy hasn’t entirely collapsed.

(Copper: five years and three months)

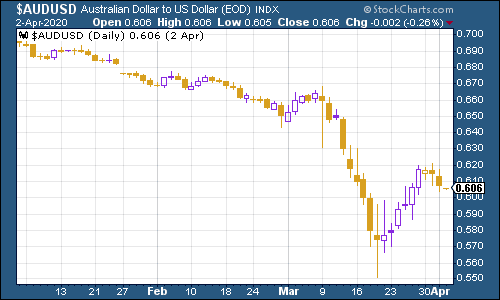

The Aussie dollar lost a bit of ground as the US dollar rallied slightly.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had a burst of volatility but ended the week pretty much where it was at the close of last week.

(Bitcoin: ten days)

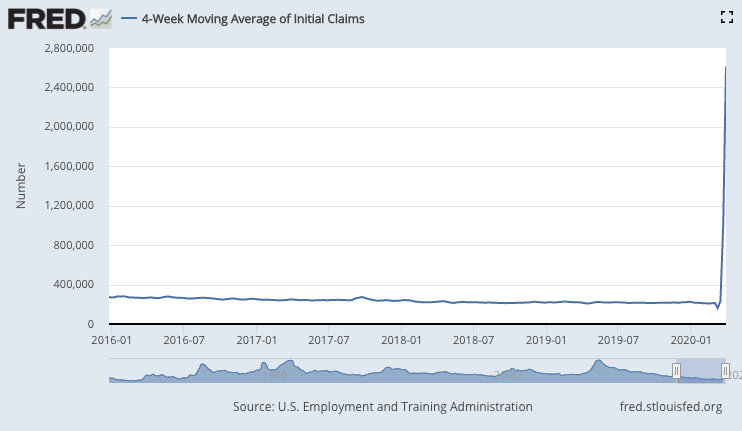

Once again, the US weekly jobless claims gives us the clearest and most brutal depiction of what’s happening in the “real” economy right now.

US weekly jobless claims rocketed to 6.6 million from 3.3 million last week, and just 281,000 the week before.

The four-week moving average now sits at more than two million (2.6 million, to be more accurate). It’s never ever been that high or anything close to it.

The monthly nonfarm payrolls figures came out too. It almost feels pointless to pay attention to them because they are even further behind the curve. But even bearing in mind that they only go up to 12 March, they were terrible. More than 700,000 jobs were lost.

Recession is here. The only questions now are how deep it will get and how long it will last. And it’s clear that there is only so much governments can do. This is the shadow that will hang over the economy and markets from here on in – if people don’t have jobs, they can’t spend as much, and if they can’t spend as much, companies eventually go out of business.

That said, no one can get out to spend so lots of businesses are going to go bust in any case. A lot depends on just how much government money can get to the end users who need it to tide them over, and how long that will take.

This is how helicopter money – literally handing out regular funds to individuals, rather than the current one-off measure, with the central bank basically paying for it – might gain acceptance. We’ll see.

(US jobless claims, four-week moving average: since January 2016)

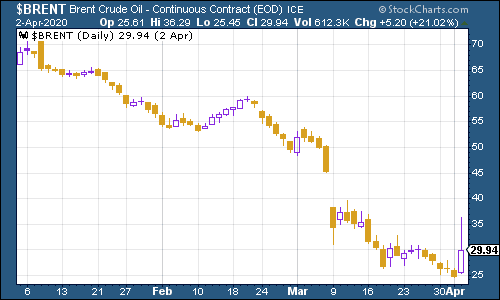

The oil price (as measured by Brent crude, the international/European benchmark) had a wild ride this week. At the start of the week, everyone was talking about oil prices going negative (because storage would fill up). By the end of the week, prices had surged as investors looked forward to production cuts being agreed by Opec and US producers. We’ll soon find out what happens – they’re due to meet up (via the magic of video conferencing tech) on Monday.

(Brent crude oil: three months)

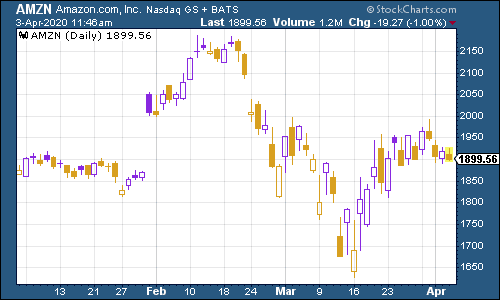

Amazon shares eased back again, alongside the wider market, as the initial rush of good cheer from the Fed’s massive activism last week gave way to a realisation that the economy is in an extraordinary bad position and there’s no clear indication of exactly how or when that will change.

(Amazon: three months)

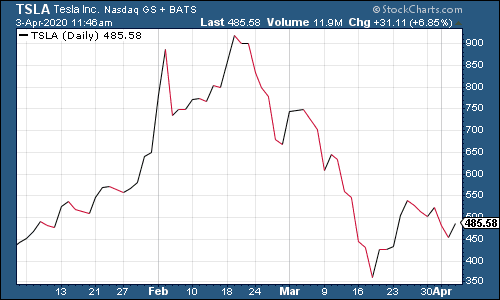

Electric car group Tesla fell a little from last week.

(Tesla: three months)

Have a good weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.