Will Trump force the Fed to lower interest rates?

Markets are ignoring the risk that Donald Trump compels the central bank into reckless interest rate cuts

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Markets are getting increasingly rattled by the difficulty of understanding what Donald Trump is likely to do next, but this should not have come as a surprise.

Trump’s great skill as a politician is his ability to convince so many people that he will be good for them, even though his policies are clearly contradictory, and there’s no sound reason for thinking that he’ll stick with the ones they particularly like. You struggle to pick out any consistent ideology other than a belief that the president’s power should be unchecked.

So we shouldn’t put too much weight on any forecasts for the next few years because they are even more guesswork than usual. Still, there is one big risk that we should not underprice: Trump forcing through a very large cut in interest rates.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Unusually consistent

It is entirely clear from Trump’s career that he will always favour lower interest rates – this is one of the rare situations where his comments and his conduct are almost always consistent.

After all, he does not fit the profile of anybody who believes in sound money. He is a real-estate developer with a history of borrowing as much as he can, and of filing business bankruptcy or getting debt forgiveness from lenders on several occasions.

Back in 2016, when first running as president, Trump accused the Fed of keeping rates too low to help Barack Obama, saying it had created a “false economy”. Once in power, that changed.

In 2018, after the central bank started to raise rates, he criticised it for moving too fast and called it his “biggest threat”.

This time, he said throughout his election campaign that rates should be lower, and he’s been stepping up that pressure since he got back in the White House.

Will the Fed cave under pressure?

The Fed is nominally independent but not immune to political pressure. It will cave in to this, just as it did in 2019.

The natural assumption is that the governors are moderately responsible, so they will give Trump lower rates, but not recklessly so (by their easy-money standards).

Yet, if the US economy starts to weaken and Trump’s approval ratings follow it down, it is very plausible that he will demand much deeper cuts.

The highest rates got in his last term was 2.5%, and much of the time, they were zero.

Would the current governors agree to that? That might not matter – Trump could try to replace them if they did not.

Fed chair Jerome Powell has said he won’t step down, and the president is not allowed to fire him. But given the approach that Trump is taking on other issues, I would take very little comfort in any legal arguments as to why he can’t replace the entire board with himself, Elon Musk or whoever else happens to be in favour.

If rates were cut aggressively, the usual tactic would be to hold long-term bonds (their price moves more for a given change in rates).

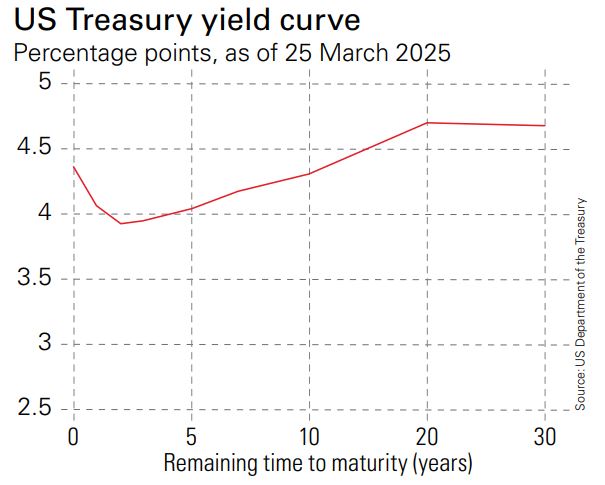

Yet, if Trump coerces the Fed, it could rattle markets even more, causing the yield curve to steepen.

I do not expect this to play out unless the US economy weakens severely, but it is another reason why our strategic portfolio holds only short-term bonds. Long-term yields are not high enough for this risk.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.