James Ferguson

James Ferguson qualified with an MA (Hons) in economics from Edinburgh University in 1985. For the last 21 years he has had a high-powered career in institutional stock broking, specialising in equities, working for Nomura, Robert Fleming, SBC Warburg, Dresdner Kleinwort Wasserstein and Mitsubishi Securities.

Latest articles by James Ferguson

-

How to play the next stage of the eurozone crisis

Features James Ferguson and and John Stepek look at the options facing the eurozone as it lurches from one crisis to another, and explain how to play the uncertain future of the euro.

By James Ferguson Published

Features -

China is heading for a fall – here’s what it means for you

Features Over the past few years, China's rampant growth has grabbed investors' imaginations. But now it shows signs of slowing. James Ferguson looks at the challenges it faces, and what you should buy when the slowdown hits.

By James Ferguson Published

Features -

What happens when quantitative easing ends?

Features Quantitative easing has been keeping the UK and US economies afloat since the financial crisis began. But America's $600bn money-printing programme is due to expire in June. So what can investors expect when the money tap is turned off? James Ferguson explains.

By James Ferguson Published

Features -

'Basel III' lets banks off the hook but keeps the rest of us on it

Features The Basel III regulations have been framed to give banks almost a decade to recover. The problem for the rest of us is that, over that time, we're the ones still on the hook says James Ferguson.

By James Ferguson Published

Features -

Is the bond market the next bubble to burst?

Features Government bond yields are at near-record lows as prices have surged. So is the bond market the latest bubble or are investors right to price in a gloomy future for the economy? James Ferguson and Dr Peter Warburton discuss whether it's time to bail out of bonds.

By James Ferguson Published

Features -

Stress tests: everyone wins, everyone loses

Features The investigations into European banks were no ‘stress test’, but a pan-continental PR exercise. Nearly every bank passed. That means we all lose, says James Ferguson.

By James Ferguson Published

Features -

Don't be fooled - house prices will fall again

Features One year on from Britain's property slump, and house prices seem to have staged a dramatic rebound. Some areas have even hit new all-time highs. So what's going on, and what happens next? James Ferguson explains.

By James Ferguson Published

Features -

We must stop pretending and face reality

Features A banking crisis can't be resolved until the banks have fixed their balance sheets. We can pretend they aren't up the creek, but they know they are, says James Ferguson.

By James Ferguson Published

Features -

House prices could fall another 40% from here

Features Despite stirrings in the property market, houses are still not affordable. Prices will fall for quite a while yet, says James Ferguson - but it will be worth the wait.

By James Ferguson Published

Features -

Lessons from Japan: why quantitative easing won't lead to inflation

Features The received wisdom is that quantitative easing inevitably leads to inflation. Not necessarily, says James Ferguson.

By James Ferguson Published

Features -

Never mind the apologies – what went wrong and why?

Features Top bankers may have delivered easy apologies to the Treasury Select Committee, but, says James Ferguson their evidence still leaves us no wiser as to how we got here in the first place.

By James Ferguson Published

Features -

Bankrupt Britain? It's not as bad as you think

Features Many people think the massive cost of the banking bail-outs will lead Britain to bankruptcy. James Ferguson isn't so sure. So what's the real worst-case scenario?

By James Ferguson Published

Features -

Bonds look like the buy of the year. But don’t be too hasty...

Features Are corporate bonds as cheap as they look? Yields are certainly high enough, says James Ferguson, but it’s early days yet.

By James Ferguson Published

Features -

The banking crisis tells us it's time to buy gilts

Features We're in a solvency crisis, not a liquidity crisis, says James Ferguson. And in times like these, banks develop an appetite for risk-free assets - government bonds.

By James Ferguson Published

Features -

Why gold bugs will get bitten by deflation

Features With commodities no longer driving inflation, deflation is a very real risk. This has huge implications for investors with big holdings in gold. James Ferguson explains why he believes the gold price is due for a fall.

By James Ferguson Published

Features -

Is it time to buy again?

Features How is the credit crisis affecting the stockmarket? James Ferguson looks at the shares that could weather the storm best, and what you need to know before buying.

By James Ferguson Published

Features -

Why it’s time to take profits on commodities

Features Fund managers see inflation as a real threat, but with America in – or heading for – recession, we should be more worried about deflation as consumer demand collapses. And that’s bad news for commodities, says James Ferguson.

By James Ferguson Published

Features -

Credit default swaps: how to spot the riskiest banks

Features When banks give you a higher savings rate, it’s not because they’re being generous, it’s because they have to compete for funds with more secure institutions.

By James Ferguson Published

Features -

Here comes the house price crash

Features Most people are still in denial about the UK property market. But prices are set to crash - and that could crush the whole UK economy. James Ferguson looks at why it's time to prepare for recession - and picks the best stocks to buy in a downturn.

By James Ferguson Published

Features -

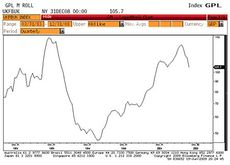

Top FTSE tips

Features If you want to make money, there are some simple rules to follows says James Ferguson: go for blue chips with good, sustainable yields.

By James Ferguson Published

Features -

Everyone agrees all is well. It isn't

Features Today, many investors are finding that, far from making them rich, their buy-to-lets are costing them dear in cash terms.

By James Ferguson Published

Features -

Where's this long-awaited recession?

Features Just around the corner, says James Ferguson. The signs are that it’s already started in America. And when America sneezes, we will all catch a cold…

By James Ferguson Published

Features -

How the US housing slump will affect us all

Features The entire world's economy rests on the price of houses in America. The bad news is, they're falling fast. So what does this mean for global stockmarkets? asks James Ferguson...

By James Ferguson Published

Features -

What Gordon Brown's premiership will mean for investors

Features Nil points. That's James Ferguson's verdict on the Brown decade. And if his track record as chancellor is anything to go by, we should be very worried about what Gordon has in store for us when he becomes prime minister. Here's how to Brown-proof your portfolio.

By James Ferguson Published

Features