Japan has seen plenty of false dawns – but this time it’s for real

Japan suffered one of the most spectacular bubbles in financial history. But today, the market is so cheap that it’s practically the opposite of where it was in 1989. Merryn Somerset Webb explains how to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On 2 February, 1987, Newsweek's cover offered unwelcome news to Americans: "Your next boss may be Japanese". This seemed likely at the time: Japan's GDP made up 18% of global GDP; five of the world's ten largest commercial banks were Japanese; and pretty much every big commercial property development in the world had a Japanese name on it. As all great bubbles do, Japan's had started out sane. In the post-war period, Japan had very low levels of debt and infrastructure and was strongly encouraged by the US to go for export growth (America was keen to see Japan proving the superiority of capitalism). Lending kicked off and fast translated into industrial-powerhouse-style GDP growth. Confidence grew. Over-ambition arrived.

Then came the Plaza Accord in 1985 when the US, beginning to feel that it might have created a monster, urged Japan to strengthen the yen (to make its products less competitive with home-grown US ones). The yen rose 50%. Lending to exporters became less profitable. So Japan's banks stepped up small company and property lending and everyone began to use the stronger yen to buy abroad. The explosion in private lending was epic. From 1985 to 1990 the value of commercial real estate loans more than doubled. The average size of a domestic mortgage doubled. Non-mortgage household debt near-tripled. Building after building "that would not be sold or even filled for years or even decades" went up, says Richard Vague in his A Brief History of Doom. Abroad the boom was shocking: in 1989, Mitsubishi bought the Rockefeller Centre, Sony bought Columbia Pictures and Japanese banks accounted for 20% of all property loans in California. And of course, the stockmarket, buoyed by extreme leverage and extreme optimism, went berserk.

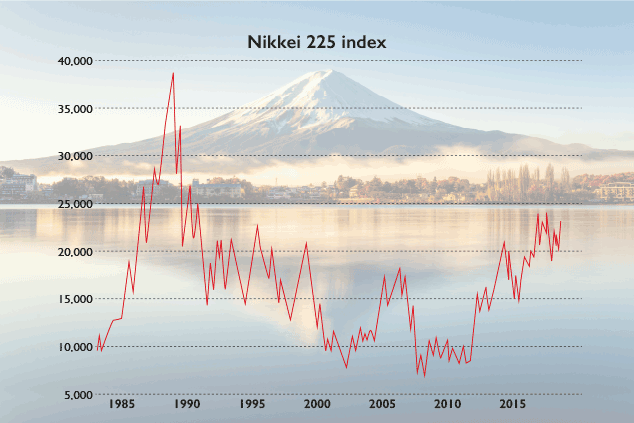

At its 1989 peak, with the Nikkei nearing 40,000 (38,916) and most commentators expecting 45,000 by the year end, the average price/earnings (p/e) ratio was up to nearly 70 (four times the US average) and the dividend yield was down to a mere 0.5%. The Japanese stockmarket made up 45% of the MSCI World Index. The land on which Tokyo's Imperial Palace sits was said to be worth more than all of California. This might not have been entirely true but the fact that it was widely considered plausible tells you all you need to know about just how much of a bubble this one was.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The end of the bubble era

Then, with debt growing faster than GDP and land valuations insane, came the inevitable crash. In 1990 the Nikkei fell 38%. By 1991 it was below 25,000. By this point, land prices were falling fast too and the more they fell, the more the loans they backed went bad. Over the next 20 years (a good few of which spanned my own rather disappointing career as a Japanese equity broker), it just kept falling, eventually bottoming at 7,055 in 2009, by which point the crisis was thought to have cost the equivalent of 20% of Japan's GDP and the attempt to sort it out had taken the public debt-to-GDP ratio to 230% (double that of the US). Today, with Japan's GDP making up just over 4% of global GDP, the Nikkei is back to 21,700 (the market now makes up 8% of the MSCI World Index). Better than 7,000 and up nearly 20% in the year to date but still a long way off that 1989 peak.

So what next? Almost everyone now hates the Japanese market. Analysts have deserted it in droves; fund managers endlessly complain that no research is ever done on the stocks they hold (it mostly isn't); and 2018 saw the highest level of foreign selling in 30 years. Most private investors have fallen for Japan at some point (me more often than most) and all have been disappointed: one of the few things the Japanese stockmarket has excelled at since 1990 is false dawns.

The two most recent? Things looked good in 2005 when the telegenic Junichiro Koizumi, then-prime minister, looked as though he really would upend Japanese politics with his "no growth without structural reform" policy: postal privatisation triggered a 40% surge in the Nikkei to around 17,000, before it fell back to 8,000. Then there was a good one in late 2012, when Prime Minister Shinzo Abe kicked off his economic reforms and Bank of Japan governor Haruhiko Kuroda humoured him with a vast quantitative easing programme. The Nikkei rose 57% in a year. We told you to buy. That was perfectly good advice. The market is up 30% since. But it hasn't gained traction with international investors: Japan remains the most under-owned developed market in the world.

This is no false dawn

Still, we are going to tell you to buy again. The first reason for this is economic. Japan has its problems in spades. It has an ageing and declining population (without immigration, the two go hand in hand) which often makes nominal GDP growth look worse than GDP growth per head. It has dragged itself out of its deflationary quicksand, but is nowhere near achieving its 2% inflation target despite a terrifying level of national debt that will surely one day lead to a nasty bout of inflation. With interest rates at zero and deflation still an occasional threat you probably don't need to worry about inflation in the immediate term. But keep an eye on it the seeds of each crisis are always sown by the reaction to the last one.

Japan also, as Chris Wood of CLSA points out, has a "well-earned reputation as a play on the global cycle". When there is an external slowdown (as there is now) the domestic economy suffers which explains why foreign investors are net sellers this year. However on the plus side, Japan has, as Tim Price of Price Value Partners points out, "paid the piper first". There is little any nation can do in the wake of the bursting of a huge credit bubble but to "suffer years of economic indignity" as balance sheets are repaired. In Japan that has happened. Debt (outside of the government) has fallen. In the mid-1990s the Japanese corporate sector had total net debt of about 350trn. It now has net cash of 50trn. Unemployment is low and wages are rising slightly. Abe is giving Japan the kind of political stability the rest of us only dare to dream of. He has also just announced an "agile" and "comprehensive" stimulus programme that, while its scale is still uncertain, is designed to take advantage of low interest rates to "deploy fiscal borrowing and investment proactively to invigorate investment for future growth".

Here's why you should buy Japan now

But the real reason for investing in Japan has little to do with most of this. It isn't macro. It's about companies how they have adapted to Japan's macroeconomic issues and, in particular, their valuations. As noted above, debt is no longer a problem for Japan's corporate sector (unlike everywhere else). That means good performance can fast translate into rising profits when things go well. And they are in the whole of the 1990s, total profits in Japan's corporate sector were "essentially zero", as Mark Pearson of Arcus tells Value Investor Insight. Now they are at record highs and near European levels. Also good news, says Fidelity, is that earnings have started to decouple from the exchange rate, "reflecting a combination of higher top-line growth and improved profitability". This is also supporting "greater efficiency through the upgrading and consolidation of production".

Corporate behaviour is also slowly but surely becoming more shareholder-friendly. That's partly down to new corporate governance obligations. Listed companies must now have at least two independent directors on their boards, for example. Institutional investors are required to play a more active role as the stewards of the business. Stock-based compensation has also increased sharply (20% of firms offered it in 2015; 70%-plus do now) which has helped align the interests of management more with shareholders. This is all due to rising levels of activism in Japan by both local and foreign players (Western private equity companies are increasingly getting stuck in), and also to some voluntary corporate restructuring the key thing here being the fall away from corporate cross-shareholdings to shares being held by professional institutional investors (see box). The latter is possibly the most important change it has been a long time coming, but suggests the corporate shift in attitude is long term rather than simply enforced by regulation.

Looking for dividends? Try Japan

One pleasing result has been the improved distribution of profits to shareholders (which Japanese managers have historically worked to avoid). Buybacks are up (I don't strictly approve of the financial engineering this often represents, but am letting it go for now). Special dividends are up. Ordinary dividends are up. The Topix index as a whole yields 2.7%. That's more than the US market, and not far behind most European markets. It's also just a starting point for stock pickers. Edward Cartwright, chief executive of Arcus, tells me that they calculate that the top 20 income-producing stocks in his firm's main Japan strategy, if held in equal weightings, would produce a gross dividend income of 4.5%. That's about the same as the FTSE 100 but with lower valuations, less debt and (probably) less political risk. And if you add returns from buybacks to those from dividends, you get a "cash return yield" of more like 5% from the market. Dividend cover is also better than in the West. More than half of the companies in the Topix have net cash on their balance sheets. The equivalent for the FTSE All-Share is just 29%. In Europe and the US, it is about 21%, says Karen See at Baillie Gifford. There is nothing more maddening than hearing investors with no Japanese exposure whinge about their desperate hunt for yield. If you want income, it is there for the taking.

Where cheap stocks are incredibly cheap

The other rather exciting thing about the income you can get from Japan is the price at which you can get it. Right now, says Cartwright, on a forward p/e of 11 and on 90% of book value, it is his opinion that the Japanese market offers an "unprecedented opportunity". We have "rarely seen p/es or p/bs [price/book ratios] at this level in our 21 years of investing in Japan". P/bs were slightly lower after the 2008 financial crisis, and they touched these levels just before "Abenomics" in 2012 too. But the data suggests that multiples haven't been at these levels at any point in at least the last 40 years: the p/e in Japan is at a 48-year low. Japan is the world's cheapest developed market.

The valuation spread is also relevant. Cheap stocks are very cheap in Japan. Expensive stocks are very expensive so within those averages there are some extraordinary bargains. Choose a value-orientated portfolio and you can move the average valuations in it down to a bargain basement 45%-65% of book and a p/e of five to seven. Recall that a company with steady earnings on a p/e of five adds 20% to its value every year, and you will see the point. "Imagine a stock that [boasted] margin expansion and earnings-per-share [EPS] growth, but had got cheaper," say analysts at the Man Institute. This has actually happened in Japan. Between 2007's third quarter and that of 2019, Japan has seen 2% annualised margin expansion, and other EPS growth of 0.75%. Yet p/es have fallen. Japan, already cheap, "is becoming cheaper despite having got operationally better". We live in an era in which the word "unprecedented" is rather overused. But on this occasion, perhaps it works rather better than usual.

A very good time to buy stocks is when they are cheap. The best time to buy stocks is when they are so cheap that other investors start to notice, and momentum is starting to build. That time might be upon us. The Nikkei is at a 27-year high (back to where it was at the start of 1992), the market is ridiculously cheap, earnings are improving, yields are globally competitive and, as evidenced by the launch of some new funds (see below) investors may be starting to see that Japan is not an uninvestable basket case, but the best place to be if you want to be a value investor and an income investor (which you do). It is, in fact, almost the exact opposite of the market it was in 1989.

The Japanese funds to buy now and a stock to avoid

MoneyWeek has long recommended Baillie Gifford's Japan investment trusts (I am a non-executive director of one of them) as a way in to the market. But if it's the income end of the Topix you are keen on, look to their newish Japan Income Growth Fund, which was launched specifically to take advantage of Japan's changing corporate governance. It's been a long time coming, says manager Karen See, but progress is now "promising". In 2004, 8% of the top 1,200 firms in Japan had an explicit dividend target. In 2016, 43% did. The fund yields 2.2% and while it does have growth exposure (2.7% in Softbank) it holds some older names too (2.7% in Toyota).

For purer value exposure try AVI Japan Opportunities Trust (LSE: AJOT), which launched last October. The trust also yields 2.2% but takes a clear value approach: the aim is to buy high quality stocks "whose economic value is increasing year after year", yet whose prices imply "an extremely distressed outlook". The managers see the "corporate governance revolution" as the catalyst that will change investor perception of Japan and drive the market up their latest note on the matter points to the 96% year-on-year rise in share buybacks in the six months to September.

The Lindsell Train Japanese Equity Fund has a lower yield (1.5%), but good diversified exposure to quality companies in Japan. Meanwhile, if you are interested in value as a whole but not necessarily in a Japan-only fund, look at AVI's other trust, AVI Global (LSE: AGT), which is 26% invested in Japan. Other trusts with high-ish levels of exposure to value in Japan include the Scottish Investment Trust (LSE: SCIN) (10%) and BMO Global Smaller Companies (LSE: BGSC) (10%). Also consider the VT Price Value Portfolio, a fund of funds which holds two funds that are hard for retail investors to get exposure to Samarang Japan Value (11.74% of the portfolio) and Arcus Japan (7.02%).

A Japanese stock to avoid

Last week, Japanese tech investment machine Softbank reported its first quarterly loss in 14 years as the valuations of some of the investments in its Vision Fund slid. Softbank's stake in the not-quite-bankrupt office space provider WeWork was, for example, slashed in value by $4.8bn. WeWork's total fair value is now thought to be more like $7.8bn than the once-mooted $47bn. In all, the $97bn Vision Fund has written down the value of 22 holdings.

You might argue that Softbank is starting to look cheap. The share price has fallen nearly 30% since April; the Financial Times reckons it trades at about a 33% discount to the value of its investments. And founder Masayoshi Son may pay more attention to detail in future. He has apologised for turning a "blind eye" to WeWork's governance issues. "I made a bad decision and I am deeply remorseful."

But investors do need to worry about the opacity of its accounts, says Lex. Softbank's profit and loss is composed of "revaluations, non-cash income from affiliates and modest flows of dividends and disposal proceeds". Its actual enterprise value is "the subject of a debate medieval theologians would find obtuse." And who really knows how much the valuations of some investments might yet fall (is WeWork worth anything at all? Is Uber?).

Finally, look at the debt, says BreakingViews. $45bn of debt may not seem much next to $260bn of equity holdings but that ignores "layers of leverage and overstates Softbank's asset value."

I wish I knew what cross-shareholdings were, but I'm too embarrassed to ask

Before World War II, Japan had a fairly shareholder-friendly stockmarket. Large parts of listed companies were controlled by zaibatsu (wealthy family groups), but individual shareholders were active and well treated.

That changed with World War II. Dividend payments were suspended in favour of reinvesting to support the war effort. Bank lending as opposed to equity issuance became the main source of company financing and the relationships between Japan's big banks and companies deepened.

After the war, the Allies dissolved the zaibatsu system. However, at the same time the high levels of loans taken out by companies during the war began to bite. Unable to repay loans, firms arranged debt-for-equity swaps. Suddenly the big banks were also big shareholders: the percentage of listed companies owned by financial institutions went from 10% in 1949 to 43% in 1988, says Baillie Gifford's Karen See.

Deprived of their zaibatsu protectors, firms also started to look around for a replacement. It came in the form of the keiretsu system in which groups of companies formed alliances, cemented with cross-shareholdings, to defend themselves against shareholder activism.

The result? A system in which neither the major shareholders (banks and keiretsu members) nor management (protected from outside investors by their bank and keiretsu) had their interests aligned with ordinary shareholders. That is now finally changing. Cross-shareholdings are being forcibly unwound. Japan is on a path back to being shareholder-friendly.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

House prices to crash? Your house may still be making you money, but not for much longer

House prices to crash? Your house may still be making you money, but not for much longerOpinion If you’re relying on your property to fund your pension, you may have to think again. But, says Merryn Somerset Webb, if house prices start to fall there may be a silver lining.

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.