Why Trustpilot is a stock to watch for exposure to the e-commerce market

Trustpilot has built a defensible position in one of the most critical areas of the internet: the infrastructure of trust, says Jamie Ward

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Trustpilot (LSE: TRST) is a unique business on the UK stock market. It sits at the intersection of technology and consumer confidence by helping people to make better-informed choices, while giving companies a seal of credibility. Its platform allows users to rate and review businesses they have bought from, creating a feedback loop that benefits both sides. The firm earns its living by selling subscriptions to businesses that want to access review data and use Trustpilot’s marketing tools to boost their reputation.

How Trustpilot went global

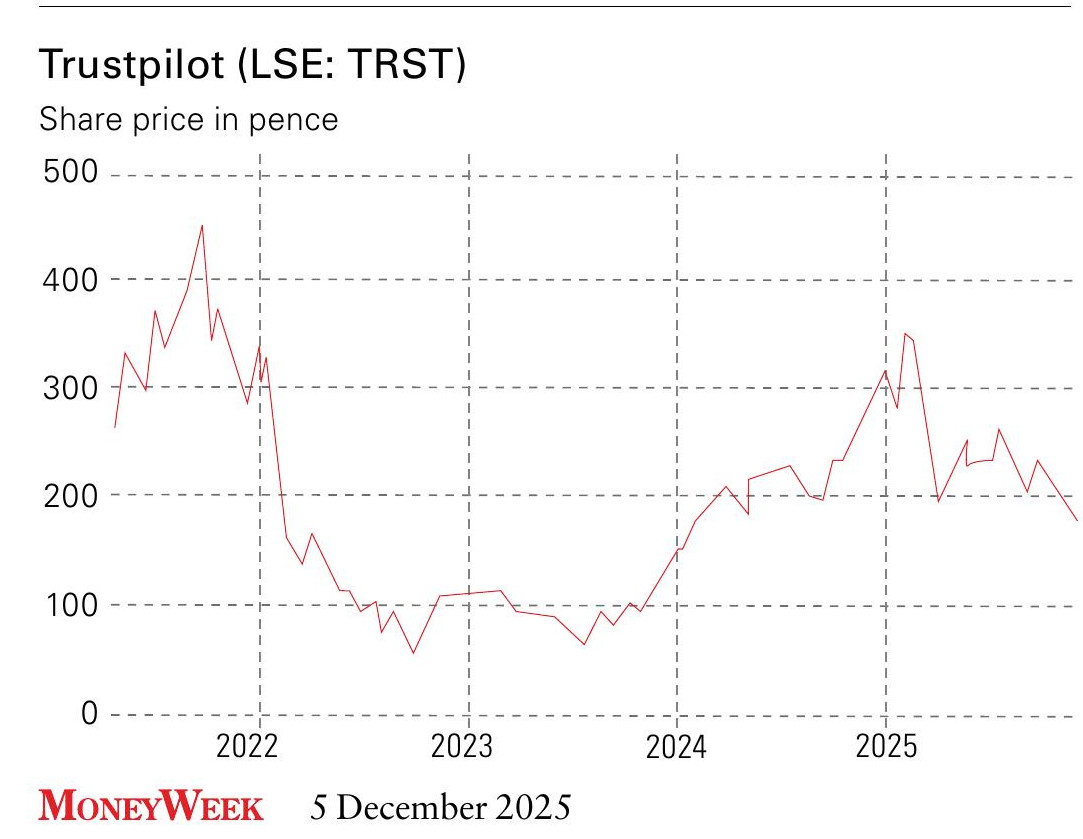

Trustpilot was founded in Copenhagen in 2007 by Peter Holten Mühlmann, then a university student. His idea came about as he observed his parents’ struggle to trust companies they were buying from online. His start-up set out to bring transparency to online commerce by letting customers review the companies they dealt with. The concept took off and within a few years Trustpilot had become a global name. It was listed on the London Stock Exchange in 2021. Mühlmann stepped down as chief executive in 2022 and was succeeded by Adrian Blair, formerly chief operating officer at Just Eat.

The company’s strategy is based on a “freemium” model. Any business can create a profile for free, but more advanced features are locked behind paid tiers. This approach encourages adoption while nudging users to upgrade. Over time, the brand itself has become a valuable asset. A strong rating on the platform lends instant credibility, making the service a near-essential cost for any online business. That gives Trustpilot a meaningful degree of pricing power. By mid-2025, users had posted more than 330 million reviews, reinforcing Trustpilot’s position as one of the most trusted sources of consumer feedback.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Trustpilot builds a value ladder

Trustpilot’s subscription model has four main levels. The free tier gives businesses basic visibility, but serious users tend to move up quickly. The Premium plan, at $299 per month, includes verified reviews and marketing tools. The Advanced plan, at $629, adds data analytics such as TrustScore forecasting and competitive benchmarking. The Enterprise plan is from $1,099 for deeper analytical and system integration. Bespoke pricing continues to rise at this level to allow customisation.

The most expensive plans deliver sophisticated business intelligence that is difficult to replicate elsewhere. This structured pricing encourages customers to upgrade over time. In the first half of 2025, the average annual contract value rose by 17%, suggesting the company’s strategy is working well.

Trustpilot’s biggest opportunity now lies in getting existing customers into these premium tiers. Enterprise clients, who pay more than $20,000 a year, have been growing at a rate of 38% over the past two years, though from a small base. These accounts are highly profitable and make the platform deeply embedded in clients’ operations, reducing the risk of them cancelling subscriptions.

The company is also developing a new product line called TrustLayer, which aims to monetise its vast data set in new ways. Using verified review data, TrustLayer will provide analytics and insights to help businesses make better decisions. Launched this year, it is hoped that it will open a valuable new revenue stream with strong profit potential. The company’s average annual contract value now stands at $9,781, confirming that its move upmarket is paying off.

How Trustpilot is building trust through its technology

Trustpilot’s reputation depends entirely on the authenticity of its content. Fake or manipulated reviews are an ever-present threat, and regulators such as the UK Competition and Markets Authority have taken a keen interest in ensuring the platform remains transparent.

Maintaining integrity is therefore a constant battle, and the company spends heavily on detection technology to root out fraud.

Competition is also a risk. Google Reviews dominates local searches, while specialist sites cater for niche markets such as restaurants or travel. This fragmentation could limit Trustpilot’s expansion outside its e-commerce heartland.

Meanwhile, advances in AI make it easier to generate realistic fake reviews, raising the bar for Trustpilot’s moderation systems. Yet the company’s scale, and investment in detection technology, make it difficult for smaller rivals to compete on trust and authenticity.

Should you invest in Trustpilot?

At roughly £800 million in market value, Trustpilot trades on roughly three times forward sales – a premium to most UK-listed software firms, but modest compared with high-growth US peers. Over the next few years, revenue is expected to grow by mid-teen percentages and margins to expand as more clients move to higher tiers.

The closest comparable model is Yelp in the US, though Trustpilot’s global reach and business-to-business focus set it apart. Google is the dominant generalist, but Trustpilot’s neutrality and transparency give it an edge among firms seeking independence from big tech platforms. In Europe, few rivals match its scale or brand recognition. This blend of characteristics explains the market’s willingness to price in further growth.

The firm is not without risks, nor is it yet highly profitable, but its importance to the functioning of digital commerce is growing.

Trustpilot has built a defensible position in one of the most critical areas of the internet: the infrastructure of trust. For investors looking for exposure to the backbone of e-commerce, it remains a company worth watching.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jamie is an analyst and former fund manager. He writes about companies for MoneyWeek and consults on investments to professional investors.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

What is physical AI, and how can you invest in it?

What is physical AI, and how can you invest in it?Artificial intelligence is increasingly taking physical form and could completely transform how we live. How can investors gain exposure?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence