The charts that matter: the un-inverting of the yield curve

The US bond yield curve turned positive again at the tail end of this week. John Stepek looks at how it affects the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. We have a new podcast for you this week, in which Merryn and I discuss the interconnected topics of the desperate reach for yield, the downfall of peer-to-peer group Lendy, and the slide in the London property market.

I also made a guest appearance on the podcast of our sister magazine, The Week. We discussed nationalisation and the Berlin property market, Elon Musk's latest brain surgery project, and the controversial subject of genetics, education and the point of Eton. Have a listen here.

Also, we're still experimenting with the very short (60-second) daily market preview see what you think here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And if you haven't bought your ticket to the MoneyWeek Wealth Summit on 22 November, do make sure to get in before the early bird discount runs out you can find out more here.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: What does China's slowdown mean for the global economy?

Tuesday: How do you profit from market bubbles? Invest in "anti-bubbles"

Wednesday: There are lots of reasons to be bearish but you should stick with the bulls

Thursday: London house prices are tumbling: will it spread across the UK?

Friday: Trump wants a weaker US dollar so what can he do about it?

Currency Corner: what's next for the euro?

Subscribe: Get your first six issues of MoneyWeek free here

And don't miss this excellent guest blog from Helen Thomas of BlondeMoney.co.uk given that we'll almost certainly have it confirmed on Monday that Boris Johnson is the new prime minister, this'll give you some valuable (and somewhat contrarian) insight into what's going through that blonde bonce of his when it comes to Brexit - and perhaps more importantly, what it means for the pound.

Now, to the charts, starting, as usual, with the yield curve.

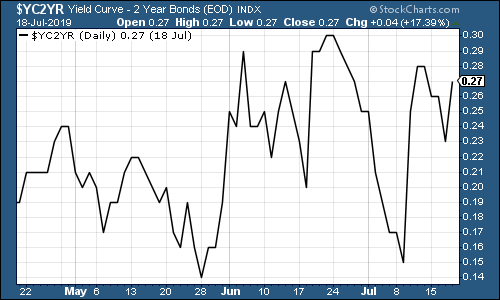

This is the difference ("spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year finally "un-inverted" - in other words, turned positive again at the tail end of this week.

Meanwhile, as the chart below shows, the gap between the two-year and ten-year (which hasn't yet gone negative in this cycle) is comfortably wider than it was a few weeks ago.

In effect, markets are betting that the Fed will cut short-term rates sharply, which seems a reasonable assumption given comments from key members of the rate-setting committee this week. For example, New York Fed president John Williams said: "When you have only so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress."

I wouldn't be surprised if they're softening us up for a half-point cut. Markets would love that, and these days, that seems to be what matters to the US central bank.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

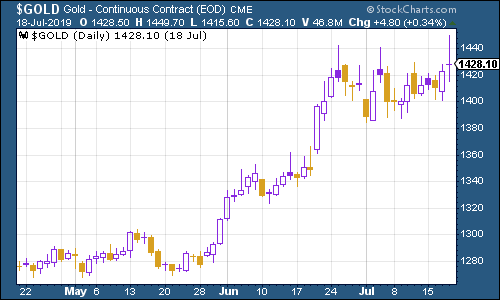

Gold (measured in dollar terms) had a good week as the markets grew ever more convinced that monetary policy will remain loose no matter how strong the economic data gets in the near term.

(Gold: three months)

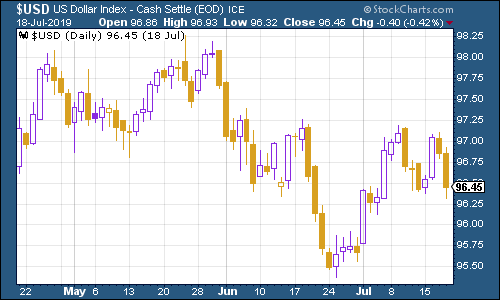

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners started to rebound this week, but took another hit amid speculation that the US Treasury might intervene. The ever-more dovish-sounding Fed also didn't help.

(DXY: three months)

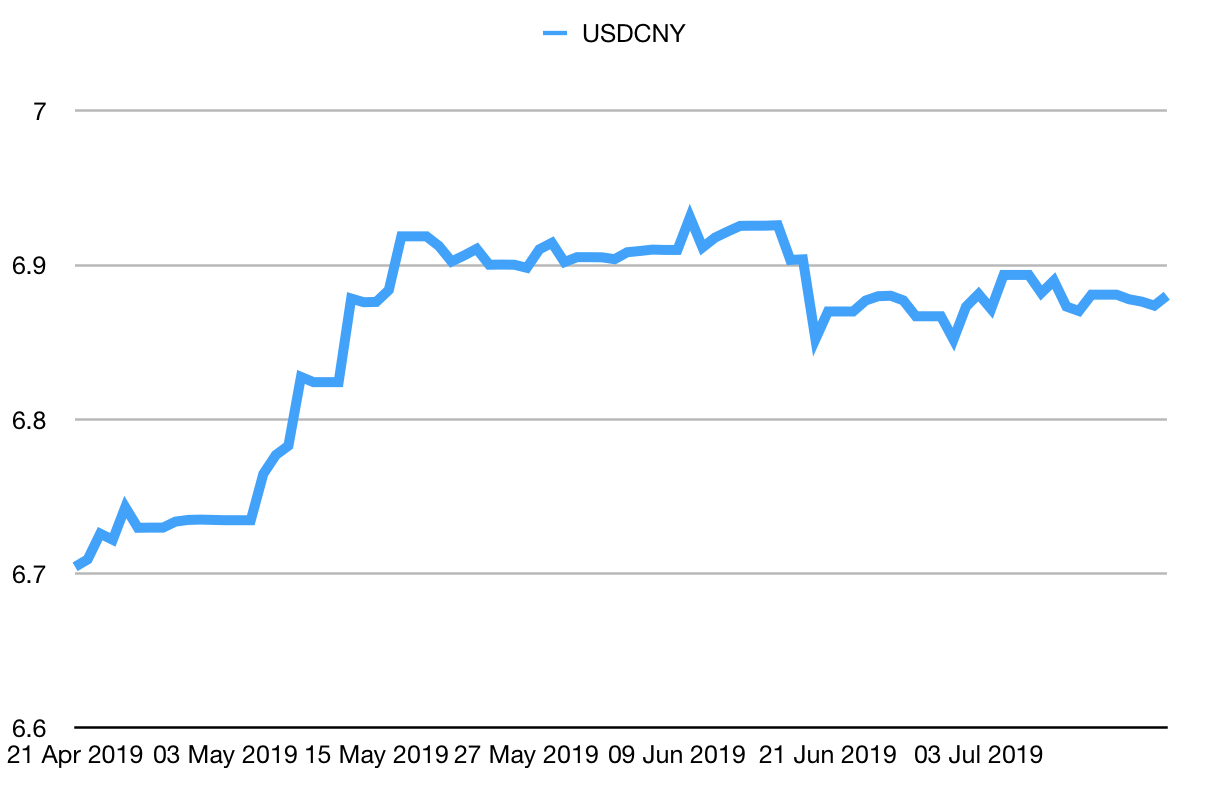

As a result, the number of yuan (or renminbi) to the US dollar (USDCNY) remains comfortably below the critical 7.0 level that would suggest China might be on the verge of a deflationary devaluation of its currency.

(Chinese yuan to the US dollar: three months)

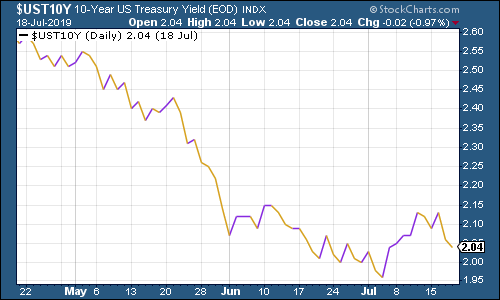

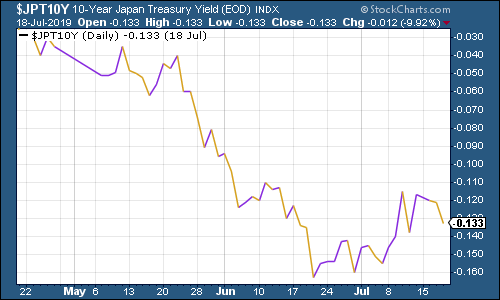

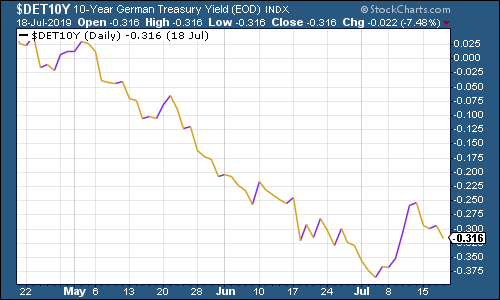

Ten-year yields on major developed-market bonds remain very low indeed, but not as low as they were a few weeks ago.

Below we see the US ten-year Treasury:

(Ten-year US Treasury yield: three months)

And then there's Japan:

(Ten-year Japanese government bond yield: three months)

And finally, Germany, still deep in negative territory:

(Ten-year Bund yield: three months)

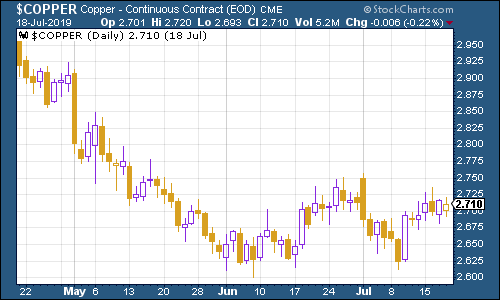

Copper meandered around this week. Chinese growth at the start of the week was nothing to write home about but nor was it as bad as it could have been.

(Copper: three months)

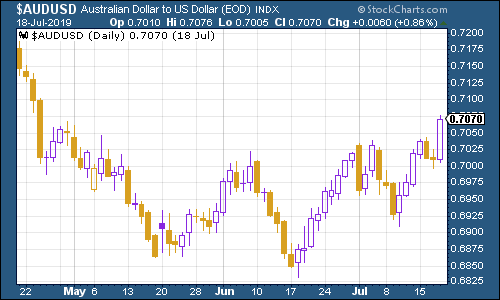

The Aussie dollar rallied, mostly as a result of the late-week slip in the dollar.

(Aussie dollar vs US dollar exchange rate: three months)

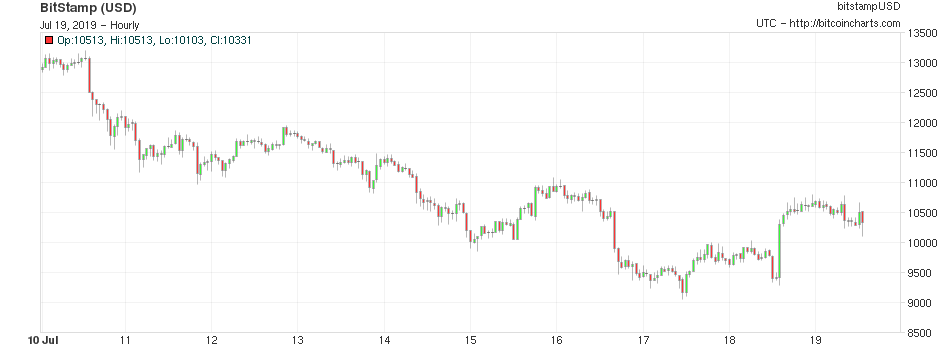

Cryptocurrency bitcoin has been slipping lower from its recent excitable spike, but it's still well above where it was just a few months ago.

(Bitcoin: ten days)

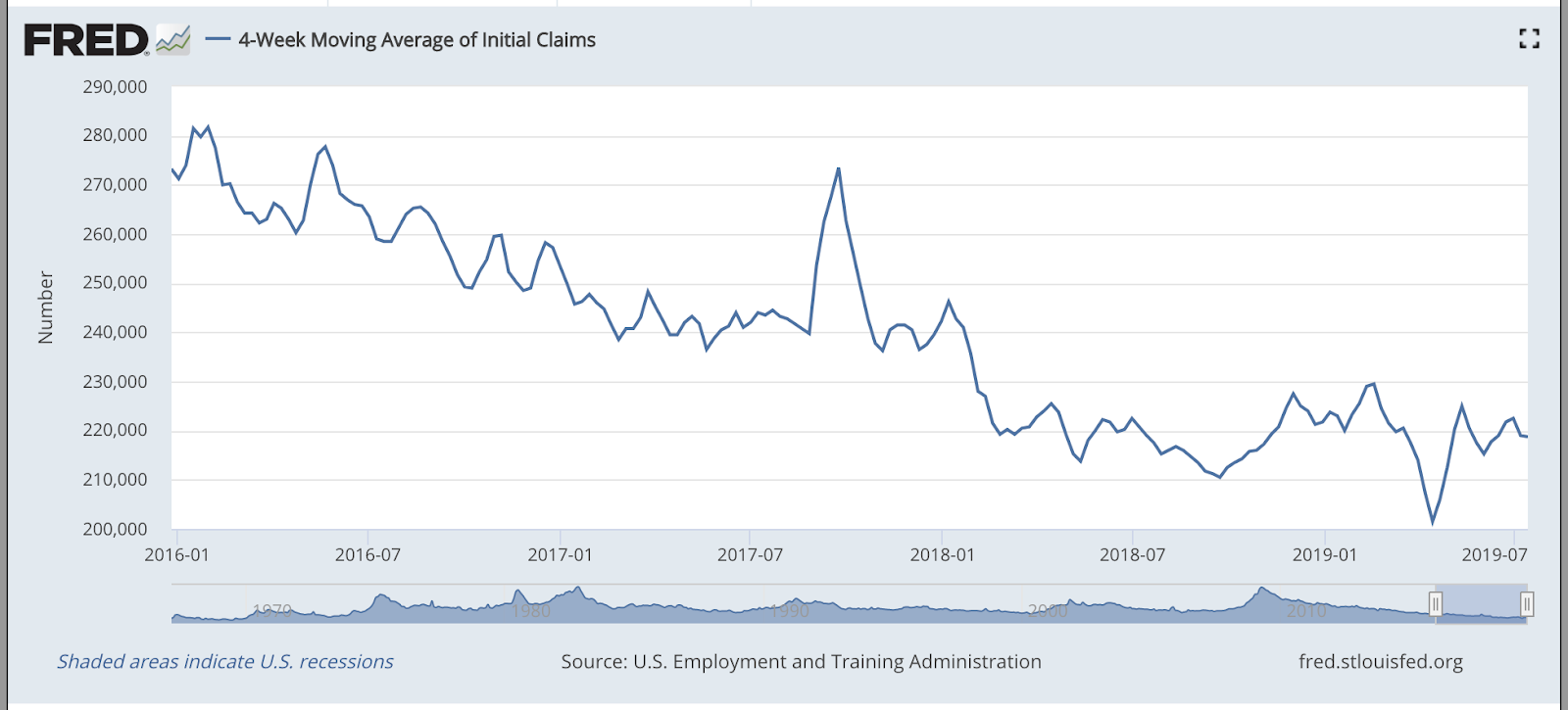

Almost three months ago, US jobless claims last hit a fresh low on the four-week moving average measure, dropping to 201,500. US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (remember that this is not scientific it's a tiny sample size, originally highlighted by David Rosenberg at Gluskin Sheff).

This week, the moving average edged lower to 218,750, while weekly claims came in at 216,000, a bit higher than expected. We've also seen fresh highs in the stockmarket this week. It still all suggests that if there's a recession on the way, it's a while off yet.

(US jobless claims, four-week moving average: since January 2016)

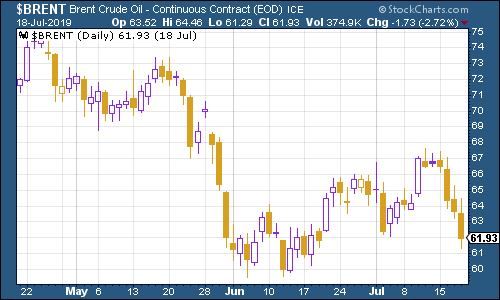

The oil price (as measured by Brent crude, the international/European benchmark) slipped back this week, despite mixed message over the tensions between the US and Iran.

(Brent crude oil: three months)

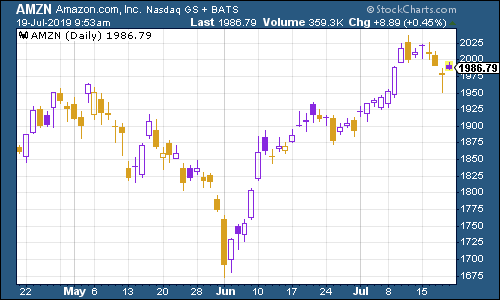

Internet giant Amazon saw its share price edge lower this week. Second quarter earnings are due from the company on 25 July.

(Amazon: three months)

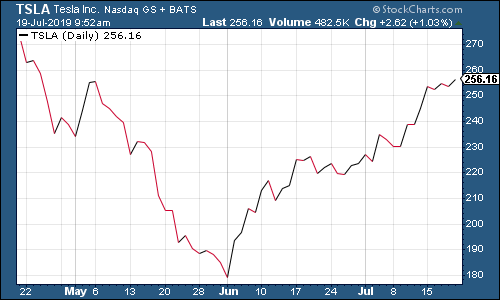

Electric car group Tesla continued its recent rally.

(Tesla: three months)

Oh and just before I go - I don't normally do this but I saw a couple of interesting pieces elsewhere on the interwebs this week that I thought might be worthy of your attention.

First, there's this Research Affiliates piece on bubbles and anti-bubbles, which I really enjoyed (I talked through it in Money Morning earlier this week, but it's worth reading the original if you have time).

Secondly, this chunky piece from Ray Dalio of Bridgewater on "paradigm shifts". For my money, Dalio is one of the most thoughtful investors around, and whether you warm to his style or not, you can't deny that he pays great attention to detail.

To cut a long story short, Dalio reckons now is a good time to add some gold to your portfolio. I'll unpack the paper in one of next week's Money Morning emails, but I think some of you will enjoy the depth of historical context in the appendix.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King