Currency Corner: what’s next for the euro?

Despite having only existed for 20 years, the euro is the world's second-most traded currency and the second-largest reserve currency. Dominic Frisby looks at its performance against the dollar and the yen, and where it might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hello and welcome to Currency Corner.

This week we are going to cast our eyes across the Channel to consider the euro.

The euro is the second-most traded currency in the world, and the second-largest reserve currency (in both cases after the US dollar), and it is the official money of 19 of the 28 European Union member states.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's also the official currency of the micro-states Andorra, San Marino, Vatican City and Monaco which aren't EU members as well as the likes of Kosovo and Montenegro.

Other European nations, notably Bulgaria and Denmark, operate currency pegs with the euro, as do numerous nations beyond Europe, especially those in central or west Africa with historical links to France Morocco, Cameroon, Ivory Coast, Republic of the Congo and Senegal, for example.

I've also only recently discovered that it has also found considerable use in Zimbabwe, albeit less officially, since the hyperinflation.

Although it is second to the US dollar in most regards, in terms of physical cash in circulation coins and notes it actually surpasses the dollar to have the highest cash value of any world currency.

It's a pretty big and significant beast, in other words.

And yet the currency has only existed for around 20 years. The name was agreed in 1995. It became an accounting currency in 1999, and an operating medium of exchange in 2002.

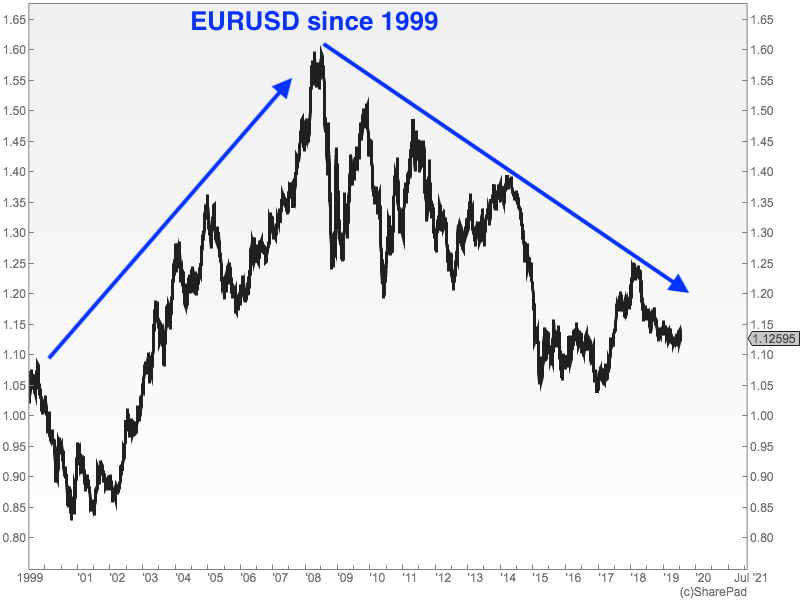

Below, we see the chart of the euro against its major competitor, the US dollar, since 1999. When the chart is rising the euro is gaining in strength, when it is falling the US dollar is strengthening.

Back in 2001, $0.83 bought you €1. In 2008, it was more like $1.60. Today we are somewhere in the middle of that range, at $1.12.

It's worth remembering that the beginning of the 21st century was a time of exceptional US dollar strength. The dollar then went into a bear market that ended with the financial crisis of 2008. Since then the US currency has been gaining in strength.

There is a lot of information in that chart, but the broader ten-year-or-so trends at play (as identified by my two blue lines) are pretty clear.

Within those trends you get counter-trend rallies that can go on for a year or two such as in 2005, 2009-2010, 2012-2013 and 2017 but the broader direction is clear.

The big question to decide is where we go now. Will it be the euro or the US dollar that gets stronger? In terms of macroeconomic strategy, it's a pretty important question.

At present we are in a downtrend both on a long-term basis and on an intermediate term basis in other words, the US dollar is strengthening. I'm not a US dollar bull, as I've said on these pages before, but nor am I a euro bull, and the current direction, I have to say, is towards relative US dollar strength.

I'll do some shorter-term technical analysis of the two currencies on another day.

The euro's long-term performance against the Japanese yen

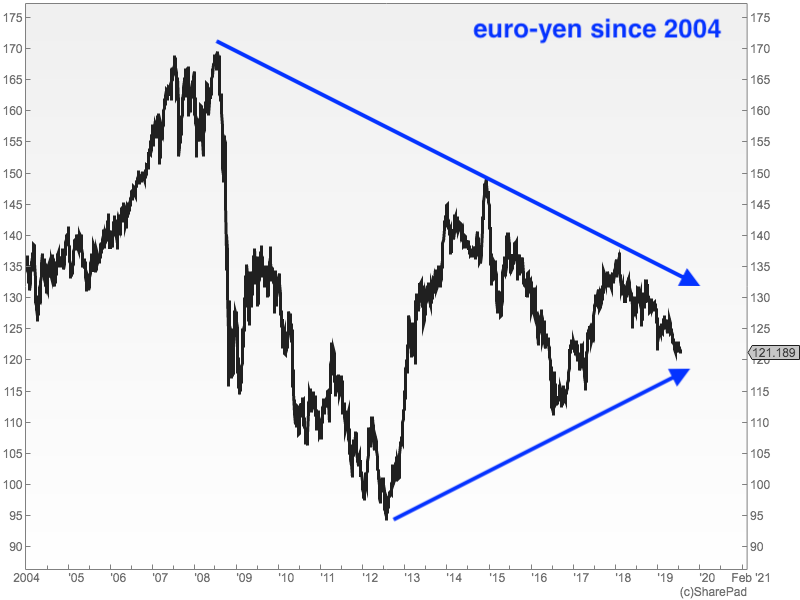

My data here only goes back to 2004, but you can see a similar long-term trend in place, one that goes all the back to the financial crisis that of a weakening euro. But at the same time, you can also see that the low was all the way back in 2012, and since then the lows have been higher.

(Again when the chart is falling, the euro is weakening).

There are two trends coming up against each other, in other words from 2008, lower highs; but since 2012, higher lows.

It'll be interesting to see how that one pans out.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how