The seven best investment opportunities in India and Indonesia

Asia contains numerous interesting developments for adventurous investors to keep a close eye on. Here, David Stevenson looks at seven of the best investment opportunities in India and Indonesia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We in the UK may be transfixed by Brexit, but out in the rest of the world there are numerous interesting developments for adventurous investors to keep a close eye on.

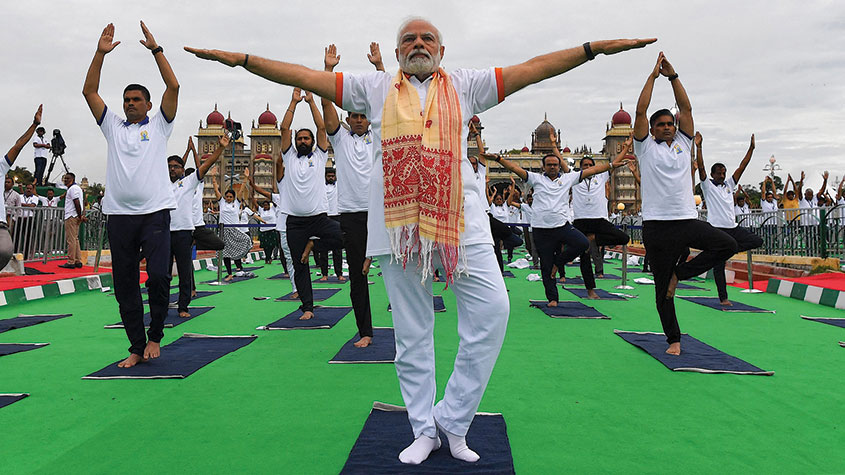

The key country to watch is India, especially now that Prime Minister Narendra Modi has been resoundingly re-elected. Although doubts about his reformist zeal have intensified over the last few years, Modi's BJP party has delivered on around 50 key reforms. It's worth highlighting real progress on rural electrification; a reform of how benefits are transferred to people; and significant investment in building toilets and new roads.

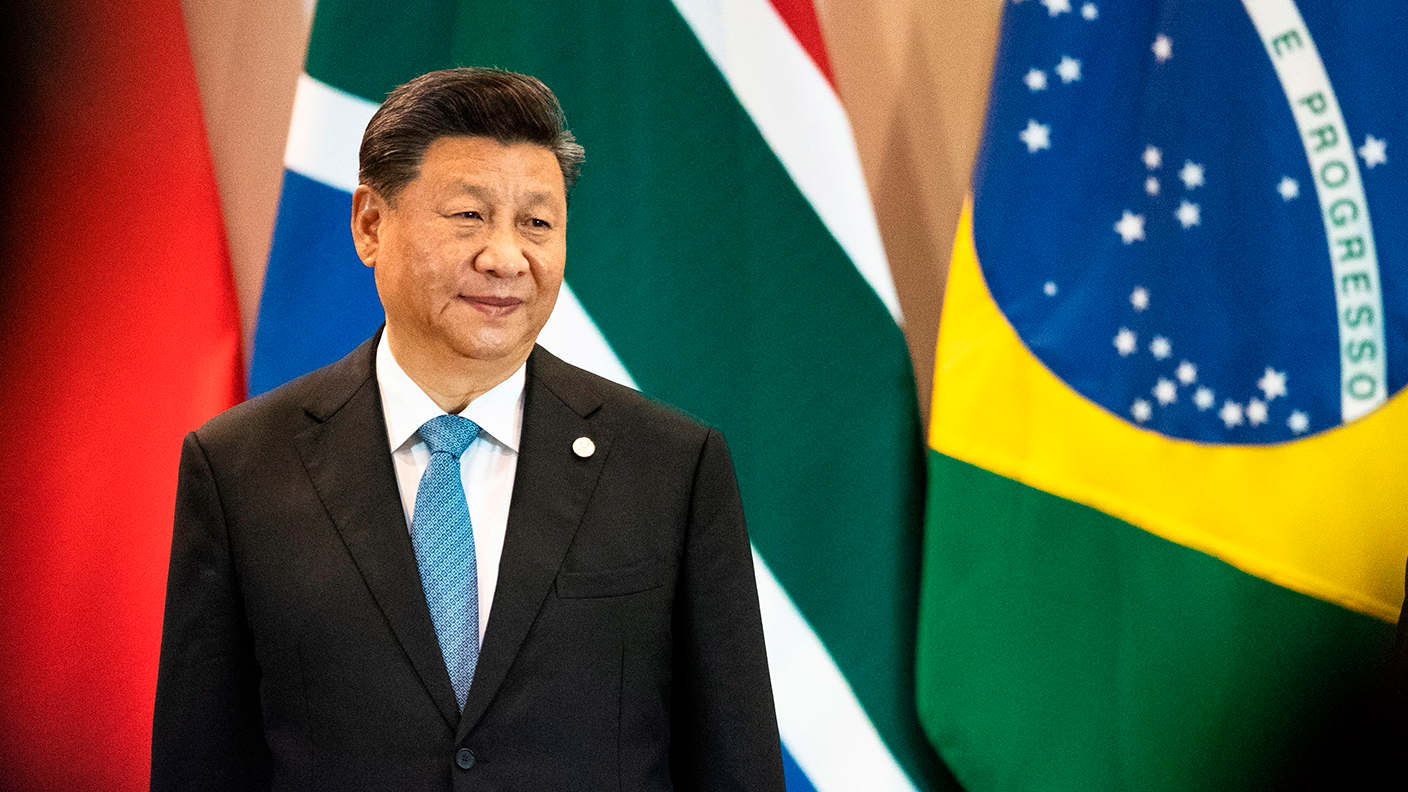

There's obviously lots still to do, not least in job creation for the young population, as well as in boosting low farm incomes. However, the political stability should help India become the world's third-largest economy by 2030. And if China becomes more of a "frenemy" than a friend to the Western world, then India could be on the receiving end of more foreign direct investment.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With GDP growth averaging around 7%, and inflation rates stabilised below 5%, the scene is set for some of that "super- growth" the BJP has been promising foreign investors for some years now. Indian equities remain expensive though, and my hunch is that British investors need to tread with care in this complex and sometimes opaque market. My preference is for the actively managed funds in this sector, with four investment trusts topping my list: Aberdeen New India (LSE: ANII), Ashoka India (LSE: AIE), India Capital Growth (LSE: IGC) and JPMorgan Indian (LSE: JII). If you are determined to use an index tracker, maybe consider the Xtrackers Nifty 50 Swap Exchange-Traded Fund (LSE: XNIF).

Indonesia settles down

Another country that could benefit from big Asian trends is Indonesia. The return to power of Joko Widodo (Jokowi), with more than 55% of the vote, is a sign that this once volatile country is settling down. On paper, it should be a powerhouse of southeast Asia, with a huge population, abundant natural resources and a tradition of moderate religious observance. Nationalism, to date, hasn't been too strong a force. The president is also sensible, reform-minded and ecumenical in religious terms, although he has been pushed into supporting more conservative Islamic policies in recent years. His convincing re-election should be a big positive, although foreign investors had largely factored it in the Jakarta Composite index dropped 8% from its pre-election level, tracking the weakness in Asian equities and the recent soft economic data.

There's value in banks

That weakness is largely because Indonesia is facing its own domestic economic issues there's been a fall in exports growth, which coincided with the rise in oil prices. This has once again raised concerns over the current-account deficit (importing more than it exports), turning the rupiah into one of the worst-performing currencies in Asia.

However, Asian equities analysts at French bank Socit Gnrale reckon matters could improve, with the recent softness in the economic data to recede in the second half of this year, led by improved investment and consumption activity. "With Jokowi's return and the elections out of the way, we expect government spending to shift back to public investment." Socit Gnrale analysts are keen on local Indonesian banks, with price/earnings (p/e) ratios running at around 14. This represent good value, with 2019 earnings-per-share growth estimates remaining unperturbed at 14%. Banks constitute a large part of the local index, which is tracked by ETFs Xtrackers MSCI Indonesia (LSE: XMID) and HSBC MSCI Indonesia (LSE: HIDR).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Modi’s reforms set Indian stocks on fire

Modi’s reforms set Indian stocks on fireIndian stocks pass a new milestone, but global fund managers are holding back. Are there signs of overheating?

-

Shining a light on India

Shining a light on IndiaAdvertisement Feature Despite some short-term challenges, India remains very attractive for investors. Here’s why.

-

India’s economy has come a long way in 75 years, but where next?

India’s economy has come a long way in 75 years, but where next?Briefings India has come a long way since independence to become the world's fifth-largest economy. But early mistakes and now a divisive leader are holding back the economy’s potential.

-

Investor optimism ebbs in Indian stockmarkets

Investor optimism ebbs in Indian stockmarketsNews India’s BSE Sensex stockmarket index has fallen by almost 8% so far this year. Interest rates are on the rise, and foreign investors have been selling up.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

The Brics never lived up to their promise – but is now the time to buy?

The Brics never lived up to their promise – but is now the time to buy?Analysis Twenty years ago hopes were high for Brazil, Russia, India and China – the “Brics” emerging-market economies. But only China has beaten expectations. Max King explains why and asks if now is the time to buy.

-

India: the next global growth engine

India: the next global growth engineNews India's stockmarket is booming, up by 37% so far this year, and the BSE Sensex index has delivered an annualised return over the last five years of more than twice that of the FTSE 100.

-

Forget China, here’s why you should invest in India

Forget China, here’s why you should invest in IndiaTips As China becomes increasingly hostile to investors, India, with a young, educated, tech-savvy population and a reform-minded government, is becoming an emerging-market favourite. Merryn Somerset Webb picks the best ways to invest.