Are your dividend payments at risk?

Vodafone cut its dividend payment by 40% earlier this month. How can you avoid similar disappointments?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

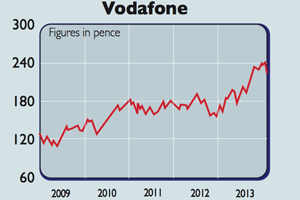

In November last year, telecoms group Vodafone said that it would maintain its dividend for the financial year. Chief executive Nick Read faced down market scepticism, saying that he was cutting costs and looking at selling phone masts to raise funds. The market wasn't convinced. Until last week, Vodafone was trading on a dividend yield (dividend per share as a percentage of the share price) of around 9%. That's when it succumbed to the inevitable it slashed ("rebased", in corporate speak) its payout by 40%, as the cost of investing in next-generation technology (5G) continued to climb.

It's not the only FTSE 100 stock whose dividend is at risk (see below). So is there any way to shield yourself from dividend disappointment? One obvious figure to look at before you consider buying any stock on the basis of its dividend yield is dividend cover. You simply divide earnings per share (EPS) by dividend per share. A dividend cover of below one shows that the company's earnings don't cover its dividend payout, and suggest that the dividend is therefore on borrowed time. Vodafone, for example, had dividend cover of 0.9. Ideally, cover would be above two, although this is rare at the moment.

You can also go deeper with this analysis by considering where the money to pay the dividend is coming from. For example, is cutting costs to pay a dividend really a great idea? If these costs can be cut so readily, then why were they there in the first place? Cover is a basic measure and doesn't work uniformly. But it's a starting point.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Another useful warning flag is the dividend yield itself. The clearest indicator that Vodafone was heading for a cut was its extraordinarily high yield of more than 9%. If a blue-chip share yields 9% at a time when a bank account offers you maybe a bit over 1% if you're lucky, that tells you that investors don't believe it will be paid.

Looking at dividend cover and yield won't, of course, protect you from unexpected events. Any company involved in resource exploration, for example, can be hit by natural or operational disasters. Any company operating in the drugs business might be storing up a future liability in the form of side effects that only become apparent over the long term.

As a result, the boring truth is that there's only one near-certain way to protect yourself from dividend cuts, and that's to diversify. You need to own a range of stocks across a range of industries so that if one cuts its dividend, your income isn't entirely ruined. And while the FTSE 100 is on an attractive yield right now, much of this is being provided by a handful of companies so it also makes sense to diversify internationally. We look at some options below.

How to secure your dividend payout

Vodafone may have cut its dividend, but several other big FTSE payers have a question mark hanging over their dividends, notes The Daily Telegraph. Utility groups Centrica and SSE are both under pressure (without even considering the threat of potential nationalisation).

Meanwhile, Vodafone's fellow telecoms group BT is also under scrutiny its dividend has been maintained for now, and as a result it yields more than 7%. But its plans to build its 5G network will be expensive, and as Phil Oakley notes in Investors Chronicle, its dividend payout is almost entirely uncovered by free cash flow, meaning that it "had to borrow $1.4bn to pay its dividend", which cannot be sustained in the long run.

So what are the best options for diversifying your dividends? You could build a portfolioof high-yielding stocks: by picking 16 to 20 from different industries, you can diversify away the majority of individual stock risk, and insulate yourself from individual nasty surprises, such as the Vodafone cut.

If you don't fancy building your own income portfolio, another option is to invest in an income-focused investment trust. Trusts have the facility to smooth out dividend payments over time by storing reserves in good times and paying them out in harder times. Trusts that are UK-focused with dividend reserves covering more than a year's worth of payouts include Dunedin Income Growth (LSE: DIG), which yields nearly 5% and trades at a discount of nearly 10% to net asset value (NAV), and whose top holdings include Prudential and Unilever; and Merchants Trust (LSE: MRCH), which yields 5%, trades at a slight premium, and holds big names such as BP and GlaxoSmithKline.

For more global exposure, look at Murray International (LSE: MYI), which trades at a small premium to NAV, yields more than 5%, and invests in a wide spread of equities from around the world.

SEE ALSO:

Vodafone shares yield more than 6% – should you buy, or steer clear?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Vodafone shares yield more than 6% – should you buy, or steer clear?

Vodafone shares yield more than 6% – should you buy, or steer clear?Analysis Vodafone grew revenue by 4% and profit by 11% last year, and offers investors a 6.4% dividend yield. So should you buy Vodafone shares? Rupert Hargreaves looks at the numbers.

-

How to protect yourself from dividend disappointment

How to protect yourself from dividend disappointmentTutorials Vodafone just cut its dividend. And it’s not the only company on shaky ground. John Stepek explains what’s so great about dividends, and how to protect your portfolio from dividend cuts.

-

Vodafone takes fight to BT

News Telecoms giant Vodafone has vowed to take on BT in the broadband and television market.

-

Which companies will benefit most from Vodafone’s cash bonanza?

Which companies will benefit most from Vodafone’s cash bonanza?Features Vodafone shareholders are about to get a windfall. Ed Bowsher looks at how this will affect the markets, and how you could take advantage.

-

Company in the news: Vodafone

Company in the news: VodafoneTutorials If you own shares in Vodafone, you're in for a big pay-out. Phil Oakley explains how it will work, and what you should do next.

-

Company in the news: Vodafone

Features Vodafone shareholders are in for big windfall following the deal with Verizon. But once the money's paid out, are the shares worth keeping? Phil Oakley investigates.

-

Vodafone’s $130bn deal

News Mobile-phone giant Vodafone has sold its stake in Verizon - the biggest deal for a decade.