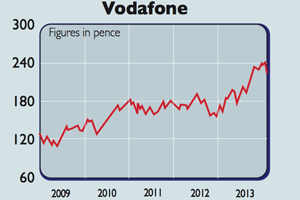

Company in the news: Vodafone

Vodafone shareholders are in for big windfall following the deal with Verizon. But once the money's paid out, are the shares worth keeping? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It looks as if Vodafone shareholders have hit the jackpot. The firm has agreed to sell its 45% stake in US mobile-phone company Verizon Wireless for a staggering $130bn (£83.5bn) to the majority shareholder Verizon Communications. The general consensus is that this is a very good deal for Vodafone. The company has fetched more than most analysts were expecting. And shareholders will pocket a bumper 112p per share in cash, which is welcome. But the big question now is: are Vodafone shares still worth holding on to after it has been paid out?

My view is no. Verizon Wireless was the jewel in Vodafone's crown. Without it, Vodafone is nowhere near as attractive. Most of its remaining business is in European economies where customers are cash-strapped and the prices mobile operators can charge for voice services are being squeezed lower.

Vodafone knows this, which is why it plans to plough lots of money into high-speed data services. But this brings it into competition with traditional fixed-line operators, so making money won't be easy. Vodafone has already bought Kabel Deutschland to defend its customer base in Germany by offering more bundled services (fixed line, broadband, mobile and TV) and may have to do the same thing in other European markets. Companies such as Talk Talk (LSE: TALK) in Britain have been mentioned as possible targets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's also a possibility that Vodafone may be a takeover target itself. Europe arguably has too many mobile-phone operators chasing too few customers. If some were to get together they could save costs and hang on to a lot of their current profits. It is also possible that an Asian or US operator may want to buy European assets, and Vodafone would make a good fit.

However, it's not all good news for Vodafone shareholders. To try to keep the share price and dividend per share the same as before the sale, it intends to halve the number of shares in issue. Talk of a dividend of 11p per share in 2014 is effectively 5.5p per share in old money a dividend cut, in other words. This is despite the fact that the current dividend wasn't based on any cash flow from Verizon Wireless. Vodafone seems implicitly to be saying that its current dividend policy is unsustainable. And if that's the case, you'd be better off elsewhere.

Verdict: take the cash and sell

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Vodafone shares yield more than 6% – should you buy, or steer clear?

Vodafone shares yield more than 6% – should you buy, or steer clear?Analysis Vodafone grew revenue by 4% and profit by 11% last year, and offers investors a 6.4% dividend yield. So should you buy Vodafone shares? Rupert Hargreaves looks at the numbers.

-

Are your dividend payments at risk?

Tutorials Vodafone cut its dividend payment by 40% earlier this month. How can you avoid similar disappointments?

-

How to protect yourself from dividend disappointment

How to protect yourself from dividend disappointmentTutorials Vodafone just cut its dividend. And it’s not the only company on shaky ground. John Stepek explains what’s so great about dividends, and how to protect your portfolio from dividend cuts.

-

Vodafone takes fight to BT

News Telecoms giant Vodafone has vowed to take on BT in the broadband and television market.

-

Which companies will benefit most from Vodafone’s cash bonanza?

Which companies will benefit most from Vodafone’s cash bonanza?Features Vodafone shareholders are about to get a windfall. Ed Bowsher looks at how this will affect the markets, and how you could take advantage.

-

Company in the news: Vodafone

Company in the news: VodafoneTutorials If you own shares in Vodafone, you're in for a big pay-out. Phil Oakley explains how it will work, and what you should do next.

-

Vodafone’s $130bn deal

News Mobile-phone giant Vodafone has sold its stake in Verizon - the biggest deal for a decade.