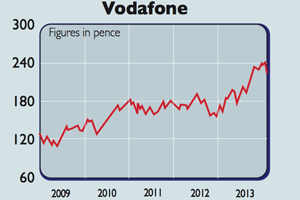

Company in the news: Vodafone

If you own shares in Vodafone, you're in for a big pay-out. Phil Oakley explains how it will work, and what you should do next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you are a holder of Vodafone (LSE: VOD)shares you are about to get a big payout. Vodafone sold its 45% stake in Verizon Wireless for $130bn, and its shareholders are going to receive $84bn (£51bn) of it referred to as a return of value. This means that you have some decisions to make.

The whole procedure is quite complicated, but this is how we see it. Shareholders will receive around 74p in Verizon shares and 30p in cash (104p in total) for each Vodafone share that they hold.

If you want to keep the Verizon shares you will need to tell your stockbroker by 1pm on Thursday 20 February and fill in a W-8 form, which means that you will get taxed on any future Verizon (gross) dividends at 15%, rather than the US rate of 30%. If you do not inform your broker, the Verizon shares will be sold for you free of charge, providing that you own less than 50,000 Vodafone shares.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The other key decision is to choose whether to treat your return of value as capital or income. If you hold your shares in an Isa or Sipp then there is no tax issue.

Outside of a tax wrapper, if you are a basic-rate taxpayer and choose the income option then the 104p per share return of value will be treated exactly the same as a dividend. That is, 10% withholding tax will be deemed to have been paid and there will be no more tax to pay.Higher-rate and additional taxpayers will have to pay more tax.

Alternatively, you could choose to receive the return as capital. This means that if your gain is less than £10,900 (the current capital-gains tax allowance) there is no tax liability at all. Above this level, basic-rate taxpayers will pay 18% and higher-rate taxpayers 28%. All cash will be paid out on Tuesday 4 March.

If you need help deciding which option to choose, please consult a tax specialist. It is important to note that this return of value will not make you any better off. On Monday 24 February, Vodafone will consolidate the number of shares in order to give the same share price andearnings per share measures as before.

Let's say that you currently own 10Vodafone shares worth £2, and yourtotal stake will be worth £20. To keepthings simple, let's assume the return ofvalue is £1 (or £10for ten shares).Normally a shareprice adjustsdownwardsafter a dividendpayment ismade in thiscase to £1 (£2 less £1 return of value).

To maintain the current share price whatwill happen is that the number of shareswill be reduced to five to keep the shareprice at £2. So you will be left with £10worth of shares (5 x £2) and £10 of cash the same £20 as before. The number ofshares you have after the consolidationwill probably not be a nice wholenumber. All fractional shares you end upwith will therefore be sold and returnedto you as cash.

Many analysts reckon that it islikely to buy fixed-line telephony assetsacross Europe, having already done soin Germany. Vodafone has been seenas a takeover target for the likes of UScompany AT&T, but it has ruled itselfout of a bid for the next six months.

The company is pledging to keep onincreasing dividends per share goingforward. With a dividend yield of around5%, the shares are probably worthhanging on to.

Verdict: hold

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Vodafone shares yield more than 6% – should you buy, or steer clear?

Vodafone shares yield more than 6% – should you buy, or steer clear?Analysis Vodafone grew revenue by 4% and profit by 11% last year, and offers investors a 6.4% dividend yield. So should you buy Vodafone shares? Rupert Hargreaves looks at the numbers.

-

Are your dividend payments at risk?

Tutorials Vodafone cut its dividend payment by 40% earlier this month. How can you avoid similar disappointments?

-

How to protect yourself from dividend disappointment

How to protect yourself from dividend disappointmentTutorials Vodafone just cut its dividend. And it’s not the only company on shaky ground. John Stepek explains what’s so great about dividends, and how to protect your portfolio from dividend cuts.

-

Vodafone takes fight to BT

News Telecoms giant Vodafone has vowed to take on BT in the broadband and television market.

-

Which companies will benefit most from Vodafone’s cash bonanza?

Which companies will benefit most from Vodafone’s cash bonanza?Features Vodafone shareholders are about to get a windfall. Ed Bowsher looks at how this will affect the markets, and how you could take advantage.

-

Company in the news: Vodafone

Features Vodafone shareholders are in for big windfall following the deal with Verizon. But once the money's paid out, are the shares worth keeping? Phil Oakley investigates.

-

Vodafone’s $130bn deal

News Mobile-phone giant Vodafone has sold its stake in Verizon - the biggest deal for a decade.