Vodafone’s $130bn deal

Mobile-phone giant Vodafone has sold its stake in Verizon - the biggest deal for a decade.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Vodafone has sold its stake in Verizon Wireless for $130bn (£84bn). In the world's biggest deal for a decade and the largest since Vodafone's $172bn acquisition of Germany's Mannesmann the mobile giant disposed of its 45% holding in the US mobile network to joint venture partner Verizon Communications. Vodafone will return £54.3bn to shareholders in one of the biggest ever payouts from a corporate asset sale. Shareholders will receive 112p a share in the first quarter of 2014 in cash or shares. Vodafone will use the remaining funds to invest in its network and pay off debts.

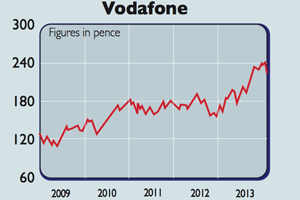

Despite criticism from Margaret Hodge, the chair of the Commons Public Accounts Committee, the transaction will not be liable for UK tax. Vodafone shares rose 9% on the initial bid talk.

What the commentators said

From Vodafone's point of view, "it is hard to quarrel" with the price, said Lex in the FT. It puts an enterprise value of 8.5 times 2013 forecast earnings on Verizon Wireless. That's "lofty" for a non-controlling stake that has not always paid dividends. Net of tax, the stake has been sold for a very healthy 166p per Vodafone share.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But what now? Vodafone aims to focus on emerging markets and on switching from selling mobile-only packages to bundled packages with its Kabel Deutschland deal, but there is "more to do". Vodafone could itself become a bid target, "although its scale limits" likely offerers. But the big task is "showing that the deal will pay long-term".

More big deals are unlikely to be on the cards, said John Jannarone and Rene Schultes in the Wall Street Journal. The benefits of "building scale through mergers and acquisitions may be limited". Customers don't change carriers overnight and owning an Italian cable operator and one in Germany won't provide new negotiating leverage on content purchases. "Bite-size" acquisitions are possible, but AT&T, which has flagged an interest in wireless assets, could swoop on Vodafone itself.

Meanwhile, Vodafone's current share-price multiple of 4.6 times earnings before tax, depreciation and amortisation (ebitda), versus a sector average of 5.3, suggests investors fear it could "misspend" the Verizon cash. (For our take on what you should do now if you're a Vodafone shareholder, click here.)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Vodafone shares yield more than 6% – should you buy, or steer clear?

Vodafone shares yield more than 6% – should you buy, or steer clear?Analysis Vodafone grew revenue by 4% and profit by 11% last year, and offers investors a 6.4% dividend yield. So should you buy Vodafone shares? Rupert Hargreaves looks at the numbers.

-

Are your dividend payments at risk?

Tutorials Vodafone cut its dividend payment by 40% earlier this month. How can you avoid similar disappointments?

-

How to protect yourself from dividend disappointment

How to protect yourself from dividend disappointmentTutorials Vodafone just cut its dividend. And it’s not the only company on shaky ground. John Stepek explains what’s so great about dividends, and how to protect your portfolio from dividend cuts.

-

Vodafone takes fight to BT

News Telecoms giant Vodafone has vowed to take on BT in the broadband and television market.

-

Which companies will benefit most from Vodafone’s cash bonanza?

Which companies will benefit most from Vodafone’s cash bonanza?Features Vodafone shareholders are about to get a windfall. Ed Bowsher looks at how this will affect the markets, and how you could take advantage.

-

Company in the news: Vodafone

Company in the news: VodafoneTutorials If you own shares in Vodafone, you're in for a big pay-out. Phil Oakley explains how it will work, and what you should do next.

-

Company in the news: Vodafone

Features Vodafone shareholders are in for big windfall following the deal with Verizon. But once the money's paid out, are the shares worth keeping? Phil Oakley investigates.