The oil price is going to keep rising – here's how to profit

The oil price has been quietly rising all year. But it's going to get noisy, and you need to be invested. Dominic Frisby picks the best ways to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

2018 has been a noisy year so far: stocks have been up, then down, then up, but ultimately gone nowhere. Precious metals are a little lower than where they started. Bonds are quite a bit lower. Crypto currencies are a lot lower.

There's been babble and squawk about all of them.

But one normally clamorous asset has quietly ground upwards.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And that asset is oil.

The stealth bull market in oil continues

Back in early 2016 I called oil my "trade of the lustrum" (a lustrum is a five-year period it's an almost criminally underused word). With West Texas Intermediate oil (WTIC) at $33 a barrel, and Brent crude oil at $36, we said "buy, hold and forget".

The wager has been a good one. With the usual wobbles along the way, oil has steadily ground higher so that now, two years on, WTIC stands at $71 and Brent at $79.

On revisiting the trade along the way, we've noted that this is a stealth bull market, and stealth bull markets are the best kind of bull markets, because few people are talking about them.

But this is the bottom line: it's a bull market. Bull markets are to be involved in, not stared at. You want to have some oil exposure in your portfolio. It's that simple.

Previous oil bull markets have been accompanied by powerful narratives: the explosion of the Asian middle class especially in China means huge demand. A dearth of new discoveries in readily-accessible locations means the end of cheap oil. Oil production has peaked; it declines from here. We are past Peak Oil.

Instead we've seen technological advances which have seen the US become the world's largest oil producer. Production is no longer such an issue, apparently. New battery technologies and electric cars have been the hot topics. And as for the Asian middle classes and their new-found wealth they appear to have disappeared, for all you read about them.

Of course, the Asian middle classes have not disappeared. They are now richer than they were during the bull market of the 2000s. There are many more of them. And, despite what you may hear about the vehicles of the future, the vehicles of the present run on oil.

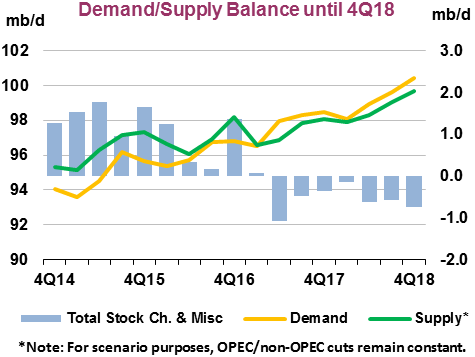

Supply may have increased, but so has demand. Demand is growing all the time and it exceeds supply, as this chart from the International Energy Agency (IEA) shows.

There will be wobbles along the way; there always are. Indeed, measures of momentum such as RSI (relative strength index) and MACD (moving average convergence/divergence) both show oil to be overbought and due a pullback.

But this is a trend, my friends, and my trade-of-the-lustrum advice remains in play: buy, hold, forget.

Oil bull markets end with a great deal of noise. This one has not got noisy yet.

I should say it's all the more impressive in 2018 for the fact that the oil price has quietly carried on rising, even as the US dollar has strengthened.

(By the way, the fact that Treasury bond yields have been rising in the US at the same time as oil makes the macro theory that the financial backdrop has changed from one of deflation to one of inflation all the more credible. More and more, the theme of inflation seems to be making itself present in our lives once again.)

So how to play all this?

The best ways to play a rising oil price

Buying barrels of oil or indeed oil futures is not advised. I don't like the exchange-traded funds (ETFs) that track the oil price, for a host of different reasons, and spreadbetting is only an option for the experienced.

Aside from the risks of leverage, another issue I have with spreadbetting is that it is very difficult to buy, hold and forget the trading stations make it too tempting to trade, and this takes both wisdom and willpower to resist. Better a brokerage account with a long-forgotten password (only kidding, but you take my point).

The two classic majors, BP (LSE: BP) and Shell (LSE: RDSB), are other options, and I have recommended the latter. (Full disclosure: I own Shell.) They have both done well. Shell is now at all-time highs, while BP is at eight-year highs. The dividend is nice (around 5%) but the leverage is such that some investors might prefer something a little more racy.

BHP Billiton (LSE: BLT) is another favourite. Even though it's known for mining, oil is its biggest product and BHP tracks the oil price well. That was 700p when we recommended it back in 2016 and it's now 1,700p, so it's done well too. There's still plenty of room for it to go higher (in 2011 it hit 2,600p), particularly if things get inflationary.

Another way of playing this is to go for the iShares oil and gas exploration and production ETF, SPOG (LSE: SPOG). This basically tracks the price of a number of companies involved in exploring for and producing oil and gas.

If the oil price rises, a diversified range of companies operating in the sector should too, although the gas factor seems to have acted as a bit of a brake. Natural gas is not in a bull market the way oil is. SPOG is at highs for the year, but has not been a runaway success. It was around 1,300p when we mentioned it last October, today it sits around 1,500p.

Then, of course, there are the juniors and mid-caps. If you can find well-managed, undervalued, low risk opportunities in this space, you are a better person than me (at least as far as finding well-managed, undervalued small and mid-cap oil plays is concerned). Such things do exist, however, and good investments in them will make you money.

Why? Because, over the next three years, the oil price is headed higher.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King