How to play oil's stealth bull market

Oil is in a bull market, says Dominic Frisby. And in any bull market, you want to be invested. Here, he picks the best ways to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we're talking oil, folks.

It looks like a bull market to me and you want to be long.

But our Money Morning begins with a half-term road trip around Texas...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I highly recommend a trip to Texas

I've just come back from a trip to Texas and what a fantastic place it is. You should all go.

The kids and I did a road trip, starting in Houston, taking in Austin, San Antonio and the Hill Country (where the cowboys live). We then drove all the way across the state to the Big Bend National Park, where we climbed mountains and even swam across the Rio Grande to Mexico.

In the course of the trip, as you can probably imagine, we did a lot of driving. A heck of a lot. Texas is big. At around 270,000 square miles it is, after Alaska, the largest state in the US. It's roughly three times larger than the UK.

The drive from Houston to Big Bend is more than 550 miles. It takes over eight hours. We were driving a Dodge Charger, which is a very luxurious V6 saloon car. When it comes to gas guzzling it's no Hummer, but nor is it what you'd call economical it only does about 25 miles per gallon.

That near-nine-hour drive cost us $37 in petrol.

Houses in Texas, meanwhile, are also cheap. We walked past a beautifully kitted out, 6,000 square-foot detached house backing onto the river for sale in Southtown, close to the centre of San Antonio. I made the kids guess how much it was. Three million pounds said one. Six said the other. I guessed four. It was $1.5m. It would be at least five times the price in London.

Young people can actually afford accommodation there.

How much difference does it make to an economy when both housing and energy are cheap? Well, it leaves a lot more money to spend and invest elsewhere. It rammed home what a drain our housing and energy markets are here in the UK.

On the other hand, when the oil price rises and falls, Americans feel it more than we do. Because so much of the price we pay at the pump is tax more than 60%, according to The Telegraph a price rise or fall of 20% a barrel does not necessarily mean a 20% change in the price we pay at the pump.

However, the price we pay at the pump is, nevertheless, creeping up. My outlook is that is going to continue to creep up. Oil is in a bull market. And it's the best type of bull market one that nobody seems to be talking about. A stealth bull market. These are the kind that we like.

It means that the phase when everybody starts talking about it is still to come. There's still space for narratives to develop and for the media to get excited.

The trouble with oil bull markets

Bull markets in oil are a mixed blessing. A rising price is often accompanied by a rising stockmarket. It's indicative of increased economic activity and of appetite for speculation a period of economic expansion. It's also often indicative of the type of inflation that is deemed "good". And those who are invested in oil love it, of course.

But sometimes they can go a little too far. The oil shock of the 1970s is one obvious example. Another is the $147-a-barrel blow-off top we saw in 2008. There are many who argue, with some justification, that $147 and the squeeze it placed on the world's finances precipitated the 2008 collapse as much as anything.

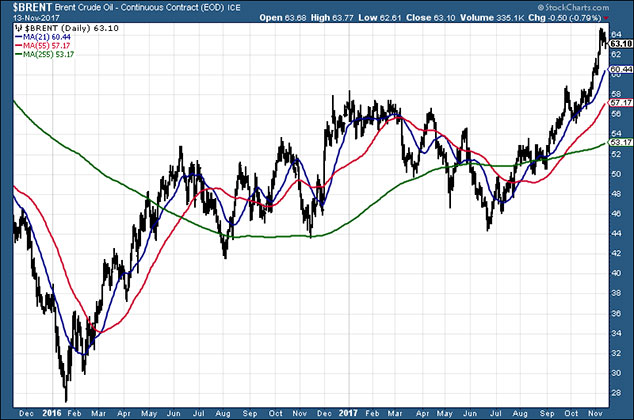

Certainly, increased energy budgets mean squeezes elsewhere. This is something we live through pretty much permanently in the UK. Here's Brent crude since 2010.

You can see oil spent a good three-and-a-half years in the $100-$125 range before it collapsed in the second half of 2014 and through 2015.

Is the world even remotely prepared for $100 oil again? I don't think it is.

A rising oil price will mean inflation. It could force central banks to raise interest rates against their wishes. Higher inflation, rising energy costs and rising rates will all affect profitability. It's not an ideal combination.

Yet looking at the above chart of the last seven years, sub-$50 oil is, I suggest, the exception, not the rule.

Let's take a closer look at the last three years.In addition to the price in black, I've drawn three simple moving averages. The green line shows the average price over the last year (255-day moving average), the red over the last 55 days and the blue over the last 21 days. These show the short, medium and longer-term trends.

You can see that not only is the price rising, but so are all the moving averages. They are also in alignment the 21-day moving average is above the 55-day which is above the 255-day. In other words, oil is trending up on a short, medium and longer-term basis.

Each low is higher than the last (except in the first half of 2017, where a nice floor was put on the price at $44). And each high is higher than the last.

I'm forever banging on about trends. They can go on for a mighty long time. It is not without good reason we have the expression "make the trend your friend" or versions of it.

It's nearly two years since the 2016 low. I imagine the correction in the first half of 2017 threw a lot of people off, but this looks like a bull market to me, folks. It may turn out to be the wrong sort of bull market as far as the economy is concerned, but it's a bull market nonetheless and my view is that you want to be invested.

How to invest in oil

Oil is a theme I keep coming back to. I identified it as my "trade of the lustrum: (of the next five years) back in early 2016, and I'm going to keep writing about it as the bull market goes on, despite the fact that the number of views my articles get actually declines when I write about oil a bullish indicator in itself.

There are various ways to play oil. I don't like the exchange-traded funds (ETFs) that track the oil price, and spreadbetting is only an option for the experienced.

There are the majors, such as BP (LSE: BP) and Shell (LSE: RDSB), but they don't give you as much leverage as perhaps you would like, though their dividends are compelling (I own some Shell in my SIPP).

BHP Billiton (LSE: BLT) is another option. Even though it's known for mining, oil is its biggest product and it tracks the oil price well.

My preferred play, rightly or wrongly, is SPOG (LSE: SPOG). SPOG is the iShares oil and gas exploration and production ETF, which, as you may expect, gives you exposure to a broad range of companies involved in exploring for and producing oil and gas. If oil goes up, a diversified range of companies operating in the sector should too.

What if I'm wrong? It often happens. What are my risk lines in the sand? I actually think a pull back from today's price of $63 to somewhere in the $50s perhaps $58 is not unlikely. I'll be raising eyebrows below $52. And below $44 I'm flat out wrong.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how