Investors should stand clear as the tech giants stumble

The likes of Facebook, Google and Netflix have enjoyed a great run. But with governments cracking down, it’s time to pull the FANGs from your portfolio, says Jonathan Compton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The likes of Facebook, Google and Netflix have enjoyed a fantastic run of it in recent years. But with governments cracking down, it's time to pull the FANGs from your portfolio, says Jonathan Compton.

I love the way that new technologies have improved my life, even though I do not understand how they work, nor how to use the many gizmos on my iPad, PC or mobile phone. I love being able to order anything online, to Skype globally, arrange travel, never get lost and pay bills; and these already-significant pluses are dwarfed by the ease of free communication, business and social, that the internet provides. I don't even mind the multiple messages from kind men in Africa and curvaceous Ukrainian women who want to give me money or be my special friend. There are a few fashions that I simply don't get: Facebook appears designed for the irredeemably needy, and Twitter for vain illiterates but this may be a function of grumpy middle age. Overall, I'm a fan of our newly hyperconnected world.

The massive utility of new technology, however, has spawned a widespread delusion among investors in stockmarkets. Their unfortunately mistaken notion is that the indispensable and revolutionary nature of the internet means that the leading technology and internet companies are therefore rock-solid investments. This is not true. The reality is that they are about to enter a dark and torrid period, especially the largest the so-called FANGs. Indeed, to my mind, they're currently the best short around.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bigger than Japan

FANGs is an acronym for Facebook, Amazon, Apple, streaming service Netflix and Google (now owned by parent Alphabet). These five alone have a combined market capitalisation of $3trn. That's greater than the UK's annual gross domestic product (GDP). If you then add in another US tech giant, Microsoft, whose market cap is $700bn, plus the FANG's equivalents in China Alibaba ($500bn) and Tencent ($560bn) then these eight behemoths together are valued at more than the GDP of the world's third-largest economy, Japan. So great is the worth of just the three largest FANGs that if they were countries each would be eligible for membership of the G20, a club of the world's richest nations.

The performance of these stocks has been wondrous. Over the last three years America's most widely used index, the S&P 500, has risen by about 40% and the tech-heavy Nasdaq index by 50%. But these excellent gains are dwarfed by the 150% increase in the New York Stock Exchange's FANG+ index. You probably own some of these companies. Their sheer size makes them significant in global indices, and thus held by tracker and active funds as well as your pension fund and insurance company. The strong price rises have sucked in momentum players who buy the trend, while the best-performing funds to which investors understandably flock are often tech-heavy.

One such widely owned star is the Scottish Mortgage Investment Trust (which is also currently a holding in the MoneyWeek investment trust model portfolio, I'm told), which invests globally. Net assets are £6.5bn, while its share price has risen by 190% over the last five years, magnificently exceeding the 85% gain by its benchmark FT World index. At the end of February, six of its top-ten investments nearly 40% of the trust were in giant tech companies. Another star performer has been the £1.6bn Fidelity China Special Situations Trust. Over the same period the 170% price gain has beaten its benchmark by 100%. Just two holdings Tencent and Baidu account for more than a quarter of the fund's portfolio, while the information technology sector as a whole accounts for a whopping 40%. For many fund managers, if they haven't been FANG-and tech-heavy they have been underperformers.

Highly valued, vulnerable monopolies

All of this is about to change. One problem is the seemingly high valuations of these giants, in already richly priced markets. Amazon is on a multiple in excess of 200 times, and Netflix over 100, compared with around 28 for the Nasdaq. Yet traditional accounting methods are of little relevance for digital companies with their asset-light models and a critical need to dash for growth critical because in many tech industries there are huge economies of scale the larger they become and because, more so than other sectors, tech is prone to creating monopolies.

Some of the best-known tech companies are ludicrously priced. Tesla, the brainchild of genius Elon Musk, ranks fourth by market cap among global car companies. It might just manage to produce 400,000 cars this year at a loss yet it is worth more than giant manufacturers such as GM or Honda. It is also haemorrhaging money, and as the larger carmakers move into electric-car production, it is likely to go "phut". Netflix, meanwhile, has negative cash flow of about $4bn a year and like cryptocurrency bitcoin relies on ever more investors buying the dream. By contrast, Amazon is a huge generator of cash, which it uses aggressively to reinvest and broaden its reach into new areas, while apparently deliberately suppressing its reported earnings.

But while valuations for tech companies are certainly an issue, more important is the growing revolt against their monopoly powers. These monopolies have arisen because they are the savviest survivors of brutal commercial warfare, but in the process of trouncing their competitors, they now have more power in some areas than governments. Microsoft and Intel essentially control 71% of the global PC market between them. Nearly 75% of all adults who use social media are on Facebook, while Alphabet (Google) has 67% of the global online search market. Last year about $200bn was spent on digital advertising globally, or 40% of total advertising spend. Of this, nearly half went on advertising on the big three: Alphabet, Facebook and Alibaba. In the smartphone market, Apple's global market share has just exceeded 50%, while Netflix has a 60% share of the digital film market.

This massive concentration of power is accelerating. Having established dominance in one field, these companies are looking for fresh pastures. Amazon and Apple are both moving into banking and healthcare distribution, for which their highly advanced platforms can be easily adapted, while Alphabet once just one of many search engines is now considered to have the most advanced technology for self-driving cars in its Waymo unit.

Enough is enough

Politicians are rarely the smartest bunnies in the warren, with most lacking either a commercial background or knowledge about these new industries. (The majority of dominant tech companies are younger than the century.) Until recently, the approach from politicians has been a burning desire to cuddle up, once reserved for the Murdochs or CNN, in the hope of accessing data for tax and surveillance, gaining electoral advantage and political donations, or reflected glory from the creation of new jobs and skills. They bought into the mantra chanted by the leaders of these gargantuan groups that they are happy-go-lucky technical hipsters bringing peace and love, lower prices and better goods to a world that they are helping to "democratise". Calls from tech savants such as Sir Tim Berners-Lee, "the father of the worldwide web", for better regulation, were ignored, as was evidence of multiple corporate abuses. Apple's suppliers continued to treat their employees like galley slaves, Alphabet fixed the advertising market for its own benefit and Uber and Deliveroo "agents" (not employees, as that costs them more) were maltreated.

But this is changing. The current hysteria over Facebook allowing personal information from perhaps 50 million accounts to be used by a lobbying firm managed by a sad wannabe-James Bond villain is delightful in its hypocrisy. Of course, companies, governments and media will use data for their own ends be it targeted advertising, political persuasion or selling products. It is little different from the now quaint supermarket cards or air-mile programmes; and if I were a shareholder in, say, Facebook, Tesco or BA, I would call for management to be eviscerated if they did not use their data to maximise profits. Yet the Facebook incident merely confirms that the tide has turned. Governments, regulators and the general public want action.

The regulators are catching up

The charges against tech giants include the truisms that self-regulation never works and that monopolies eventually abuse their position. Another charge is tax avoidance; these self-styled "citizens of the world" are adept tax dodgers. In February 2016, the then chancellor George Osborne triumphantly announced he had extracted ten years of back taxes worth £130m from Google. Shortly thereafter, in its financial report for the year to June 2016, Google UK reported revenue of £1.03bn, profits of £146m, and paid the correct 20% tax. A triumph? Hardly. For in its US filing for the same year, the parent company reported UK revenue six times higher and most of the profits booked offshore. All Osborne won were a few pennies from down the back of the sofa.

But now the regulatory noose is tightening. Late last year the European Union (EU) fined Google €2.4bn for unfair practices. Earlier this month a court in Washington ordered music-streaming service Spotify to pay much more to its artists. The EU commission in Brussels is looking to target digital platforms and unfair trading with a short-term tax on revenue and advertising. The UK, EU, and others recognise that these companies will hire the best lawyers and accountants to minimise their tax liabilities so are considering directly targeting revenue (rather like VAT), which is much harder to duck. India is considering going a step further taxation based on the number of users. China and Russia's emperors are taking a simpler approach: total obedience to the party line and pay what we tell you.

Other legislative changes are around the corner. Again the EU is in the vanguard, proposing that tech companies are not passive platforms but liable for content with swingeing fines for not taking down, say, terrorist material within an hour, or for privacy breaches. Defamation will be next. Product liability is on the rise. Today if your money disappears when booking a holiday via TripAdvisor or Expedia, or you suffer an injury on that holiday, the companies pretend that they are mere introducers and thus cannot be liable; so too Amazon or Google if you buy defective goods off their pages, or Airbnb if you are assaulted in one of their apartments. Not for much longer.

A major change of mood

These potential new liability costs are before plans that firms should also pay for (often nebulous) "deleterious social consequences", such as online gambling addiction. Admissions from within the industry add to widespread suspicion. The former Facebook engineer who invented the ubiquitous "like" symbol stated that a key target was to make the site become addictive.

Another threat is the risk of rising tariff barriers, or worse, trade wars. Companies such as Apple or Microsoft would be especially vulnerable. Yet perhaps most important of all, the public mood has swung against free-wheeling capitalism. Nor are some of the business models as safe as they appear. Microsoft's core business disappears as users move to tablets. Self-driving cars may well be the future except that hackers have already proved that they can crash them. Social media is prone to fashion change and boredom, while the barriers to entry for streaming films or music aren't particularly high. Meanwhile, the industry has been slow to notice the change in the mood music; its responses to mistakes are usually feeble and legalistic. I think it is no coincidence that many loss-making "new tech leaders", such as Spotify and storage group Dropbox, are racing for an exit through a premature stockmarket listing as their owners pick up the odd billion on the way.

Yet overall the bottom line is simple. After a wild "anything goes" party, giant tech is about to suffer multiple assaults from tougher regulations, higher taxes, and legal liability for their products. Their costs will blow out as they will be forced sharply to increase headcount. Rising costs, slower growth and tighter margins are never a formula for future stockmarket winners. I look at how to purge your portfolio below and at some better-value tech stocks to buy instead.

Five alternative tech plays

Before considering what to buy, check what you already own directly or via your wealth manager, or in your pension fund. The first two you can reduce or sell if this check reveals that you are overinvested in FANGs. Your pension manager will probably not respond, or will fob you off with blather about investing long term and historical strong performance; but write it down to batter him with later. Some exchange-traded funds (ETFs) offer the ability to short-sell technology stocks, but holding costs can be very high, so too the risks that the underlying derivatives do not necessarily work. But if you are a numerate, risk-hungry professional then the US-listed ETF ProShares UltraShort Technology (NYSE: REW) may be right for you. The price is expected to inversely correspond to twice the daily performance of the Dow Jones Technology index.

Back in the world of investing in businesses, I have just bought or topped up four companies with strong technologies. In secured managed hosting and cloud computing both growth businesses I like Iomart (LSE: IOM). The market cap is £400m, while compound annual growth in sales and operating profit over the last five years has been 21%. And unlike many tech stocks it pays a dividend it yields 2.1%.

I also like dull but necessary technology. Here the £7.2bn market cap Sage Group (LSE: SGE) fits the bill. It provides integrated accounting, payroll and payments services and has moved into computer hosting and also cloud storage. The share price has fallen sharply this year on fears of slower growth and margin pressure, but it's more likely that the new businesses will improve both. The forward multiple I estimate is now 19, and the yield 2.4%.

In retail, online shopping is the winner. But the hugely successful ASOS is now pricey. I prefer a similar German group Zalando SE (Frankfurt: ZAL), an €11bn fashion retail disrupter. The multiple of over 100 makes it look expensive, but like Amazon it sacrifices margins for growth and reinvests heavily to gain market share. In the last four years revenue and net profit have more than doubled and should do so again in the next four.

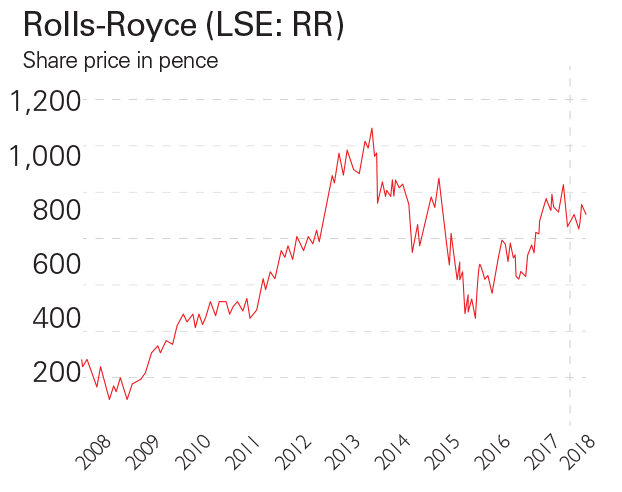

Finally, there is one superb engineering tech company that I think is an obvious recovery after several torrid years, Rolls-Royce (LSE: RR). New-ish CEO Warren East is doing a good job both on cost cutting and streamlining: 2017 results easily beat forecasts with underlying pre-tax profits up by 25%. Not only is it a world leader in aero engines, but it also has fabulous recurrent income. Expect growth to stabilise, then improve. Free cash flow is expected to exceed £1bn by 2020.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.