The cloud over retail has a silver lining

A sense of gloom hangs over the retail sector – but pick the right stocks at the right price and there are still potential pots of gold out there for long-term buyers, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A sense of gloom hangs over the retail sector but pick the right stocks at the right price and there are still potential pots of gold out there for long-term buyers, says Phil Oakley.

The high street is in decline. "Bricks and mortar" chains are just waiting for Amazon to wipe them out. The crashing pound is driving up costs, squeezing both customers' wallets and retailers' profit margins. You don't have to look far to find reasons to be gloomy about retail right now. Yet ask any retailer and they will tell you that selling stuff to consumers has never been easy every sale is hard won. And if you focus too closely on general economic trends, it's easy to forget that good retailers adapt to the changing world around them, while ambitious newcomers exploit those changes.

Yes, over the past decade, well-known brands such as Debenhams, Mothercare, Laura Ashley, French Connection, and even Marks & Spencer, have seen profits and share prices come under severe pressure. But there have also been some amazing successes. Online fashion retailers such as Asos and Boohoo have seen their profits and share prices rocket, making many of their earliest investors rich in the process. And it's not just the tech-savvy firms. Some traditional retailers have also prospered just look at the success of sportswear company JD Sports. Or even WH Smith the newsagent is regularly described as a high-street dinosaur, but its strategy of focusing on locations with high footfall, such as train stations and airports, while shedding unprofitable sales, has delivered total returns of more than 430% for shareholders over the decade.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So while it makes sense to take account of the big picture, the reality is that retail is no different from any other sector there are always threats and opportunities. It's all about finding the right stocks at the right price. And as you'll see, there are still potential pots of gold out there for long-term buyers.

How skint are consumers?

Britain is a nation of shoppers, with consumer spending vital to the UK economy. The good news is that people are still buying retail sales rose by 5.7% in the year to June, according to the Office for National Statistics. The bad news is that wages are growing more slowly than inflation in other words, household incomes are shrinking in real terms. Meanwhile, consumer debt is rising at its fastest rate since the last boom in 2006. It's hard to see this as a good thing, particularly for businesses such as car dealerships, where recent strong growth in new car sales has been primarily driven by credit and the use of personal contract plans (PCPs).

That said, while these concerns are undoubtedly valid, wages and credit are not the only drivers of spending. For a good few years now, consumption has received a significant boost from retiring baby-boomers, who are now spending money rather than saving it something that is often overlooked. Affluent pensioners who have accessed their pension pots and perhaps released equity by trading down to a smaller house have also boosted the "silver pound". So while a long consumer boom may not be on the cards, talk of an imminent collapse in spending may be overplayed.

The rise of internet and discount retailers

While some retailers have undoubtedly struggled, others are making hay from the disruption caused by the internet and other new shopping trends. Successful online retailers who lack the legacy costs of bricks-and-mortar stores have been able to undercut prices charged by their high-street rivals. As their sales rise, they benefit from economies of scale, which allows them to cut prices further, in a virtuous circle.

Then there's the rise of the discount retailer. The rapid growth of Aldi and Lidl has wreaked havoc on the profits and strategies of the big supermarkets, for whom the only bright spot has been the growth of convenience stores smaller town-centre branches. Tesco and Sainsbury's are trying to buy their way out of trouble. Tesco is looking to buy food wholesaler Booker, while Sainsbury's has bought Argos and is taking on Amazon. Time will tell whether this pays off. The discounters are also on the march in general retail the likes of B&M Stores, Home Bargains and The Original Factory Shop are all growing rapidly. These companies have wooed shoppers by selling goods at very cheap prices, and look well placed to continue to do well with bargain-hunting, cash-strapped shoppers.

Shopping around for bargains

The sense of gloom hanging over the retail sector means it is currently possible to tap into some of the best growth trends in the sector, while also potentially picking up some bargains. But be careful. Some apparent bargains may be value traps (that is, stocks that look cheap but are likely to stay that way). Some of the struggling chains mentioned at the start of this article Debenhams, say face a very difficult future. These shares are probably best left to more adventurous investors with a considerable appetite for risk.

Instead, I've looked for shares in the most promising retailers that right now are trading at reasonable, rather than very expensive, valuations. I've split these into three main categories: growth companies capable of exploiting some of the prevailing retail trends; undervalued shares; and finally, possible takeover targets.

B&M European Value

(LSE: BME) 370p; forward p/e 21.5; yield 1.9%

A successful business must do something that its rivals cannot. Usually this means selling a superior product or service that cannot be copied, or selling the same products or services, but at a lower price. Discount retailer B&M's selling point is the latter: it sells selected branded goods and various non-grocery products at much lower prices than the big supermarkets. So how can a relatively tiny retailer like B&M which is chaired by former Tesco chief executive Sir Terry Leahy undercut its giant competitors in this way, and still make a profit?

First and foremost, B&M is a very focused retailer. It keeps a limited stock of goods. So for example, it might sell just two brands of washing tablets rather than ten. This is repeated across its range. So it ends up only really selling around 5,500 different products, whereas some of its rivals might sell up to 30,000. As a result, the company never gets bloated with too much stock. It operates on a "one good in, one good out" basis, and rarely holds more than three months of potential sales of a product in stock. Holding too much stock eats up cash flow. B&M's policy minimises this risk. It also allows the company to focus its buying power behind particular brands, so that it can buy them more cheaply and pass the savings on to customers. If it sells a lot of a particular product, it can then go back to the supplier and negotiate a better deal.

Secondly, the company has a stake in a Far East buying and importing company that allows it to import goods from China at very good prices. It has built up good long-standing relationships with more than 300 suppliers by treating them well and paying them quickly. In return, B&M has been able to stock its stores with a wide range of non-grocery goods, such as toys and homewares, that sell at prices which the competition finds hard to match.

Thirdly, B&M adopts a flexible approach to trading in its stores. It stocks seasonal goods at relevant times of year to attract more customers. This has enabled it to deliver very healthy profit growth consistently. The group now wants to increase its number of UK stores from 543 to 950, and to expand its German business too. It has just bought convenience retailer Heron Foods in order to extend its retailing skills in this growing market. The shares are not cheap, but with like-for-like sales growing strongly, they could be worth paying up for.

JD Sports

(LSE: JD) 375p; p/e 17.1; yield 0.4%

This is another solid growth play. JD Sports has rewarded long-term investors spectacularly.But there could be yet more to come the company looks very well placed to capitalise on the growing trend for "athleisure" (wearing sports clothes and trainers for everyday use). JD has enjoyed a long period of impressive like-for-like sales growth a key measure of retail performance leading City analysts consistently to raise their profit forecasts. It's also benefited from the chaos at arch-rival Sports Direct, opening new shops in the UK to take advantage, and has quietly built a presence in Europe and Asia too.

Yet the shares have sold off recently, as the period of analyst upgrades has come to an end. A recent trading statement spooked investors profit margins had fallen slightly, in an effort to maintain high sales growth. However, forecasts were not cut, and decent growth is still expected. As a result of the sell-off, the shares now trade at a much more reasonable valuation. With good underlying growth and further benefits to come from the recent acquisition of Go Outdoors, the shares look decent value. Throw in a squeaky clean balance sheet with a large net cash balance, and there's a lot to like about this business.

Next

(LSE: NXT) 4,380p; p/e 10.8; yield 3.6%

Next is one for the value investors. The high-street stalwart has gone from being a sector darling to dog as sales and profits growth have ground to a halt. Its shares had more than halved from its late 2015 peak before rallying recently. Yet despite its growth setback, Next remains very profitable and continues to generate impressive returns on investment and prodigious amounts of free cash flow. Its financial position is very strong, even when the hidden debts from its rented stores are taken into account (by "hidden debts" I mean the fact that Next is tied into leases on these stores that it cannot break without incurring costs). It is in no danger of going bust.

Last week's trading statement revealed that sales had not deteriorated any further, which kicked off a relief rally in the shares. Sales at Next Directory the company's online business grew by a healthy 11.4% and the company's previous profit forecast was maintained. Next Directory already makes more profit than the high-street stores, which means that Next already has the basis of a very strong internet business. Unlike rivals such as Debenhams, which are locked into long-term rental deals on its stores, Next is in a position to reduce its high-street exposure as its leases mature in the next few years, or to slash its rent bill and boost profits.

The shares are not expensive, and offer a reasonable yield of 3.6%, based on a regular dividend of 158p per share. On top of that, as Next continues to generate lots of surplus cash, this is likely to find its way into shareholders' pockets. For example, it looks set to pay four 45p special dividends this year, which would bump the yield up to a chunky 7.7%. If Next can maintain its levels of cash flow then this looks like a decent tangible return, especially if the dividends are reinvested. Next does carry some risks. Directory profits contain a large amount of interest payments on credit balances, which could be under threat if the economy slumps. Its high profit margins may also be a sign that its prices are too high, leaving it vulnerable to competition.

McColl's Retail

(LSE: MCLS) 268p; p/e 15.5; yield 3.8%

Finally, keep an eye on potential takeover targets. McColl's owns 1,292 convenience stores and358 newsagent outlets. Its shares have performed well recently as investors have begun to see the potential of its growing size in an expanding market. Its competitive position has also been strengthened by a new wholesale food-supply agreement with Morrisons.

Underlying sales growth is nothing to write home about right now, but profits should grow due to the recent purchase of nearly 300 stores from the Co-op. Analysts also point out that McColl's is a potential takeover target for a big supermarket looking to grow its convenience business. Morrisons may have first refusal, given its food-supply deal, but it could draw the attention of Sainsbury's if the latter's attempt to buy Nisa falls through.

A consolidation drive in car sales

Another area of the retail market that may see some takeover activity is the car dealership sector. Consolidation has been quite common in recent years. The sector is understandably out of favour just now, given the credit-driven nature of new-car sales. But profits can be supported by used-car sales which tend to be more profitable and more lucrative servicing and repair work. The valuations of some companies are low, as shown in the table below, and this may also attract some takeover interest.

| Name | Price | Market cap. | Fwd p/e | Yield |

| Inchcape (LSE: INCH) | 840p | £3,486.2m | 13.3 | 3.10% |

| Pendragon (LSE: PDG) | 31p | £442.2m | 7.8 | 5.20% |

| Lookers (LSE: LOOK) | 107.25p | £425.3m | 7 | 3.60% |

| Vertu Motors (LSE: VTU) | 41.75p | £165m | 6.6 | 3.60% |

| Motorpoint (LSE: MOTR) | 138.5p | £138.8m | 9.1 | 4% |

| Marshall Motors (LSE: MMH) | 143.5p | £110.8m | 5 | 4.30% |

| Cambria Autos (LSE: CAMB) | 64p | £64m | 7.3 | 1.60% |

(Disclosure: Phil Oakley owns shares in B&M European Value Retail and JD Sports)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Most popular stocks of 2023: AI on the up while interest in Netflix plummets

Most popular stocks of 2023: AI on the up while interest in Netflix plummetsWe reveal the most popular shares of 2023 so far.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

Macron has failed France – but there is still plenty to invest in

Macron has failed France – but there is still plenty to invest inCover Story Emmanuel Macron won a convincing victory in France's presidential election, but he has no clear vision for halting the country’s decline. Frédéric Guirinec looks at the state of France and picks 20 French stocks to buy.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

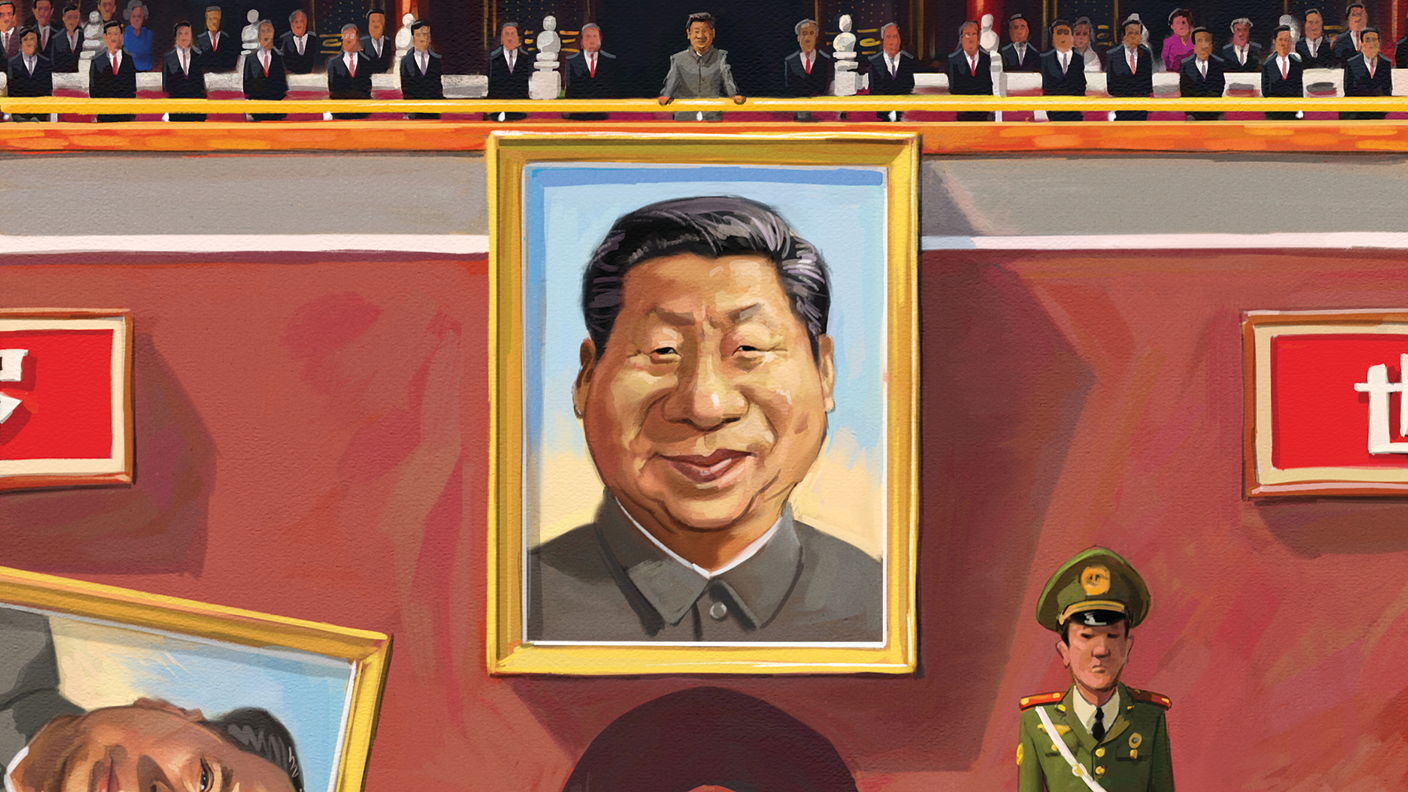

The three key risks for investors in China, and how to tackle them

The three key risks for investors in China, and how to tackle themCover Story Xi Jinping’s vision for the future of China is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton.

-

Japanese stocks offer plenty of promise at the right price

Japanese stocks offer plenty of promise at the right priceCover Story After decades of disappointment, Japan is packed with opportunities for investors, says Alex Rankine.

-

The five best ways to invest in India's promising future

The five best ways to invest in India's promising futureCover Story The pandemic has been catastrophic for India, yet the stockmarket is hitting record highs. Investors are right to remain optimistic about the long term, but they are pricing all the good news in, says Cris Sholto Heaton