India: the world’s hottest emerging market

Is India the last great growth story – or overhyped and doomed to disappoint? In part one of our feature, Jonathan Compton argues that you should leave India well alone.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Is India the last great growth story or overhyped and doomed to disappoint? Jonathan Compton and Rupert Foster set out both sides of the argument. In this first part, Jonathan Compton argues that you should leave India well alone.

Read the second part of this feature here Rupert Foster on whyinvestors should keep faith with India

I began my love affair with India in the 1990s, when I set up and managed a broking operation in Mumbai. At that time the data looked horrible but India had hit a brick wall and had no choice, but to change. I found all the positive clichs were true and we made good money. The prospects today are not so bright.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's the data-heavy spreadsheet analysis much favoured by central banks and investment firms, then there's the quizzical, wandering-about school to which I belong. For the former, because India's leading index has risen sixfold this century, the data looks good and the outlook bright. Yet for us wanderers, everything suggests that the tide is ebbing and the outlook is gloomy to torrid. Foreigners have long been enamoured by the potential of a population of 1.3 billion (shortly to overtake China), with an enormous, well-educated middle class, a high savings rate, pockets of excellent technology, currently high economic growth, two-thirds of the population under 35 and the potential for a consumer boom. I would really like this boom to happen, but India seems incapable of escaping its history, culture and perennially awful governments.

The mistakes started immediately after independence in 1947. The history of the British in India is at best mixed, but the country's reactive swerve into the USSR-led Comecon block and Mahatma Gandhi's legacy of simple self-reliance proved an economic disaster. (The national flag by law must be made of hand-spun cloth and has a spinning wheel at its centre.) In 1947, India accounted for about 2.5% of world exports. By the mid-1980s this was down to 0.5% and even now is only 1.6% despite having 17% of the world's population. Foreign investment and expertise were actively discouraged. Popular imported products banned. While this has changed, the legacy of bumbling bureaucracy and Byzantine planning remains. India needs new infrastructure, but too often developments become mired in inertia and successes are over-hyped. The government trumpets that 96% of villages in the north now have electricity, yet only 69% of the houses are connected, supply is patchy and the classification of villages excludes many smaller ones.

The economy is racked with expensive subsidies. The government boasts that 800 million people receive food aid, but this is another sign of chronic inefficiency. Farmers have made shortages worse by abandoning grain crops, which the country needs, in favour of specialist foods for the wealthy classes, while an estimated 30% of all funding magically ends up in the pockets of the rich. This in turn highlights another structural problem: embedded corruption. Nearly half of all regulators and police admit to receiving bribes. Property prices in Mumbai are more expensive than Mayfair or Manhattan, and the city beats even London as a money-laundering centre. So weak are checks on ownership that funds are laundered through local property or via one of India's thriving successes Bollywood. Venal chief ministers publicly blow over a million pounds on their children's weddings even though the best-paid minister in Punjab has a basic annual salary of £15,000. All this comes at a high price. India ranks 130th in the World Bank's Ease of Doing Business Index, the worst of any major nation, yet it probably tops the global league for illegal monies. A report from the Swiss Banking Association stated that India has more black money in Swiss banks than the rest of the world combined, a multiple of the national debt. There have been no serious attempts by India's government to track the owners or to punish them.

Yet this corruption pales against core social problems. Advertisements posted by mothers seeking suitable brides for their seemingly hapless sons provide clues. The most common criteria are caste, religion, then, frequently, skin colour discrimination so blatant even the National Front would blush at the bigotry. Every society has contradictions, but India's are extreme. In theory, the law supports equal rights, but centuries-old traditions prevail and are often upheld by the courts. In the caste system every child is deemed at birth to belong to one of the five main classes, which in turn sub-divide into more than 250 sub-castes and occupational groups. Thus a son whose father is a dhobi (clothes washer) or an upper-caste IT technician has a greater than 50:50 chance of being forced into the same occupation as his father. Successive governments have tried to eradicate these prejudices, such as via occupational quotas if only because the lowest castes are the largest bloc of votes but progress has been glacial.

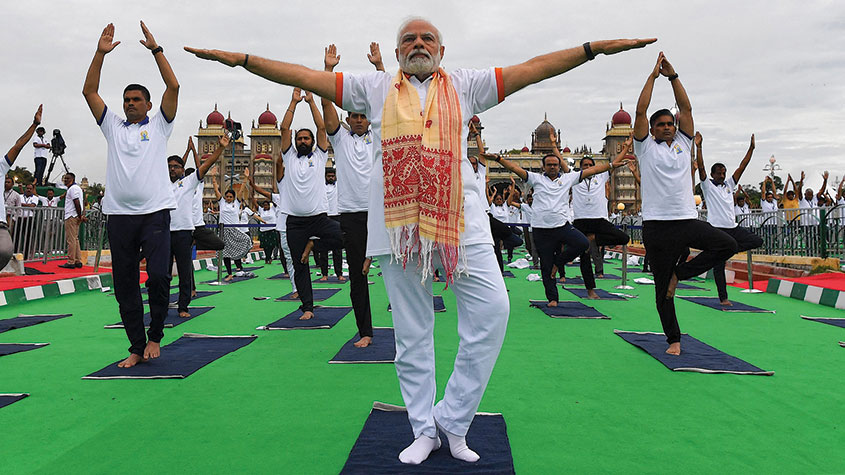

These entrenched class and colour prejudices ensure the abilities of millions of people remain untapped, but the additional religious overlay dooms all hope of meaningful near-term change. The majority of the population is Hindu (a varied, polytheistic form of belief), but India is also the world's second largest Muslim country, with more than 180 million adherents. Often the poorest are despised as untrustworthy (Slumdog Millionaire was not entirely fictional) and Muslims are regularly oppressed. So to a lesser extent are the 150 million in other religions and sects. All must tread carefully against a background of rising Hindu nationalism. The left-wing Nehru-Gandhi dynasty and their Congress Party dominated politics for independent India's first half century, based on support from the lower castes and Muslims. This support waned as they failed to deliver, to be replaced by the Hindi-nationalist Bharatiya Janata Party (BJP), many of whose leading figures make Donald Trump look a bleeding-heart liberal. The current prime minister, Narendra Modi, crushed all opponents in the 2014 election through promises (yet again) of a clampdown on corruption and on his record of success as a reformer and moderniser when chief minister of the pro-business state of Gujarat. Many of his policies are sensible. These include reforming the tax system (only 3% of Indians pay income tax), and wiping out the black market and corruption although the execution of the latter goal, such as abolishing high-denomination notes, has been clunky. However, he is also tainted by his rule in Gujarat, when the authorities turned a blind eye to a pogrom in 2002 that killed hundreds of Muslims and other minorities. Modi was eventually cleared of complicity in 2012, but suspicion remains over his active-passivity and subsequent minority abuses, not least because strident Hindu nationalism has become a vote winner. In March this year, the BJP stormed to victory in the former Gandhi/Congress heartland of Uttar Pradesh, India's most populous state with 220 million people. Modi, a charismatic speaker, led the campaign then installed a zealous acolyte, the radical Hindu monk Yogi Adityanath, as chief minister. His speeches are plain sinister.

Economics is a fluffy discipline, but some rules are immutable. No economy has ever made the top tier without reasonably clear property rights enforced by a largely honest judiciary. India has neither. Then there is the issue of women in the workplace. In every advanced economy development has gone hand in hand with a rapid increase in the participation of women in the workforce, to over 60%. India's rate is falling and is now around 22%. Also important is domestic order and security. Kashmir voted by an overwhelming majority in 1947 to join Pakistan, but the Maharajah opted for India. The resulting long civil war makes few headlines nowadays, but unrest there is worse than ever. In addition, most of Assam State (larger than Scotland) and swathes of East India are barely under government control as local tribes rebel against their exploitation.

The country's banks are effectively bust. At least 15% of loans are believed to be unrecoverable, so their equity is worthless. Plans for restructuring are perennially kicked into the long grass. Real loan growth to industry is now contracting, while that in consumer credit is slowing. Even currently high economic expansion is insufficient to absorb a rapidly increasing labour force, hence growth in employment is feeble. Foreign investment from Japan and Korea especially has been robust over the last five years, in anticipation of a cheap manufacturing base and a vast new consumer market. But many other foreign companies have found the problems so insurmountable they have scaled back or closed their operations out of frustration. Foreign asset managers such as JP Morgan and Goldman Sachs have sold their local operations or, like Fidelity, simply quit.

India is possibly the saddest of all emerging market tales. The potential is enormous. But while there will be spurts of growth, India is doomed to disappoint until there is major structural and social reform. These will only happen when a major slump forces the government to act. Until then, leave well alone.

There are better options for investors

Given my views (see above), I would be idiotic to tip Indian equities or funds, says Jonathan Compton. But the misplaced popularity of India is based on a wider idea: that growth in emerging markets will be fuelled increasingly by consumption. Here are four beneficiaries of that trend. Even the smallest of my tips has a market capitalisation in excess of a billion pounds.

The first two I own already. US-listed AGCO (NYSE: AGCO) makes agricultural equipment such as tractors and combines. The majority of its earnings, profits and plants are overseas and it is a market leader in several developing countries. Earnings per share have been falling for four years, in part because of a major expansion programme and also weak agricultural prices, thus it looks expensive. However, farming is cyclical and I think profits are at an inflexion point. Next is Television Broadcasts (Hong Kong: 511), Hong Kong's dominant terrestrial broadcasting company, which is expanding into new digital businesses. Until June last year the share price trend was dire, reflecting flat earnings and management bungles. Now three events make it interesting: a mystery buyer trying to acquire 29% (probably backed by the government in Beijing); significant cost cutting (so earnings should rebound); and an aggressive share buyback programme.

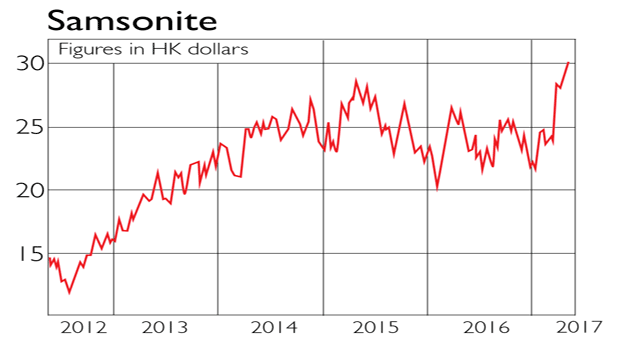

Samsonite (Hong Kong: 1910) is also Hong Kong-listed, but should be in America or the UK given its global business. The century-old firm is a major player in luggage manufacturing. Competition is stiff, but it has moved upmarket, which gives better profit margins and a steadier customer base. Results for 2016 beat analyst estimates easily. At 17 times forecast earnings, it trades on a premium over its competitors, which is deserved. I'm considering it as a long-term investment.

As poorer countries develop, so travel increases rapidly, especially short-haul flights. A leader in the manufacture of the mid-sized aeroplane market (80-140 seats) is Brazil's Embraer (NYSE: ERJ). Its latest model is proving a great success with a strong order book. The huge development costs of the last seven years will fall away, meaning a rapid upturn in profits. Competitors in Europe and North America such as Bombardier have had major development problems with their new airplanes, so Embraer has a relatively open market for now.

Read the second part of this feature here Rupert Foster on whyinvestors should keep faith with India

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Modi’s reforms set Indian stocks on fire

Modi’s reforms set Indian stocks on fireIndian stocks pass a new milestone, but global fund managers are holding back. Are there signs of overheating?

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

Shining a light on India

Shining a light on IndiaAdvertisement Feature Despite some short-term challenges, India remains very attractive for investors. Here’s why.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

India’s economy has come a long way in 75 years, but where next?

India’s economy has come a long way in 75 years, but where next?Briefings India has come a long way since independence to become the world's fifth-largest economy. But early mistakes and now a divisive leader are holding back the economy’s potential.