Why investors should keep faith with India

Is India the last great growth story – or overhyped and doomed to disappoint? In the second part of our feature, Rupert Foster gives the positive side of investing in India.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Is India the last great growth story or overhyped and doomed to disappoint?Jonathan Compton and Rupert Foster set out both sides of the argument.In the second part of our feature, Rupert Foster gives the positive side of investing in India.

Read the first part of this feature here Jonathan Compton on why investors should leave India well alone

Narendra Modi is the sort of politician that we don't get in the West any more. The sort that will take decisions that bring significant short-term pain for significant long-term gain. On 8 November last year, Modi announced the abolition of the two larger-denomination rupee bank notes, in an attempt to shock India into accelerating its movement to a digital economy and to damage those operating in the black economy. India has cash in circulation of about 12% of its GDP (the UK is about 2.6%), so this was an aggressive step. There was pandemonium at banks as people scrabbled for cash or wondered what to do with the stack of R1,000 notes they had buried in the back garden to avoid inconvenient taxes. The consumer economy slowed dramatically for a number of weeks. But Modi stuck firm to his policy, explaining the long-term benefits of the move to the electorate.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The bravery of this policy is only compounded when one knows it took place only shortly before the elections in Uttar Pradesh, which Modi won resoundingly. This victory implies that the BJP will take control of both houses of the Federal Parliament in the next national elections in 2019. Modi looks guaranteed to continue as prime minister after 2019, and can thus now initiate additional long-term reforms, the like of which it is so difficult to initiate in the West.

These reforms start with the implementation of a national goods and services tax (GST the equivalent of VAT) on 1 July. This will undoubtedly have many teething issues, but in the long run it will provide the government with a much-needed financial boost. At some point, India will need to accelerate infrastructure spending, and the revenue from a GST will aid the government's ability to deliver this. Many foreign investors were optimistic that Modi would initiate a new splurge of infrastructure spending following the earlier burst in 2005-2008.

He has disappointed many of these investors with his fiscal prudence. The Indian stockmarket rose by around 35% in the 10 months after Modi's 2014 election victory, but then fell back by almost the same amount over the next 12 months as the infrastructure boom did not materialise. However, investors are now coming to appreciate the long-term approach adopted by Modi and earlier this month the Sensex index went to a new all-time high.

India is the leading market in emerging Asia. Even without an infrastructure boom and avoiding fiscal profligacy, it is set to see GDP growth of 7.3% this year. The country ticks all the required boxes for strong stockmarket performance of a high-growth Asian economy: low wage rates (particularly in relation to China), a pro-business political leadership, improving levels of corruption, and a solvent banking sector.

The last of these points is possibly the most contentious for some investors. The state-controlled banking sector, which still has a more than 50% share of the market, remains mired in bad debts, which are mostly still unreported. Previous governments have allowed state banks to be used for corrupt loan policies for politicians' friends and families. It was hoped that Modi would force openness on the state banks and then set in place policies to clear up the revealed bad debts. This has not happened probably because too many of Modi's own party members would have been revealed as corrupt. Thus Modi's policy on the state banks appears to be one of natural attrition.

This appears rather passive for some investors and may well delay the hoped-for infrastructure boom, but it allows us high conviction investment into the banking sector. Private banks have been stockmarket darlings for many years, but they remain small players in the overall banking industry and will continue to take market share for many years to come. In this process they will be aided by both Modi's demonetisation and anti-corruption policies and by technical development elsewhere. Demonetisation encouraged the adoption of the digital, or cash-less, economy. Modi initiated a national identity card system, Aadhaar, which 700 million Indians now have. This allows for direct payment of subsidies into bank accounts through digital means without any local officials getting their hands on them.

India is racing to adopt the digital economy. This process was given a massive fillip by the entry of Reliance Jio into the mobile phone market. Jio offered cheap, generous data allowances to its customers, sparking a price war in the sector. Historically, in other countries, the offer of cheap unlimited mobile broadband has led to an explosion in the internet industry in particular, casual gaming, streaming TV and social-media usage.

India remains the last country that can really move the global dial for all consumer companies around the world in particular, those in the internet world. The Chinese internet sector still has a great deal of room to expand, but the government has largely excluded foreign firms from this market. Thus India is the focus for all large internet firms with international ambitions. They are likely to follow Reliance Jio's lead in throwing vast amounts of money at the problem of building market size and share in this key growth market.

Investors can benefit from this trend by investing in those companies that will directly or indirectly benefit from the explosive growth in internet usage. Anyone who has watched the crowd at an Indian Premier League cricket match will have an idea of the desire for Indian consumers to show off their new hi-tech equipment.

None of this is to say that Modi does not have his issues, such as his belief in or, at best, decision to pander to the Hindu nationalist cause. But he appears to have all the makings of the long-sighted and brave politician which all countries need to drive development. He now appears to be acquiring the political mandate to effect dramatic change. Investment in India should always be viewed on a long-term basis but luckily foreign investors appear to finally be aligned with the country's political leader.

Five ways to back India's boom

The problem is that you are not the first to spot the long-term opportunity in India. For many investors, the country is the best and last opportunity to get exposure to the largest national development story left on the planet. Thus valuations are high for any company that appears to obviously be a beneficiary of these trends. Most high-quality consumer stocks, such as Marico and Godrej Consumer Products, trade on price/earnings ratios of 40-60 times. If that's a bubble valuation, it's a bubble that has been in operation for nearly a decade now. The return on capital employed of many of these firms is so high (40% or more) that these valuations may be justified although advocates such as Terry Smith of Fundsmith appear to be looking forward an eye-watering 40 years to make the case.

It is now possible for individuals to invest directly in companies listed in India under the qualified foreign investor system introduced in 2011, but it requires registering with the Indian authorities and opening an account with a broker in the country. Most MoneyWeek readers are unlikely to take that step, so we'll look solely at options that are also listed abroad. These include HDFC Bank (NYSE: HDB), the banking subsidiary of Housing Development Finance Corporation, the bluest of blue-chip private mortgage players. Other private banks such as ICICI (NYSE: IBN) also offer value: the credit cycle is nicely positioned and recent worries on credit costs are a cyclical phenomenon. Construction firm Larsen & Toubro (London International: LTOD) will be a key beneficiary of the infrastructure boom when it comes along.

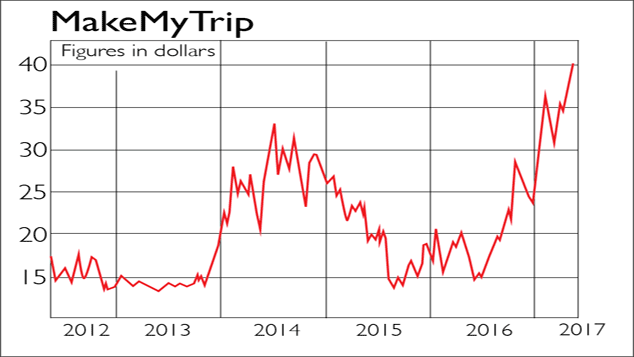

There is one Indian major ecommerce company listed in the US: MakeMyTrip (Nasdaq: MMYT). This is by far the largest player in the Indian online travel agency market. The valuation is now high, but the company's competitive position is unique in the Indian internet sector.

Lastly, if you prefer to invest in a fund, MoneyWeek favours the Aberdeen New India Investment Trust (LSE: ANII). It now trades on a discount to net asset value of 11%.

Read the first part of this feature here Jonathan Compton on why investors should leave India well alone

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is an investment strategist and adviser at J & C Foster, providing Asian, Consumer and Global Equities Strategy advice to a number of family offices and portfolio management organisations. He writes on Asia and Global Macroeconomics for a number of investment publications including MoneyWeek and HL Investment Times.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how