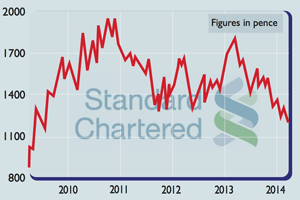

Standard Chartered swings the axe

Standard Chartered has launched a major restructuring programme after reporting its first quarterly loss since the Asian crisis in the late 1990s

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Standard Chartered has launched a major restructuring programme after reporting its first quarterly loss since the Asian crisis in the late 1990s. It will reduce its workforce of 86,000 by 15,000 over the next three years as part of a bid to cut the bank's cost base by 30%. The bank will scrap the final dividend and restructure around a third of its risk-weighted assets in order to bolster returns. The shares have halved in the past two years as the Asia and emerging-market-focused group has lost its way.

What the commentators said

For years, it denied it needed more capital and "rubbished suspicions of large risky loans in its balance sheet". This quarter's loss, however, shows that there are plenty. The bank took $1.2bn of provisions for them. "They ended up lending to people they shouldn't have touched with a barge pole," according to one shareholder.

The idea now is to shift the emphasis from corporate banking to "affluent retail clients". But this will be "much harder to pull off than it sounds", said Alistair Osborne in The Times. Standard Chartered may have a 150-year-old brand, but competition is intense.The bank's big shareholders, including Aberdeen Asset Management, "should look in the mirror", said Nils Pratley in The Guardian. The market has "smelled trouble" for years, yet the shareholders raised barely a murmur. "They were too willing to believe the boasts from the highly remunerated boardroom."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three laggards to buy for long-term growth

Opinion Some of the best long-term capital-growth opportunities lie in companies that have struggled over the past few years, says professional investor Ben Ritchie. Here, he picks three of his favourites.

-

Banks pass stress test

Banks pass stress testFeatures Britain’s seven biggest lenders have passed the second round of annual stress tests – but how resilient are the tests?

-

Shares in focus: Can Standard Chartered find its form again?

Shares in focus: Can Standard Chartered find its form again?Features Banking giant Standard Chartered has fallen out of favour with investors. Is it time to buy in? Phil Oakley investigates.