Three laggards to buy for long-term growth

Some of the best long-term capital-growth opportunities lie in companies that have struggled over the past few years, says professional investor Ben Ritchie. Here, he picks three of his favourites.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, aprofessional investor tells us where he'd put his money now. This week: Ben Ritchie of the Dunedin Income Growth Trust.

Although economic conditions remain uncertain, valuations in parts of the UK market seen by some as relatively stable have moved to extremely full levels. By contrast, in 2015 companies that disappointed investors or were exposed to emerging markets or commodities were punished severely.

Despite persistent "big picture" concerns, we believe that some of the best potential capital-growth opportunities for those who can take a long-term view lie among those companies that have struggled over the past few years. This is particularly so where those businesses have fundamentally strong franchises and good long-term growth potential. Three such investments are detailed below.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Pearson (LSE: PSON) is the world's leading for-profit education business, with high market share and extremely valuable intellectual property and technology. It is currently facing cyclical and government-policy-related headwinds in several key markets, which has seen the share price fall substantially.

We believe these problems will prove transitory as enrolments in American higher-education colleges stabilise. We also believe that a return to growth, combined with the company's recently announced cost-cutting plans and its strong balance sheet, should see a significant recovery in its market value.

Rolls-Royce (LSE: RR) is facing well-publicised challenges in its more cyclical businesses, such as its marine unit, and in the transition to delivery of its new engine programmes.

However, its order bookis worth more than £70bn and has the capacity to deliver a big lift to revenues, profit margins and cash flow over the medium term. This is not guaranteed, of course, but while recent developments have been difficult, we think investors should be patient and give the new chief executive, Warren East, the chance to deliver on the fantastic base that this business has.

In many of its operations, Rolls-Royce is competing in more or less a duopoly, with world-leading technology in a high-growth market. By 2020, we estimate the business could be generating close to a double-digit free-cash-flow yield at its current valuation.

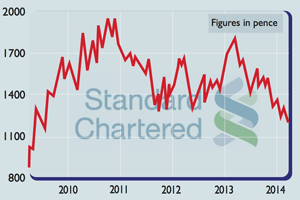

Standard Chartered (LSE: STAN) has a strong retail and commercial banking network in economies that enjoy high long-term structural growth potential, such as Africa, the Middle East and Asia. It has been hit by the recent slowdown in emerging markets, and its overexposure in lending to commodity producers.

Under the new management of Bill Winters, the bank is taking action to raise capital, improve credit quality, cut costs and realign its operations to where it has the most significant competitive advantages.

Times are likely to remain tough over the next 12 to 18 months, but the current valuation is even lower than that experienced by the bank in the depths of the 1997/1998 Asian crisis. The potential rewards for investors who are prepared to stick with it through this challenging period are substantial.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ben Ritchie is a senior investment manager at Aberdeen Asset Management.

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

What are Avios-only flights and who is eligible?

What are Avios-only flights and who is eligible?Avios-only flights have proved incredibly popular since launching in 2023. We explain what they are, how they work and who qualifies

-

Bausch Health: an ex-sinner to buy now

Bausch Health: an ex-sinner to buy nowFeatures Pharmaceutical firm Bausch Health, formerly known as Valeant, is putting a dodgy past behind it.

-

Banks pass stress test

Banks pass stress testFeatures Britain’s seven biggest lenders have passed the second round of annual stress tests – but how resilient are the tests?

-

Standard Chartered swings the axe

News Standard Chartered has launched a major restructuring programme after reporting its first quarterly loss since the Asian crisis in the late 1990s

-

Shares in focus: Can Standard Chartered find its form again?

Shares in focus: Can Standard Chartered find its form again?Features Banking giant Standard Chartered has fallen out of favour with investors. Is it time to buy in? Phil Oakley investigates.