If this corporate giant breaks up, shareholders should prosper

The boss of pharmaceutical giant GSK has hinted the company could be split in two. That would be great news for shareholders, says Ed Bowsher.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's funny how fashion changes in the corporate world.

Back in the 70s, the sexiest companies were conglomerates that operated in lots of different industries. So a conglomerate might have separate divisions selling, say, tobacco, frozen food and hotel rooms.

In the 90s, fashion changed. Focus became trendy. Many conglomerates were broken up into separate companies operating in just one industry. That was a sensible change. If the directors of a company focus on just on one industry, they're more likely to build up specialist knowledge and not get distracted by ephemera.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That said, even though this change in fashion started 25 years ago, there are still some conglomerates with break-up potential. And there's one which I think is well worth buying.

This company could slim down

So which company am I talking about?

GlaxoSmithKline (LSE: GSK), the pharmaceutical giant.

I know, the words, pharmaceutical giant' suggest that Glaxo is a company that operates in one industry medical drugs. But actually, that's not true.

Granted, the main part of Glaxo's business is developing patent-protected pharmaceutical drugs. But Glaxo also has a consumer healthcare business that sells products you can buy in your local convenience store things such as toothpaste and vitamin tablets.

Admittedly, there is some overlap between pharma drugs and consumer healthcare, but not that much, and I think it would be better for shareholders if consumer health was spun off into a separate company. Senior management in both companies would then be fully focused on either pharma drugs or consumer products. And that should lead to improved performance.

What's more, a break-up gives more choice to investors. Currently, if you buy shares in Glaxo, you're investing in the main pharma drugs division as well as the consumer health division. The consumer division generates around 20% of sales and roughly 10% of the profits. So on a back of the envelope' basis, perhaps 15% of your investment is going into consumer health with the rest in pharma drugs.

But you might think that consumer health is a rubbish business, and you really want to invest all your cash into pharma drugs, or vice versa. But you don't have that option. You're stuck with Glaxo as it is. It's a simple binary decision you invest in Glaxo as it is now, or not at all.

But if Glaxo was split up into two companies with separate stock market listings, you could invest 60% of your money in Glaxo Consumer' and 40% in Glaxo Pharma'. Or whatever proportions you fancied. The choice would be yours.

I think that extra choice could bring in more investors.

We could also see some multiple expansion'. Basically, large consumer product companies tend to trade on higher price/earnings (P/E) ratiosthan pharmaceutical companies. For example, Glaxo currently trades on a price/earnings ratio of 12, whereas Unilever's ratio is 19. So Glaxo Consumer' might well trade on a higher multiple than 12, and that would deliver a financial boost to existing shareholders.

If you're wondering why consumer companies tend to have higher price/earnings ratios, I think it's mainly because they're less risky. The likes of Unilever (LSE: ULVR) and Reckitt Benckiser (LSE: RB) don't have to worry too much about their products losing patent protection'. But patent expiries are a huge issue for large pharma companies.

Why now?

I'm writing about this now because Glaxo's boss, Sir Andrew Witty, hinted in an FT interview yesterday that he might be willing to spin off the consumer health division. What's more, I think a corporate deal with Novartis earlier this year makes a spin-off even more attractive and more likely too.

You see, Glaxo and Novartis are about to merge their consumer divisions into a joint venture where Glaxo will have a 63.5% stake. As a larger business, it should be all the more attractive as an independent entity.

It's also worth noting that Reckitt Benckiser announced yesterday that it was selling off its pharma division so that it can focus purely on its 19 consumer power brands'. So I think Glaxo should follow Reckitt's lead.

So should you buy shares?

Well, I own shares in Glaxo, so you'd expect me to be positive. But at the current price of £14.12, with a price/earnings ratio of 13, I think the company is in bargain territory. Admittedly, bears are concerned that the company's new respiratory drugs have got off to a disappointing start in the US, but I think that's probably a short-term problem and the shares have fallen too far.

In fact, I think the shares are a bargain even if Glaxo never does spin off the consumer division. But if the spin-off does happen it will be a nice catalyst for some share price growth. Go on, Sir Andrew. Spin off consumer health!

Our recommended articles for today

Latin America's new best friends

Russia, China and Japan are starting to take Latin America seriously, and investment is pouring into the region. That's great for investors, says James McKeigue.

Should you invest in Tesco?

In his latest video, Ed Bowsher asks if the appointment of Dave Lewis as CEO of Tesco means you should go out and buy its shares.

On this day in history

29 July 1948: opening ceremony of the 1948 London Olympics

Dubbed the 'Austerity Games', the XIV Olympiad opened in London to 85,000 spectators in Wembley Stadium on this day in 1948.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

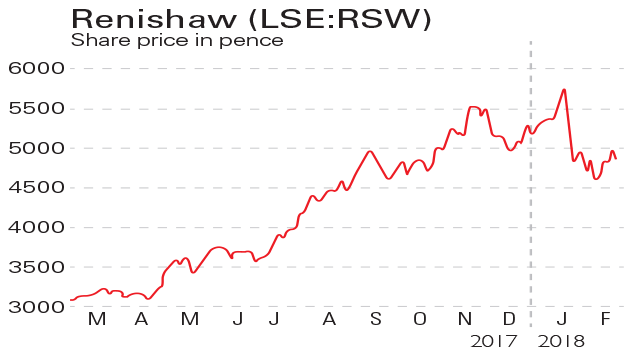

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.