Shares in focus: Should you take a punt on William Hill?

Bookies William Hill is a decent business. But is it worth a flutter? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The betting firm is a decent business that's worth a flutter, says Phil Oakley.

Investing in such things as tobacco, alcohol or gambling is not to everyone's taste. That's understandable, but these types of businesses have been very generous to investors over the years.

The companies that become the industry leaders in these areas tend to be very successful at marketing their products, and when it comes to gambling, bookmaker William Hill has proved that it has got what it takes to do well.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Up until quite recently, you might have thought that being a bookmaker was a licence to print money. But things are now changing and dark clouds are forming over the UK betting industry.

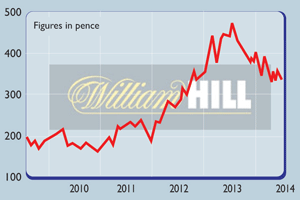

Over the last year or so, more investors have been betting against William Hill, and its share price is down by nearly a third. So is the business on borrowed time, or is now the time to take the plunge and buy in?

The outlook seems bad

However, while people still place lots of bets on sports such as football and horse racing, betting shops have become increasingly reliant on fixed-odds betting machines, which allow punters to gamble on a number of games, such as roulette.

On average, William Hill has nearly four of these machines in each of its shops, and they account for a very big chunk of its profits.

The trouble is that the government is worried that some people like these machines a little bit too much and are running up big debts because of them. Opponents call these terminals the "crack cocaine of gambling", and so the government has revealed plans to crack down on their use.

New limits will restrict the amounts users can gamble on the terminals, and also the time they spend on them too. On top of that, the tax levied on these machines has been increased from 20% to 25%.

This all adds up to lower profits for the likes of William Hill so much so that it's closing 109 shops, which are no longer viable under the new rules.

If that wasn't bad enough, betting taxes are going to be levied on the basis of where the bet was placed, rather than where the betting company is based.

As a result, profits will fall at companies that have set up businesses in places such as Gibraltar to avoid UK tax on certain types of bets. And then there's the fact that William Hill's customers have done a bit better with their football bets this year than they usually do.

but is it really that bad?

First and foremost there are still enough people willing to place lots of bets on sports on a regular basis. And lots of them are prepared to do it with William Hill. Despite plenty of competition, online sales have been growing rapidly as the company has been very good at building websites and apps that customers like, and that allow them to bet on the move.

The company is also branching out online, with an emphasis on casino games and bingo. What's more, it's not just a UK bookmaker. It has decent businesses in Australia, Spain, Italy and America, and these overseas operations should give it a good chance to grow its profits.

Then there's what's going on with betting itself. Going forward, punters are unlikely to be as lucky on the football as they were in 2014. So profits from this area should get back to their normal patterns soon.

Also, William Hill is getting more customers to place accumulator bets ones that require more than one event to happen for the gambler to win. Accumulators are more profitable and should help in the years ahead.

But in spite of these positive factors, many investors, including hedge funds, have placed negative bets on the stock. In other words, they've shorted' the stock by borrowing shares and then selling them with a view to buying them back later at a lower price .

However, the share price may not fall any further due to the company's resilience and the fact that the shares have actually become quite cheap. If hedge funds are forced to buy back the shares they have borrowed, then the price could rise quite sharply. William Hill remains a decent business for those prepared to invest in gambling firms.

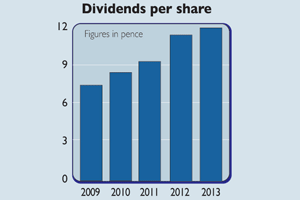

It has a decent return on capital (ROCE) of over 17% and generates plenty of surplus cash flow to pay dividends. Currently you can buy this business for under 12 times forecast earnings with a well-covered dividend yield of 3.6%. The shares look well worth a flutter.

Verdict: buy

William Hill (LSE: WMH)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

William Hill goes all in on PokerStars

Features William Hill is in talks with Canada’s Amaya, owner of PokerStars – the world’s largest online poker business – about a £5bn merger. But is it a good idea?

-

Company in the news: William Hill

Features These are tough times for bookmakers, but William Hill is doing all the right things. Phil Oakley explains what that means for the shares.