Company in the news: William Hill

These are tough times for bookmakers, but William Hill is doing all the right things. Phil Oakley explains what that means for the shares.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Being a bookmaker is quite tough these days. Not only is there lots of competition, but the government is looking to clamp down on the industry. To survive and thrive in this environment you have to be good at keeping your customers happy. William Hill (LSE: WMH)looks like it is doing lots of things right.

This week's trading update revealed that the business isdoing very nicely. Sports betting boosted by the WorldCup has been very kind to William Hill.

The profits of the online business have more than doubled compared tolast year, while high-street profits rose by nearly a third. Overseas ventures in Australia and Italy are also doing well. The company now expects profits for 2014 to be at the top endof City analysts' expectations.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

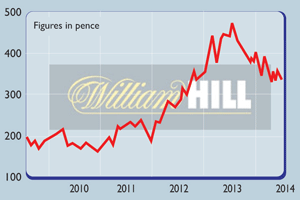

One of the things I like about William Hill is its ability togenerate lots of cash. As a result, net debt fell by nearly aquarter last year and we may see a nice dividend increase.I tipped the shares as a buy' back in July at 335p.

At 363p theyhave performed quite well in a difficult stockmarket. They arenot that expensive on 12 times forecast earnings, but I probablywouldn't chase them now.

Verdict: a solid hold

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

William Hill goes all in on PokerStars

Features William Hill is in talks with Canada’s Amaya, owner of PokerStars – the world’s largest online poker business – about a £5bn merger. But is it a good idea?

-

Shares in focus: Should you take a punt on William Hill?

Shares in focus: Should you take a punt on William Hill?Features Bookies William Hill is a decent business. But is it worth a flutter? Phil Oakley investigates.