Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

William Hill, Britain's biggest bookmaker, is in talks with Canada's Amaya, owner of PokerStars the world's largest online poker business about a £5bn "merger of equals". The new company would be headquartered in London, with Amaya's CEO, Rafi Ashkenazi, taking the top job.

The deal adds to "the feeding frenzy among bookies", say Peter Evans and Daniel Dunkley in The Times, driven by "rising taxes and a crackdown on fixed-odds betting terminals". Mergers include Paddy Power and Betfair, Ladbrokes and Gala Coral, and GVC and Bwin.party.

"The new company would have 60% of its revenues from online betting, and 40% in land-based' business," says Murad Ahmed in the FT, making it "well diversified across different betting areas", and bringing cost savings of more than £100m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, the deal is risky, says Nils Pratley in The Guardian. PokerStars faces a lawsuit in the US state of Kentucky that comes with a potentially huge fine. And the combined firm would be too exposed to markets where gambling is either "banned or the rules are so unclear that your local operation can be legislated out of existence".

Overall,"both these companies have bad hands, says James Moore in The Independent. "The best bet for their shareholders? Fold."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

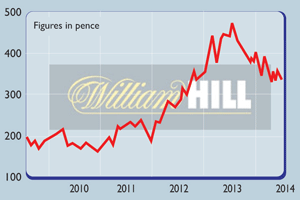

Company in the news: William Hill

Features These are tough times for bookmakers, but William Hill is doing all the right things. Phil Oakley explains what that means for the shares.

-

Shares in focus: Should you take a punt on William Hill?

Shares in focus: Should you take a punt on William Hill?Features Bookies William Hill is a decent business. But is it worth a flutter? Phil Oakley investigates.