Industrial Metals

The latest news, updates and opinions on Industrial Metals from the expert team here at MoneyWeek

-

How to invest in gold

There are a number of ways you can invest in gold, from buying the yellow metal directly to investing in a gold ETF or buying gold-mining stocks. We look at the pros and cons of each strategy.

By Dan McEvoy Last updated

-

Should you invest in copper?

A critical metal in electronics and the energy transition, copper is often viewed as a bellwether for the global economy. How can investors gain exposure to changing copper prices?

By Daniel Hilton Last updated

-

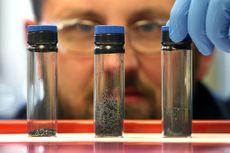

The graphene revolution is progressing slowly but surely

Enthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

By Dr Matthew Partridge Published

-

US stocks: opt for resilience, growth and value

Opinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

By Julian Wheeler Published

Opinion -

Metals and AI power emerging markets

This year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

By Alex Rankine Published

-

King Copper’s reign will continue – here's why

For all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too

By Alex Rankine Published

-

The looming copper crunch

Miners are not investing in new copper supply despite rising demand from electrification of the economy, says Cris Sholto Heaton

By Cris Sholto Heaton Published

-

'It’s time to close the British steel industry'

Opinion The price tag on British steel is just too high. It's time for Labour to make a grown-up decision and close down the industry, says Matthew Lynn

By Matthew Lynn Published

Opinion -

Why is the copper price rising?

Fears of an upcoming 50% copper tariff have caused a spike in copper prices in the US, though the red metal’s price is falling elsewhere

By Dan McEvoy Published