Company in the news: Next

Next is on a roll, but the high-street fashion retailer no longer wants to buy its own shares. Phil Oakley reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Sales from its retail stores grew by 7.7%, while its online Next Directory continues to be the star performer, with sales up by 21%.

Earnings per share for the year will have increased by nearly one quarter. Profits for next year are expected to increase at a more modest rate between 3% and 7%.

Next is a rare example of a share buyback working well for shareholders. This is because it has had strict limits on the maximum price that it will pay for its own stock. By not paying too much it has turbocharged returns to investors.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now it thinks that its shares are too expensive for a buyback to give a reasonable return, which is probably a good enough reason for private investors to hold back too. Instead, it will pay a special dividend of 50p per share. At £61.30, the shares look pricey on nearly 18 times forward earnings, so don't expect the buybacks to resume any time soon.

But Next still expects to have £300m of surplus cash (equivalent to 193p per share) in 2014/2015, so expect more special dividends during the year. With an expected dividend of 167p for next year, this would give a total income payout of 360p per share or an income return of 5.9%. This prospect makes the shares a solid hold.

Verdict: hold

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Stock market circuit breaker: Why did Korean shares stop trading?

Stock market circuit breaker: Why did Korean shares stop trading?The fallout from the conflict in the Middle East hit the Korean stock market on 4 March, with shares forced to temporarily stop trading. What is a stock market circuit breaker, and why did the KOSPI trigger one?

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

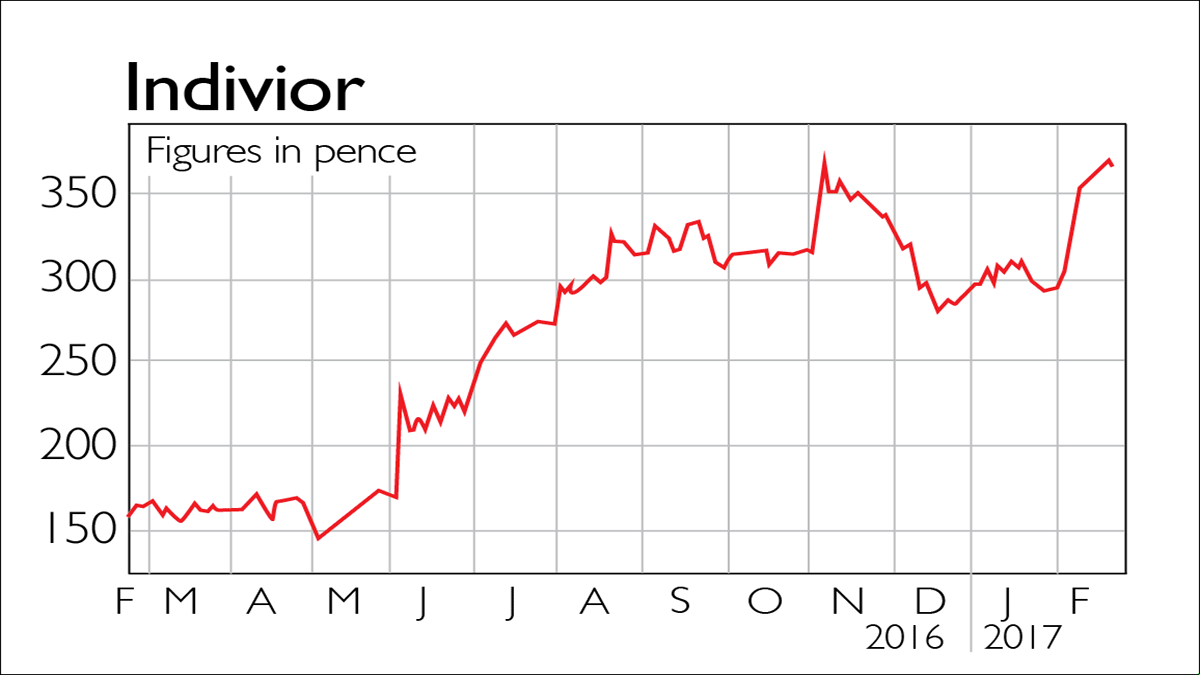

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.

-

Next faces its toughest year since 2008

Features The clothing retailer has long been a favourite of long-term investors, but now Next is facing tough times.