Why now looks a good time to buy this blue-chip drug giant

GlaxoSmithKline has had a rotten time recently. But it’s still got plenty going for it. And now could prove a very good time to buy, says Ed Bowsher.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

GlaxoSmithKline (LSE: GSK) has had a rotten time recently.

A big bribery scandal in China has triggered an 11% fall in the share price since May.

Then this week, the drugs giant admitted that a clinical trial for a potential blockbuster drug had gone badly.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But shareholders shouldn't be too gloomy. Even after this week's disappointing news, Glaxo still has a decent number of promising new drugs coming through in its pipeline. And profits and dividends are on the up.

In fact, now could prove a very good time to buy.

Glaxo's latest drug disappoints but there's plenty more where that came from

Now, despite this week's poor trial results, it's still possible that regulators might approve the drug in the end. But the chances of approval have fallen. And even if the drug does pass muster, sales will probably be lower than some analysts had previously thought.

So I can understand why the market has been spooked by the bad news. Particularly as, for the last decade or so, the discussion around big pharma' stocks like Glaxo has been all about the patent cliff'.

This cliff' refers to the fear that the big drugs companies are not developing enough new medicines to replace products that are about to lose their patent protection.

However, while this is a legitimate concern for some companies, it's not a serious issue for Glaxo not even after this week's disappointing news. Glaxo is developing new drugs at a decent pace. Four new products have been approved this year, including treatments for cancer and HIV.

What's more, Glaxo is about to launch a potential new blockbuster drug called Breo, which treats various respiratory conditions. This will replace one of its current bestselling drugs as it loses all of its patent protection.

Glaxo's China scandal

Glaxo executives have apparently been bribing Chinese doctors to boost sales

Sales in China have crashed as a result, with revenues falling 61% in the third quarter. This is clearly bad news. And it's hard to know whether this problem will be a temporary blip or a more prolonged struggle.

However, even if Glaxo never makes a strong recovery in China, it won't be a disaster for the company. Glaxo can still make good money elsewhere and achieve decent growth in other emerging markets. Even with this big crash in Chinese sales, for example, Glaxo was still able to deliver a 1% rise in overall sales for the quarter worldwide.

The other important point here is that all of this bad news is in the price'. Glaxo paid out a total dividend of 74p last year, putting the company on a dividend yield of 4.6%. That yield is well ahead of the market average and is pretty impressive given that Glaxo has consistently increased its dividend every year for the last 12 years recently by around 5% a year.

What's more, it has already spent more than £1bn on share buybacks in 2013 and trades on a price/earnings ratio of around 14 for this year.

Granted, when you look at a pharmaceutical stock, profits and dividends don't tell the full story. You need to be sure that the company has decent assets that can continue to generate profits in the future.

But Glaxo has those. It has a good portfolio of existing patent-protected drugs. It also has a strong development pipeline of new drugs coming through. And it also has the ability and pedigree to add new drugs to that pipeline in the future.

That's why I think Glaxo will continue to grow profits and dividends in future. To me, this is the sort of stock you want at the heart of a long-term portfolio it's delivering both income and some capital gains. I've owned shares since 2010 and I expect to hold them for many years to come. If you'd like to join me as a long-term shareholder, I think now's a good opportunity to make your move.

Our recommended articles for today

Britain will never be the same again

Why is GBP/USD not moving higher with the UK economy?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

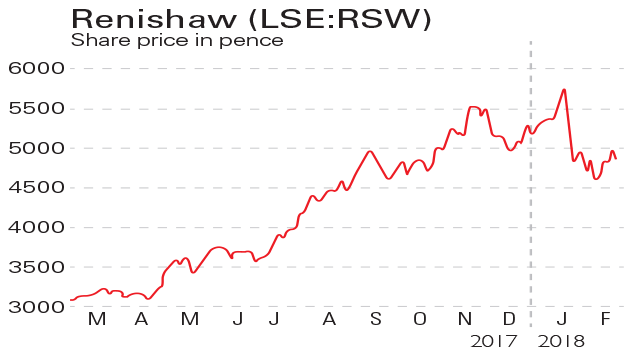

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.