GSK: on the mend?

Glaxo’s chief executive has stepped down after nine years at the top. Has he left the pharma giant in good health? Alex Rankine reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Glaxo's chief executive has stepped down after nine years at the top. Has he left the pharma giant in good health? Alex Rankine reports.

Andrew Witty ended his near decade-long tenure at the helm of GlaxoSmithKline (GSK) on a high after full-year results from the UK's biggest drugmaker beat market expectations, says Sarah Neville in the Financial Times. Core operating profit hit £7.7bn, a 36% year-on-year rise thanks to the weak pound, or 14% when currency effects are stripped out. However, restructuring and transaction-related costs meant that total operating profit was a rather more underwhelming £2.6bn. And not everybody was impressed.

"What's good for a headache?" asks Matthew Vincent, also in the FT "Drinking heavily the night before. To this old joke, GSK, maker of Panadol pills, has inspired a new punchline: deciphering the adjustments in its annual accounts." The gap between the group's core and total profits has "dilated like blood vessels around a soused brain". What is certain is that with dividends, research and development and pensions costs all on the rise, GSK "may not have as much headroom as its headline numbers suggest".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Witty certainly leaves his successor Emma Walmsley with lots to do, says Neil Unmack on BreakingViews.com. Key respiratory products such as blockbuster Advair are coming under pressure from generic alternatives, while the consumer division "needs to trim costs". "Yet Witty can point to solid numbers and strategic decisions," not least the asset swap with Novartis that bulked up its consumer division at a time when governments and insurers are pressing for lower drug prices. GSK deserves more credit than it's getting, but setbacks could still lead to fresh calls from investors "for a unit to be spun off. That means Walmsley can't relax."

Let's hope the incoming chief executive "takes a dim view of the break-up idea", says Nils Pratley in The Guardian. Witty fought against the claim that "GSK would be better broken up into its constituent parts pharmaceuticals, consumer healthcare and vaccines": fund manager Neil Woodford once described GSK as being "four FTSE 100 companies bolted together". Developing new drugs is risky, and could become more so if Donald Trump succeeds in cutting prices. "It seems reasonable to balance those risks with annuity-like toothpastes and hard-to-manufacture vaccines". The latest figures show that the current setup is getting results. "GSK isn't ill."

Witty leaves behind a "balanced group", agrees Alistair Osborne in The Times. The Novartis deal got him labelled as a "toothpaste salesman", but the figures show a group with a "reassuring mix of growth and resilience". True, GSK shares have lagged behind AstraZeneca under Witty, but they have still beaten the FTSE. "Investors don't have a lot to complain about."

A turn in the shipping market?

Danish shipping giant Maersk has announced a net loss of $1.9bn for 2016, says Richard Milne in the Financial Times. The loss was only its second in seven decades, and initially led its shares to fall by 7%. Yet its Hong-Kong listed peers rallied the following day "as the market focused on Maersk's comments that 2017 will be a better year", says the FT's Lex column. The shipping sector is still suffering from excess capacity, but the problem looks to be easing as Korea's Hanjin Shipping enters liquidation and a three-way merger between Japanese peers makes headway. "This is not a trade on which to get carried away, but bulls are right to ignore the blip in the shares of the Danish group."

Maersk is likely to face "fewer headwinds in future", agrees Olaf Storbeck on BreakingViews. Shipping industry consolidation will help, while the group is set to split its "capital-intensive and fickle oil businesses from container shipping". The oil business has been a drag in recent years, but with the crude price rising Maersk should at least get a decent price for its oil assets.

So what could go wrong with the shipping recovery? The big threat is a collapse in trade between China and the US, says David Fickling on Bloomberg Gadfly. There's no sign of a slump yet US container port volumes actually grew at a healthy 8.7% on the year in December "but that trade war could still happen" under Trump.

City talk

The government reacted to the 2007 banking crisis by increasing regulation, yet "putting better brakes on a car does not stop accidents", says Anthony Hilton in the Evening Standard. We must return to a model of banking where banks stop trying to make money through "frenzied trading and gambling" and focus on providing "basic deposit and loan services in local communities".

Take Swedish firm Handelsbanken, which offers this kind of banking. It's just reported strong growth in its UK business. "Our banks should look at Handelsbanken and feel ashamed because it does everything they say no longer works, and makes a pile of money out of it."

Communities secretary Sajid Javid "sounded like the scourge of the big housebuilders as he complained that current rates of housebuilding were not good enough'", says Nils Pratley in The Guardian. Yet his white paper is unlikely to scare them. Developers will be forced to build on land within two years of gaining planning permission, but most say that they already do. Fat margins at big developers have failed to encourage new entrants, and promises of government assistance for small housebuilders are unlikely to change anything. "The stick Javid has chosen to beat the big boys with looks more like a twig."

Theresa May's panacea for executive pay is to calculate "a number to show just how well paid the boss is compared with the staff", says Robert Lea in The Times. That's an irrelevance. "People know the guv'nor is on a decent screw." What they care about is why executives also get generous pensions, bonuses and even paid perks such as their own large car, flat and gym membership while the average worker struggles. We need "fundamental corporate reform" of the "complacent inequity" found in many big firms.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

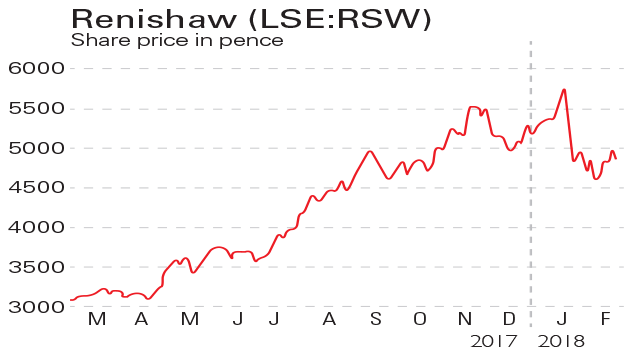

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.