Company in the news: Hargreaves Lansdown

Investment firm Hargreaves Lansdown has delivered another great set of results. But are the shares good value, asks Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

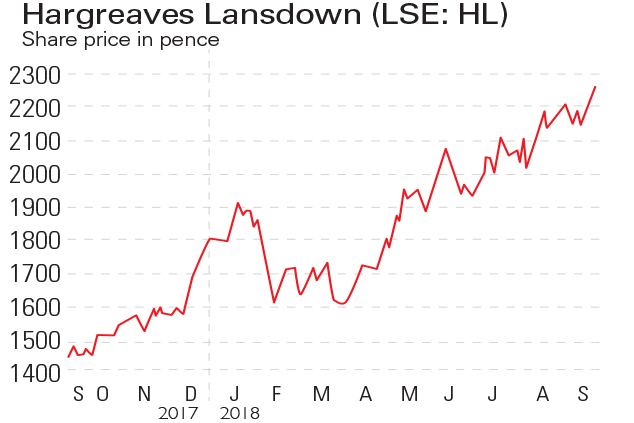

From humble beginnings in a Bristol bedroom in 1981, to FTSE 100 stalwart, investment platform provider Hargreaves Lansdown is undoubtedly one of the corporate success stories of recent times. Last week it delivered another great set of results, with profits and dividends both up by 31%. Rising stock markets have resulted in more trading by its customers, and have also boosted the amount of money it has under management.

The Retail Distribution Review has also been good to the company so far. These regulatory changes have driven lots of new business to the firm, as many financial advisers have left the industry now that commission on new fund products has been banned, and advisers have to be better qualified. This has seen many investors take charge of their own money, whether by choice or necessity, which has boosted Hargreaves' user numbers. But is this as good as it gets?

The company has built a fantastic business backed by marketing and branding that is tough to compete with. Its profit margins of 63% are evidence of that. However, its Vantage investment platform still gets 56% of its income from trail commissions paid by fund managers on funds bought before the end of 2012. These costs (less rebates) are borne by its customers' investment accounts, which looks an expensive arrangement for what they get in return.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The move to clean funds' that don't pay commission means investors can save a lot of money. Hargreaves will have to replace this commission income by charging a platform fee. The Vantage platform is still earning 0.68% on customer assets, whereas some brokers now charge just 0.25% to hold clean funds. Hargreaves hopes the introduction of 'super clean' funds with very low charges will keep customers happy. How it keeps shareholders happy at the same time remains to be seen. As good a business as it is, on nearly 28 times earnings, the upside looks limited.

Verdict: too expensive

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Hargreaves Lansdown takeover: what it means for your money

Hargreaves Lansdown takeover: what it means for your moneyBritain’s biggest investment platform has agreed a £5.4 billion takeover. What does it mean for shareholders and customers?

-

Neil Woodford, fund managers, and the systemic risk to the financial system

Neil Woodford, fund managers, and the systemic risk to the financial systemFeatures The consequences from the Neil Woodford debacle aren't limited to his fund's investors. He and his ilk could pose a systemic risk to the financial system, says Merryn Somerset Webb.

-

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?

After the Woodford fallout, is it time to buy Hargreaves Lansdown and Patient Capital?Features Two of the biggest casualties from Neil Woodford’s fall from grace are his investment trust - Woodford Patient Capital - and broker Hargreaves Lansdown. John Stepek looks at whether you should snap them up or leave them well alone.

-

What Neil Woodford’s woes mean for your money

What Neil Woodford’s woes mean for your moneyFeatures With the suspension of dealing in Neil Woodford's Equity Income fund, John Stepek looks at where it all went wrong for the “star” fund manager, and what it means for you.

-

If you'd invested in: Hargreaves Lansdown and Alfa Financial Software

If you'd invested in: Hargreaves Lansdown and Alfa Financial SoftwareFeatures Hargreaves Lansdown, the UK’s biggest investment platform, has seen profits rise, while Alfa Financial Software has suffered two profit warnings and share-price slump.

-

Investment platforms are great, but they need to up their game

Investment platforms are great, but they need to up their gameFeatures Investment platforms have opened up investing for many people. But their pricing structures are obscure and switching between them is expensive and slow.

-

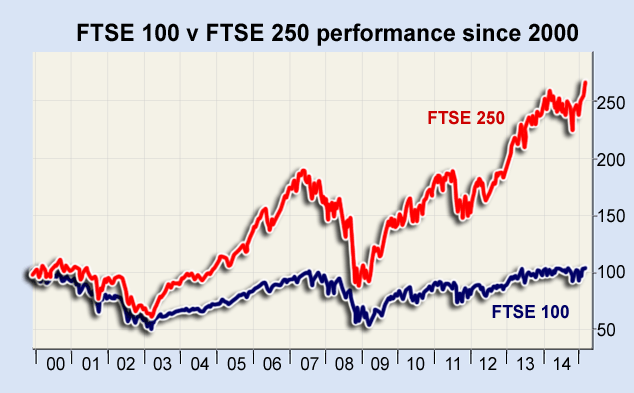

FTSE 100 v FTSE 250: why have they diverged by so much?

FTSE 100 v FTSE 250: why have they diverged by so much?Features Kam Patel examines the reasons behind the heavy parting of ways between the FTSE 100 and the FTSE 250, and asks where they might be heading next.

-

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrong

‘Don’t buy our sector’ says Aberdeen boss – but he’s wrongFeatures The chief executive of Aberdeen Asset Management believes fund managers’ share prices are too high. But there are some good stocks in the sector, says Ed Bowsher.