Shares in focus: Should you buy Unilever shares?

Unilever is a solid consumer goods company. But are the shares cheap enough to buy right now? Phil Oakley reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This consumer goods company is a solid firm but wait till the price is right, says Phil Oakley.

It's not hard to see why consumer goods companies are so popular with investors. Customers trust branded goods. Once they find a brand that they like, they will stay loyal to it for years to come. This means that demand for top branded products tends to hold up well regardless of how much the economy is suffering. In fact, companies are often able to keep on charging just a little bit more for them every year, especially when raw-material costs are going up.

So leading consumer-goods companies such as Unilever, along with similar ones such as Reckitt Benckiser, Colgate and Procter & Gamble, are in demand. In an uncertain world, they can mostly be relied upon to keep growing their sales, profits and dividends, certainly more so than the majority of companies. Given the alternative of having money stuck in a low-interest savings account, millions of investors have decided to put their money into these dependable, dividend-paying, blue-chip shares instead.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Unilever, whose brands include Persil, Dove, Domestos and Wall's ice cream, wasn't always dependable though. For much of the last decade it was constantly criticised in the City for not doing as well as its competitors. It was good at cutting costs, but lacked the focus and cutting edge of a business such as Procter & Gamble, and was losing out to rivals.

And make no mistake, this is a cut-throat business. You just have to walk down a supermarket aisle to see how the big consumer brands are constantly offering enticing deals so that their product ends up in your trolley.

Thankfully for Unilever investors, in 2009 the company poached Paul Polman from Nestl to sort it out. He got rid of the obsession with hitting the City's quarterly profit forecasts and set about changing the culture of the company. The focus was to be on the long term, prioritising product innovation, selling more to emerging markets, and generating cash.

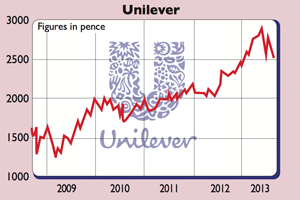

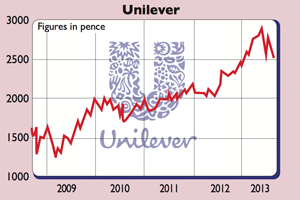

Polman has done a good job. The share price and dividends paid to shareholders have grown nicely under his leadership on the back of selling a lot more products to emerging markets such as China, India and Latin America. But, as good a company as Unilever is, is it a buy at today's prices?

Can Unilever keep growing?

But so far this doesn't seem to be happening. Despite all the chatter about China's credit boom and potential bust, and Brazil's lacklustre economy, things are still looking good for Unilever. Yes, its sales growth has slowed down a tiny bit, but sales growth during the first half of 2013 in the Far East and Africa was still 9.2%, while Latin American markets posted their eighth successive quarter of double-digit sales growth.

All in all, Unilever's home care and personal care products are doing well. And what's encouraging is that Unilever is selling more of its products to these customers, rather than just jacking up prices although it is increasing these as well. It is also growing its profit margins too, proving that it isn't winning customers at the expense of profits.

It's true that Unilever is very vulnerable to a slowdown in emerging-market sales. Trying to make money from European and North American consumers has become a lot harder in recent years, with cash-strapped customers constantly looking for bargains. If companies don't offer discounts from time to time, shoppers are likely to switch over to supermarket own-label products in order to save money. But while nobody really knows what the growth rate of profits will be over the next ten years, there's a good chance that more people will be buying Unilever products at a higher price than today.

Should you buy the shares?

Return on capital employed (ROCE)

In May, at 2,900p, the shares traded on over 21 times 2013 projected earnings, which was arguably a bit toppy. Today they trade on 18 times. That makes the shares more expensive than Reckitt Benckiser, cheaper than Colgate-Palmolive and about the same as Procter & Gamble. But it's hard to argue that any of these shares are cheap right now, with earnings only expected to grow by 5%-6% in 2013. Unilever offers a decent dividend yield of 3.6%, which should grow, but I think that investors are paying just a little too much for its quality at the moment. It's one for your watch list.

Verdict: add to your watchlist

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Inflation is hurting Unilever, but investors shouldn’t give up just yet

Inflation is hurting Unilever, but investors shouldn’t give up just yetAnalysis Consumer goods group Unilever has been underperforming as inflation bites. It's made errors in the past, says Rupert Hargreaves, but with valuable brands and a global reach, it still has plenty going for it.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Unilever puts the U in U-turn

Unilever puts the U in U-turnFeatures The Anglo-Dutch consumer-products giant irritated shareholders with plans to redomicile in Rotterdam. Now it has beaten a retreat. Marina Gerner reports.

-

Unilever and the erosion of shareholder democracy

Unilever and the erosion of shareholder democracyFeatures The way Unilever went about planning the vote on moving its head office out of the UK wasn’t normal and it wasn’t right, says Merry Somerset Webb.

-

Unilever leaves Britain

Unilever leaves BritainFeatures Consumer-goods giant Unilever has chosen Rotterdam over London for its unified headquarters. Takeover threats and taxes played a part. Alice Gråhns reports.

-

Nick Train: the value in Unilever

Nick Train: the value in UnileverFeatures Quality growth companies are still cheap relative to history, thinks fund manager Nick Train.

-

Unilever should snub the “crazy cost-cutters”

Features Unilever could soon dispose of some of its best-known brands in a bid to appease shareholders. But should it listen to them?