Why I’ve just shorted the market

Autumn is usually a tough season for investors. But with Spain on the verge of meltdown, this October promises to be especially bad, says Bengt Saelensminde. Here's how to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

October can be a bit of wrench to get through. It's not just the autumnal feel, it's also a tricky time for markets. And this year I've certainly got the jitters.

So to make myself feel a little bit better, I've just put a small short on the market.

It's not something I do lightly, and I expect to be out of it by the end of the month. But I thought I'd write to you today to tell you about it. Maybe it'll keep us both in good spirits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Spain wants to play chicken

In a world full of ticking financial time bombs, it's Europe that really has me worrying.

This morning, sees the launch of Europe's new Europeanstability mechanism (ESM) effectively a new bail-out fund. Everyone in Europe wants Spain to rock up and take a bail-out. But Spain doesn't want to get involved...

Spain's politicians and its people see what's happening in Greece. They see that accepting a bail-out is tantamount to giving up sovereignty. The so-called Troika of ECB, European Commission and IMF act like the receivers in the case of a failing business. You take a loan. They tell you where they want cut-backs (austerity) and how they want to increase revenues (taxes). Then the public go bananas, the economy goes down the drain and the Troika increases the dose.

So Spain doesn't want to invite the witch doctor into its home. And European officials are spitting feathers. They thought they had this one in the bag. I mean, the only reason Spain has been given a little breathing space is because Mario Draghi (head of the ECB) promised to buy Spanish bonds in the market. Yields on Spanish debt have fallen out of the danger zone on the mere mention of help from Doctor Draghi. But yields are creeping up again. And that makes this situation dangerous.

You see, Draghi will only help if Spain first goes cap in hand to the Troika. He wants the Spanish to take their medicine. He wants them to invite in the IMF to police Spain's finances and make sure these bonds are repaid...

Get ready for some October nasties

I think it's a matter of time before Spain caves in.

Last week, I said that the banking industry has the most powerful political lobby in the world. And that takes the form of the central banks. Draghi is head of Europe's central bank. Ultimately his aim is to keep the banks in good shape, or at the very least solvent. And seeing as the banks are full of souring European sovereign debt, he has to find a way of keeping this paper from heading down the tubes. The way to do that it seems, is to foist more debt on the peripheries (so they can make good on their bonds) and take control of the nation's treasury.

Unfortunately for Spain's politicians, it's not for them to decide that they don't need a bail-out. It's not for the nation's citizens either. The banks have already put in motion what's going to happen.

I'm sure the bail-out will come. And I'm sure it won't be long either. But I'm worried that before Spain ultimately cedes control of her destiny, we'll have to see some market nasties. October is a good month for that.

How to spot a good trade here

Here's why now seems as good a time as any to put on a short...

Six-month FTSE 100 chart with Bollinger bands

Source: Digital Look

Regular readers will know that I always like to throw the Bollinger band overlay onto a chart. It's the shaded blue area it's a simple technical tool that shows the upper and lower levels of where the stock or index should trade at any given time.

I like to buy when the blue line (the FTSE 100 in this case) is near the bottom of its band. And if I'm selling a position, I'll tend to do so near the top of the band.

And on the rare occasion that I short something (effectively selling), it's going to have to be near the top of the Bollinger band for me.

While the FTSE isn't hugging the top of its band, it's not far off.

And it is October after all.

I used a spread bet. If you plan to do the same, please bear in mind the dangers. A £1-a-point down-bet when the index is 5,850 will effectively give you £5,850 of financial exposure.

Now, though the provider may only ask for a much smaller deposit (£300 maybe), it's easy to see that you can lose more money than you put down.

Always multiply the index value by the number of pounds per point to see exactly what you're getting yourself into.

I'll update you on this trade in the coming weeks. But if you are interested in learning to trade, you should also sign up to MoneyWeek Trader. It's a completely free trading email written by John Burford a former rocket scientist for NASA and a superb mentor for anyone new to trading.

This article is taken from the free investment email The Right side. Sign up to The Right Side here.

Important Information

Your capital is at risk when you invest in shares - you can lose some or all of your money, so never risk more than you can afford to lose. Always seek personal advice if you are unsure about the suitability of any investment. Past performance and forecasts are not reliable indicators of future results. Commissions, fees and other charges can reduce returns from investments. Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future. Please note that there will be no follow up to recommendations in The Right Side.

Managing Editor: Frank Hemsley. The Right Side is an unregulated product published by Fleet Street Publications Ltd.

Fleet Street Publications Ltd is authorised and regulated by the Financial Services Authority. FSA No 115234. https://www.fsa.gov.uk/register/home.do

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bengt graduated from Reading University in 1994 and followed up with a master's degree in business economics.

He started stock market investing at the age of 13, and this eventually led to a job in the City of London in 1995. He started on a bond desk at Cantor Fitzgerald and ended up running a desk at stockbroker's Cazenove.

Bengt left the City in 2000 to start up his own import and beauty products business which he still runs today.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

Investors dash into the US dollar

Investors dash into the US dollarNews The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

A weakening US dollar is good news for markets – but will it continue?

A weakening US dollar is good news for markets – but will it continue?Opinion The US dollar – the most important currency in the world – is on the slide. And that's good news for the stockmarket rally. John Stepek looks at what could derail things.

-

How the US dollar standard is now suffocating the global economy

How the US dollar standard is now suffocating the global economyNews In times of crisis, everyone wants cash. But not just any cash – they want the US dollar. John Stepek explains why the rush for dollars is putting a big dent in an already fragile global economy.

-

The pound could hit parity with the euro – but if it does, buy it

The pound could hit parity with the euro – but if it does, buy itFeatures Anyone visiting the continent this summer will have been in for a rude shock at the cash till, says Dominic Frisby. But the pound won't stay down forever.

-

Gold’s rally should continue

Features Matthew Partridge looks at where the gold price is heading next, and what that means for your online trading.

-

Prudent trades in Prudential

Prudent trades in PrudentialFeatures John C Burford shows how his trading methods can be used for more than just indices and currencies. They work for large-cap shares too.

-

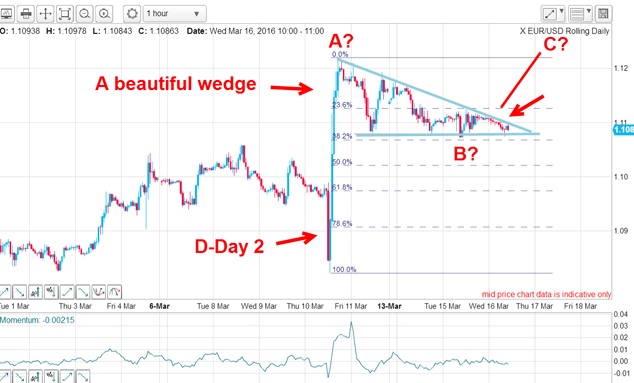

Did you find the path of least resistance in EUR/USD?

Did you find the path of least resistance in EUR/USD?Features John C Burford outlines a trade in the euro vs the dollar in the wake of the US Federal Reserve’s most recent announcement.