The lowdown on gold – Part one

Ed Bowsher looks at the pros and cons of investing in gold, and examines the idea that gold can provide insurance against disaster in any portfolio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in gold has always been a popular pursuit for many private investors. And many gold investors have made a big profit in the last ten years or so.

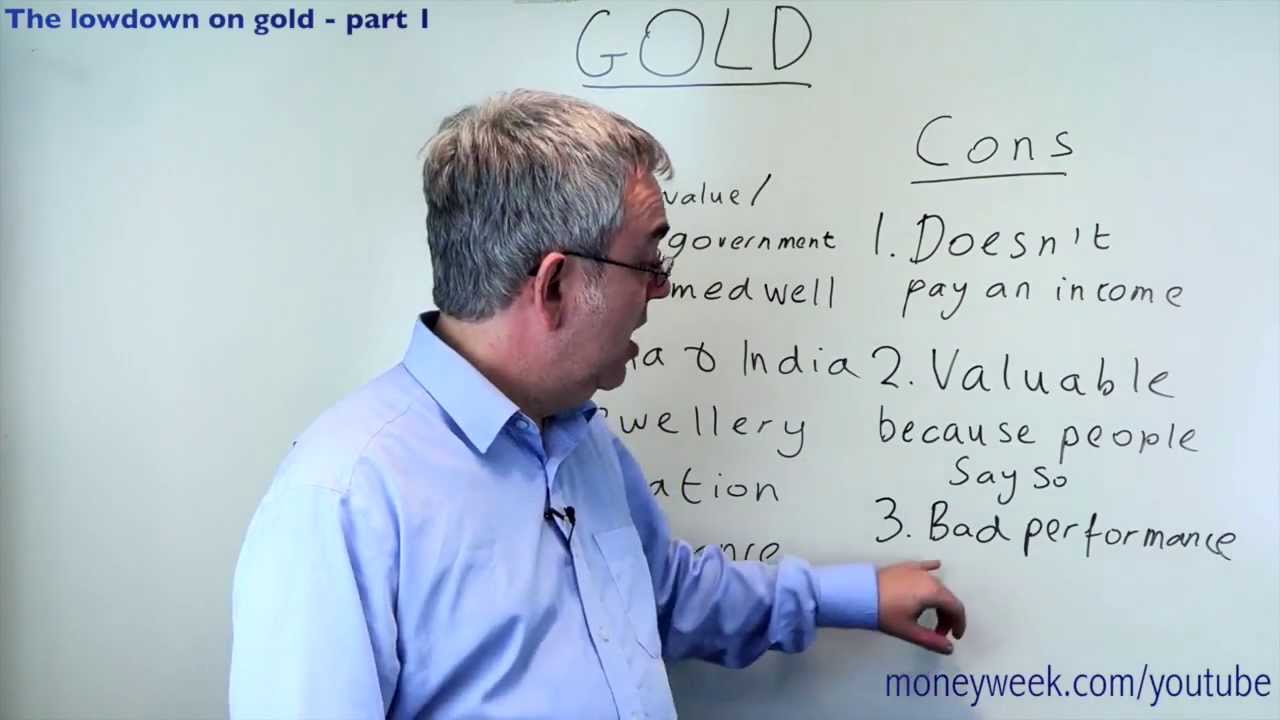

In this video, I look at the pros and cons of investing in gold. I also take a close look at the idea that gold can provide insurance against disaster in any portfolio.

View the next video in this series The lowdown on gold Part two

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Transcript

Let's dive in with the big plus points for investing in gold: gold is seen as a good store of value. It's almost a cultural or psychological thing that humans for many years, hundreds if not thousands of years, have seen gold as a good place to store your wealth.

Leading on from that, gold often appeals to people of a sort of libertarian bent, because they see gold as an asset that's free from government interference. If you put all your money into cash there's the risk that the worth of that cash could fall if the government, say, prints a lot more money. That'll devalue the worth of the currency and your cash.

Whereas with gold the government at best can only have relatively marginal influence, as central banks buy and sell gold. That's the only way governments can influence the gold price, and it's relatively small. So, people like the way of storing their wealth, keeping it away from anything that the politicians might do.

Another big plus point for investing in gold is that it has performed very well as an investment over some periods. Recent history has been one of those periods. If you'd invested £1,000 in gold in 2000 it would be worth roughly £3,600 now. So it's been a very well- performing asset in recent years.

One of the reasons why gold has done so well over the last decade or so has been demand from China and India. Obviously, those have been economies that have been growing fast. And, the cultural and psychological attachment to gold is very strong there.

So you've had lots of people who've become newly wealthy in those countries. They've decided to put a lot of their wealth into gold. That's an asset they trust. As a matter of fact, many people in China and India have just been buying gold bars and either keeping them in the bank or in their homes. That's been another good support.

Then, I guess it's possible that if humans completely changed their psychology and said "we're not interested in gold any more", the gold price wouldn't fall all the way to zero. It would fall a long way, but it would still have some value. That's because there's always the demand for jewellery from gold.

Another big reason is inflation. If you're worried that inflation's going to take off, gold is seen as a good asset to hold. That really goes back to times like Weimar Germany where there was hyperinflation. A lot of money was being printed by the government, but gold held its worth more effectively.

Of course, right now a lot of people are thinking that governments and central banks have printed all this money over the last few years, that means inflation is inevitable in the short to medium term. That's not a view that I hold, but many people do. If you think that way, gold could be a good asset to invest in.

Last but not least, gold can be an insurance policy against any crisis. This is a reason why at MoneyWeek we think gold is a good investment.

If you've got a financial or a political crisis happening you'll see the value of a lot of assets fall - share prices falling, probably bond prices, property prices, all falling at the same time. The beauty of gold is it's an asset that isn't necessarily correlated with other assets, to use the jargon.

If we go back to the 2008 crisis, in October 2008 Lehman Brothers went bust. We saw share prices crashing, but not so with gold. In October 2008 the gold price started to move firmly upwards. It moved in a different direction from other assets. Gold gives you that insurance protection that if there's a crisis it probably won't lose money like your other assets, and it may indeed go up.

Now, let's look at the arguments against holding gold, the cons if you like. I think the biggest one here is gold doesn't pay you an income. If you invest in stocks and shares, most shares on the stock market pay you a dividend, and that's a big part of the return you get from the stock market. Gold's never going to do that.

Secondly, there's this issue - and it's always worried me - that the only reason gold is valuable is people say it's valuable. It's going back to this social cultural thing that humans just see gold as a valuable thing, as a good store of wealth. Fair enough, I don't think that's going to change any time soon. It's much too ingrained in humanity that gold is a good store of value. But, it's worried me in the past. It's worth bearing in mind.

The final argument against investing in gold is that there have been times where it's performed very badly as an investment. If you'd put £1,000 into gold in 1980 and sold in 2000 your £1,000 would've fallen to about £170. So, there are times when gold has done really well - in the last decade or so. There have been times when it's done very badly. Don't assume gold is a one way bet.

As I said, we've looked at the pros and cons here. I think the big pro here is the insurance point. It's a useful insurance against a future crisis. I've actually just made my very first ever investment in gold a couple of weeks ago, and I did it precisely for this insurance policy reason. You could consider putting 5, 10, even 15 percent of your portfolio into gold just depending on your attitude to risk and depending on how long you think you're going to be invested.

I think that the longer you're going to be invested, the less your need for gold. Because if you stay invested for 20 years, even if there's a crash the markets will probably recover. So, you've got less need of the insurance you get from gold.

That's a really quick overview of how gold works. I'm going to do another video on how to invest in gold. We'll be putting that up quite soon. I hope you take a look at that video, too.

View the next video in this series The lowdown on gold Part two

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Inheritance tax investigations net HMRC an extra £246m from bereaved families

Inheritance tax investigations net HMRC an extra £246m from bereaved familiesHMRC embarked on almost 4,000 probes into unpaid inheritance tax in the year to last April, new figures show, in an increasingly tough crackdown on families it thinks have tried to evade their full bill

By Laura Miller Published

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

By Daniel Hilton Published