The lowdown on gold – Part two

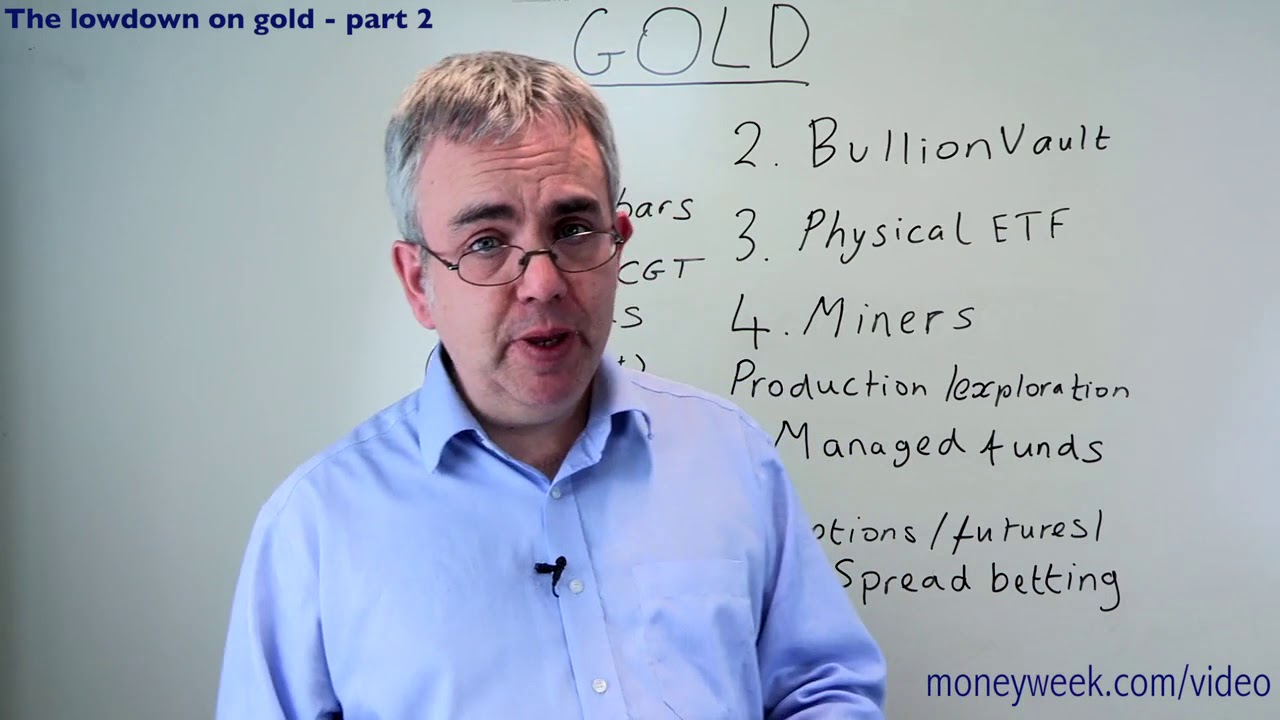

In part two of this video series on gold, Ed Bowsher looks at the different ways you can invest in gold – from physical bullion to gold futures.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In part one of this video series on gold, Ed Bowsher looked at the pros and cons of investing in the metal.

Now in part two, he looks at how you can invest in gold. There are several different options, ranging from Krugerrands to futures.

Transcript

So, these are the six most common, most widely used ways to invest in gold.Number one is just buying gold bullion - buying some gold yourself. And you can either do that by buying some coins or buying some bars.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now, loads of countries around the world issue gold coins, but perhaps for most of us, the most obvious ones to go for are either the South African Krugerrand or ones from the Royal Mint in the UK.

The Royal Mint do Britannias and Sovereigns. The attraction for the Royal Mint coins is you don't pay any capital gains tax when you come to sell your coins, assuming you make a profit.

The attraction with the Krugerrands is that whenever you buy a gold coin or indeed a gold bar, you'll almost certainly pay a slight premium over the underlying gold price. And if you buy a Krugerrand, you may get a slightly lower premium than you would with a Britannia or a Sovereign from the Royal Mint.

If you move on to a bar, obviously they're bigger, they've got more gold, the premium may be a bit lower again. The problem with a bar is it's bigger, so you'll need to put up more money.

And if you're quite a small investor, you may be able to only afford two or three coins, or more to the point, you might be able to afford one bar. But if you want to sell 20 or 30% of your investment down the line, you can't split the bar apart.

Obviously, if you bought five or six coins, it's easy to just sell a couple. So, it's kind of horses for courses, whatever suits you. You can buy bullion through reputable dealers. Check that the dealer you're dealing with is on the LBMA website, that's the London Bullion Market's Association.

That way you'll know it's a reputable dealer and they're probably happy to deliver the bullion to your home, so you can keep it in your home if you like. Obviously, there are potential safety issues. Or you could store it at your bank. Pay your bank, and have a safe deposit box there.

Another option if you want to buy bullion itself, but you don't want to store it, are sites like Bullion Vault. So with Bullion Vault, you're buying gold. That gold is designated as your gold, but you're not storing it. Bullion Vault is storing it for you. They've got vaults in London, New York, and in Switzerland. They only charge a small fee. Well worth looking into.

The third option is the route I've gone down. I've only just started investing in gold, but this is what I decided to do: I've used an ETF that invests in physical gold. So, ETFs exchange-traded funds - they're really nice, cheap, passive funds that can invest in a range of assets. They can be used for gold. I like the ETFs that actually buy underlying physical gold. You know the fund owns the gold, so as the gold price goes up, your investment should move up in line with the gold price, and there's nothing fancy there that could go wrong.

There are other ETFs that instead of investing in physical gold, follow the gold price using various financial instruments. I think that's riskier, I wouldn't go down that road.

Another option is to invest in gold-mining companies. A popular option, but riskier really, because you're no longer just taking a bet on the gold price, you're also taking a bet on the gold mining company, its future, its prospects. Some gold mining companies are primarily focused on exploration. They're looking for new gold mines that might be commercially viable. They may not be producing much gold now.

Other companies are more focused on production, doing perhaps a bit of exploring, but more on production. Production companies should be lower risk than an exploration company, because they've actually got some gold and they're producing it.

That said, a production company has higher risk than with bullion, because let's say if the gold price right now is $1,100 and the gold company can produce gold at $1,000, then it's fine, it's making a profit of $100. But if the gold price falls to $800, with the production cost at $1,000, the production company is losing money.

But your bullion, it's falling in value, but it's still there, it's still worth $800 an ounce, it's still worth some money. So, you've actually done better sticking with the bullion than investing in the miners.

If you like the idea of investing in mining companies, but want to spread out across a range of companies, there are managed funds that invest in gold miners. The best known fund is probably the Black Rock Gold and General Fund. Or you could use more sophisticated financial instruments, options or futures or spread betting to invest in gold, but I would say for the vast majority of people, don't go near them for gold.

You need to have a really good understanding of the gold market and a really good understanding of how options or futures or spread betting works. You could easily end up losing all of your stake, or actually even more money than your stake.

So, only a very few people, I think, should go down this road. There are loads of other good options out there. I really like the physical ETF, because it's simple and it's cheap. Other people like the bullion, because they like to feel the gold is theirs and no one can take it away from them.

You know, it's up to you what you go for, it's a question of horses for courses. Hope you found that useful. I'll be back with another video soon on a different investment topic, not gold. And of course we've got more than 100 videos looking at a range of other topics in our video archive.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

By Sam Walker Published

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

By Laura Miller Published