The euro after Cyprus’s bail-out – watch and wait

It's little wonder the euro fell following the news of the shambolic bail-out deal for Cyprus. But is this the start of a prolonged decline, asks John C Burford, or just a temporary blip?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Over the weekend, savers in Cyprus got a grim surprise. The government agreed to levy everyone's bank deposits in order to obtain a bail-out from the IMF and ECB.

A parliamentary vote on the levy has now been postponed until tomorrow.

Predictably, the EUR/USD opened on the weak side this morning in Asia. But will the shock from Cyprus lead to even weaker values directly ahead?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I last covered the euro on 11 March, when it was trying to stabilise around the 1.30 level.Below isthe 15-minute chart then.

My tramlines are being observed with a small bounce to the then current market.

At the time I wrote: "As I see it this morning, there appears to be little gas in the tank for another rally back above the 1.31 area and the path of least resistance still appears to be down."

(Click on the chart for a larger version)

Since then, my forecast has turned out correct, with last week's rally being turned back at the 1.31 level at my upper tramline.

That was a possible short trade entry.

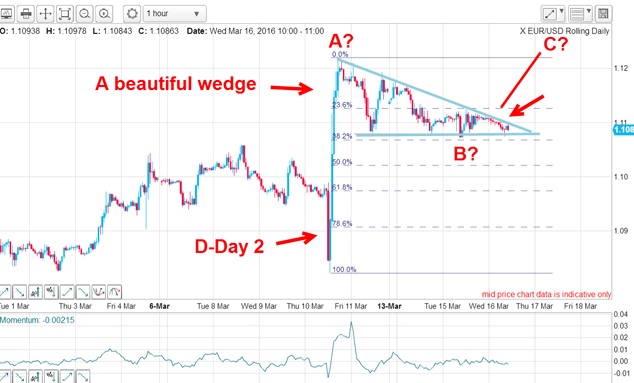

So, what have recent developments done to this chart. Here it is on the hourly scale:

(Click on the chart for a larger version)

The opening today took the market below the lower tramline, but is this a genuine break? After all, the market has come back into the trading channel as I write.

The rule I use in these situations is simple: watch and wait.

The huge gap in the chart from the weak opening today has done a lot of damage. But as a rule, gaps tend to get filled, or at least, a partial attempt is made to fill them.

This means, unless you have a position, the prudent course is to wait for further developments.

The Cyprus news has not radically altered my belief that the US dollar, which has been strong of late, is due a pause with the euro tending to gain in the short to medium term.

What evidence do I have for this?

Here is the daily chart. It shows the market has met the Fibonacci 50% retrace level:

(Click on the chart for a larger version)

Also, the 1.29 area lies within the chart support zone from last year.

And my lower tramline on the hourly chart has not yet been convincingly broken.

But if that does occur, the next support lies at the Fibonacci 62% retrace in the 1.2750 area.

The alternative is that my upper tramline will be taken out leading to a most likely assault on the 1.33 level.

But for now, we are in no man's land between the tramlines.

If you're a new reader, or need a reminder about some of the methods I refer to in my trades, then do have a look at my introductory videos:

The essentials of tramline trading

An introduction to Elliott wave theory

Advanced trading with Elliott waves

Don't miss my next trading insight. To receive all my spread betting blog posts by email, as soon as I've written them, just sign up here . If you have any queries regarding MoneyWeek Trader, please contact us here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

Investors dash into the US dollar

Investors dash into the US dollarNews The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

A weakening US dollar is good news for markets – but will it continue?

A weakening US dollar is good news for markets – but will it continue?Opinion The US dollar – the most important currency in the world – is on the slide. And that's good news for the stockmarket rally. John Stepek looks at what could derail things.

-

How the US dollar standard is now suffocating the global economy

How the US dollar standard is now suffocating the global economyNews In times of crisis, everyone wants cash. But not just any cash – they want the US dollar. John Stepek explains why the rush for dollars is putting a big dent in an already fragile global economy.

-

The pound could hit parity with the euro – but if it does, buy it

The pound could hit parity with the euro – but if it does, buy itFeatures Anyone visiting the continent this summer will have been in for a rude shock at the cash till, says Dominic Frisby. But the pound won't stay down forever.

-

Gold’s rally should continue

Features Matthew Partridge looks at where the gold price is heading next, and what that means for your online trading.

-

Prudent trades in Prudential

Prudent trades in PrudentialFeatures John C Burford shows how his trading methods can be used for more than just indices and currencies. They work for large-cap shares too.

-

Did you find the path of least resistance in EUR/USD?

Did you find the path of least resistance in EUR/USD?Features John C Burford outlines a trade in the euro vs the dollar in the wake of the US Federal Reserve’s most recent announcement.